Weathering the Storm: Decoding Market Signals in Agriculture's Future

The Dual Influence: AI Predictions Versus Traditional Assessments in Crop Forecasting

Artificial intelligence is increasingly utilized to forecast crop yields, offering advanced models based on satellite imagery. However, the United States Department of Agriculture's (USDA) time-tested approach, relying on direct farmer surveys, remains the benchmark for accuracy. Despite AI's potential for rapid data processing, the human element in USDA's assessments continues to provide the most reliable estimates, which are ultimately crucial for official agricultural statistics. This blend of new technology and established methods shapes the narrative around anticipated harvests.

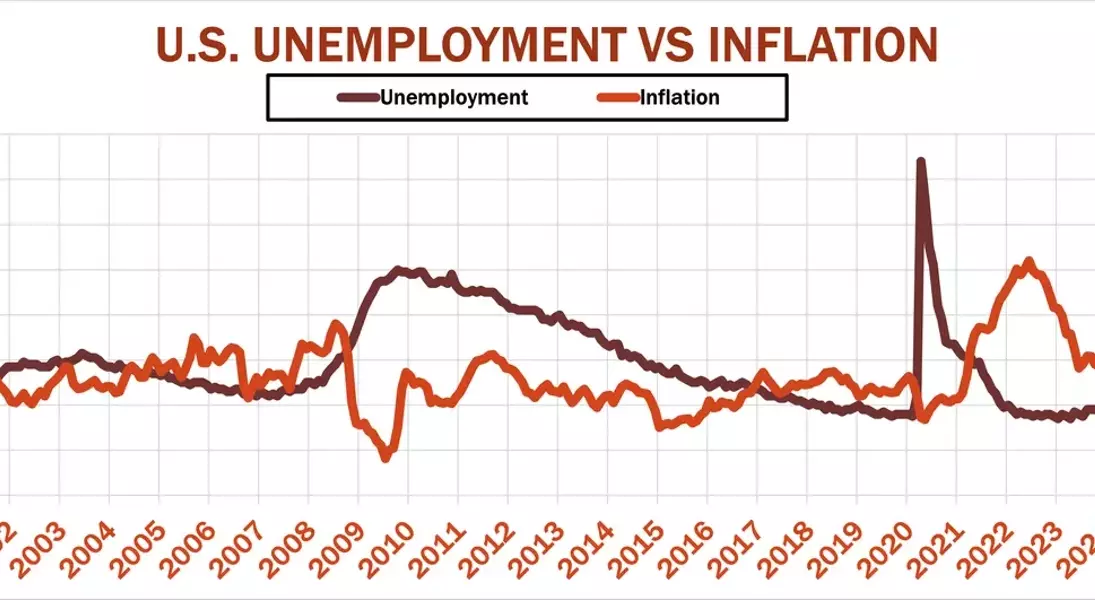

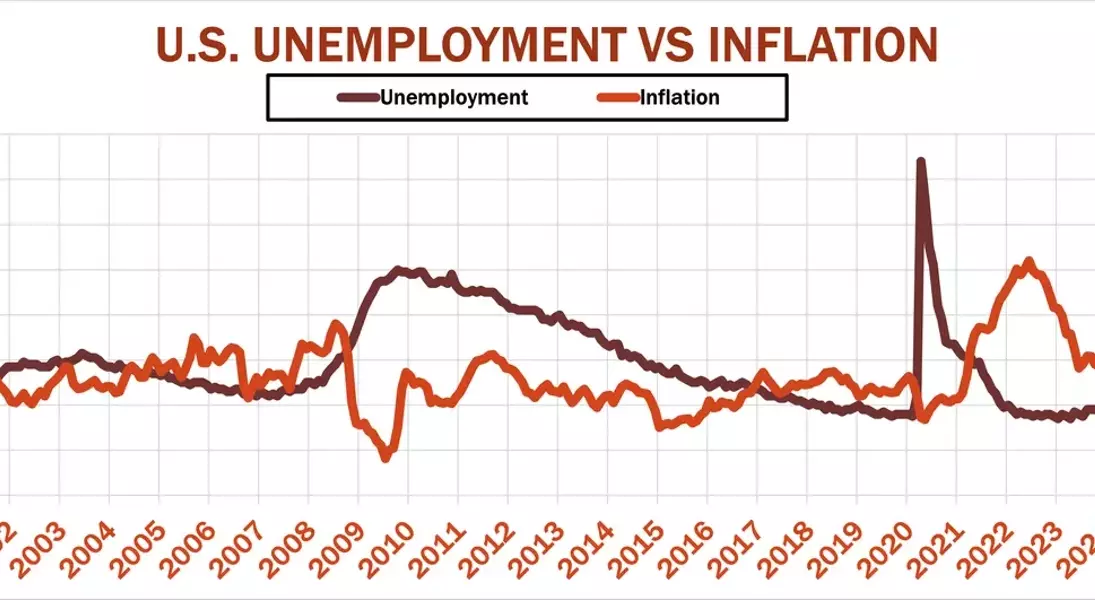

Economic Headwinds: How Broader Financial Trends Impact Agricultural Prices

Beyond agricultural specifics, a multitude of economic indicators heavily influence grain prices. Factors such as interest rates, economic growth rates, employment statistics, inflation figures, and corporate earnings collectively exert significant downward pressure on commodity values. Recent market shifts, including a slowdown in job creation and political interference in financial policy, underscore the interconnectedness of global finance and agricultural trade. The vast inflow of capital into artificial intelligence, for instance, has had a ripple effect across various sectors, including commodity markets.

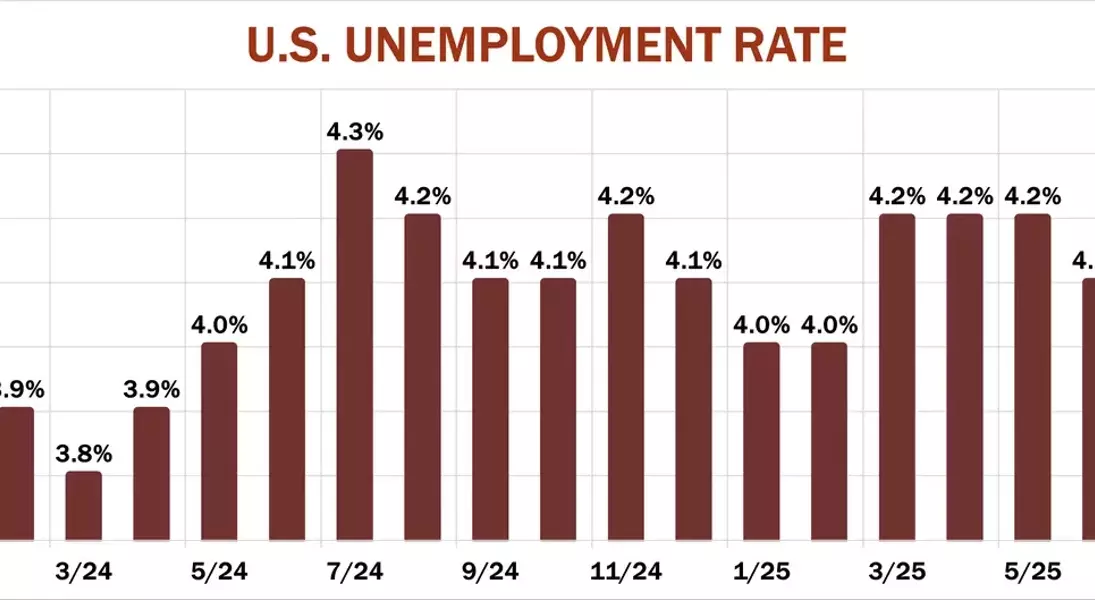

Labor Market Dynamics and Their Repercussions on the Economy

