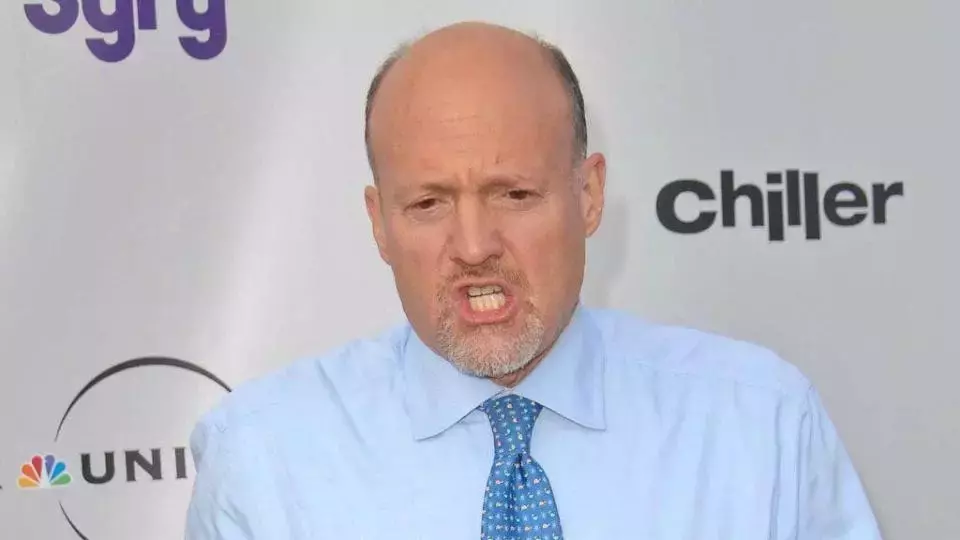

In the ever-evolving world of finance, investors are constantly seeking guidance to navigate the complex and often unpredictable markets. Jim Cramer, the renowned host of CNBC's "Mad Money," has once again shared his insights on two prominent companies, Palantir Technologies and Travere Therapeutics, offering a unique perspective on their current trajectories.

Uncovering the Potential in Palantir and Travere Therapeutics

Palantir: Riding the Wave of Investor Enthusiasm

Palantir Technologies, the data analytics firm, has been a topic of intense interest among investors. Cramer's advice on the stock is clear: "Hold on to it as a spec and let them walk it up." This sentiment suggests that Cramer believes Palantir's stock has the potential to continue its upward momentum, driven by the unwavering enthusiasm of investors. The company's upcoming third-quarter earnings report, scheduled for November 4th, will be a crucial milestone in determining the market's perception of its performance and future prospects.Palantir's ability to consistently deliver strong financial results will be a key factor in sustaining investor confidence. Analysts expect the company to report quarterly earnings of 9 cents per share, up from 7 cents per share in the year-ago period, and revenue of $701.13 million for the quarter. These projections indicate that Palantir is maintaining its growth trajectory, which could further fuel the stock's ascent.Travere Therapeutics: Navigating the Challenges of Profitability

In contrast, Cramer's assessment of Travere Therapeutics, a biopharmaceutical company, is less optimistic. He bluntly stated that the company is "losing a ton of money," a concerning observation that investors should heed. Travere Therapeutics is set to report its third-quarter financial results on October 31st, and analysts expect the company to report a quarterly loss of 66 cents per share, a significant decline from the year-ago profit of $1.97 per share.The company's ability to stem its losses and demonstrate a clear path to profitability will be crucial in determining its future direction. Cramer's warning suggests that investors should approach Travere Therapeutics with caution, as the company's financial performance may continue to be a source of concern in the near term.Stanley Black & Decker: A Steady Performer Amid Volatility

Amidst the discussion of Palantir and Travere Therapeutics, Cramer also commented on Stanley Black & Decker, a diversified industrial company. Cramer expressed optimism about the company, stating, "I don't think Stanley Black & Decker (NYSE:SWK) is going to give you a discouraging forecast." This positive sentiment is supported by the company's recent announcement of a regular fourth-quarter cash dividend of 82 cents per common share and the appointment of a new board member, John L. Garrison, Jr., former chairman, president, and chief executive officer of Terex Corporation.Stanley Black & Decker's ability to maintain a steady performance and provide consistent returns to shareholders, even in the face of market volatility, could make it an attractive investment option for those seeking stability in their portfolios.Capitalizing on High-Yield Opportunities in Private Real Estate Investments

As the article highlights, the current low-interest-rate environment has created challenges for investors seeking high-yield returns. However, the article suggests that private market real estate investments, such as the Arrived Homes Private Credit Fund, may offer a solution. This fund, backed by Jeff Bezos, provides access to a pool of short-term loans backed by residential real estate, with a target of 7% to 9% net annual yield paid to investors monthly.The key advantage of this fund is its low minimum investment of only $100, making it accessible to a wider range of investors. This opportunity allows retail investors to capitalize on the high-yield potential of private real estate investments, which may be an attractive option for those seeking to diversify their portfolios and generate consistent income.As the financial landscape continues to evolve, investors must stay informed and adaptable to navigate the complexities of the market. Cramer's insights on Palantir, Travere Therapeutics, and Stanley Black & Decker, combined with the potential of private real estate investments, provide a multifaceted perspective on the current investment landscape. By carefully considering these insights and exploring alternative investment opportunities, investors can position themselves to weather the volatility and potentially capitalize on emerging trends in the market.