Recent employment data revealed a deceleration in job growth, signaling potential economic weakness. A slight uptick in the unemployment rate, coupled with fewer-than-anticipated new positions, indicates a cooling labor market. Such shifts often lead to speculation regarding monetary policy adjustments. Despite reassurances about economic health, the Federal Reserve faces mounting pressure to consider interest rate reductions, as evidenced by surging bets on futures markets following the jobs report. This economic uncertainty is a key component of the 'noise' impacting market stability.

Global Trade, Tariffs, and Their Tangible Effects on Agricultural Exports

International trade policies, particularly the imposition and negotiation of tariffs, significantly affect agricultural markets. While some trade agreements include pledges for increased U.S. agricultural purchases, the lack of concrete fulfillment creates anxiety among traders. The International Monetary Fund's warnings about decelerating global growth due to trade disputes further amplify these concerns. For grain markets, the ability to maintain strong export volumes is paramount, especially when domestic supply projections remain robust, making global demand a critical factor.

Anticipating Harvests: The Ongoing Outlook for Corn and Soybean Yields

Despite recent weather events, such as a July heatwave, the outlook for corn and soybean yields continues to appear favorable. Although some crop conditions have slightly deteriorated, overall ratings remain above historical averages. Predictive models, including those based on Vegetation Health Index maps, suggest substantial yields for both corn and soybeans, potentially setting new records. However, official USDA estimates often moderate these higher projections. Regardless, the abundance of projected supply emphasizes the importance of sustained demand, particularly from international markets, to absorb the large harvest. Without significant changes in supply or demand fundamentals, grain markets will remain sensitive to the broader economic narrative emanating from global financial centers.