Soaring Treasury Yields Rattle Wall Street as Earnings Season Heats Up

Stock futures are falling Wednesday, with futures tied to the Dow Jones Industrial Average (DJI) down 235 points, after the S&P 500 Index (SPX) logged its first back-to-back losses since early September. Higher bond yields continue to weigh on Wall Street, with the benchmark 10-year Treasury note rising 3 basis points to 4.23% — levels not seen since July. Meanwhile, investors are digesting plenty of corporate earnings reports.Navigating the Turbulent Market Landscape

Surging Treasury Yields Spark Investor Concerns

The recent surge in Treasury yields has become a significant concern for investors, as it can have far-reaching implications for the broader market. The benchmark 10-year Treasury note has risen to 4.23%, a level not seen since July, putting pressure on stock prices. This rise in yields reflects the Federal Reserve's ongoing efforts to combat inflation through aggressive interest rate hikes, which have had a ripple effect across financial markets.As yields climb, the cost of borrowing for both consumers and businesses increases, potentially dampening economic growth and corporate profitability. Investors are closely monitoring the situation, as the delicate balance between taming inflation and maintaining a healthy economy remains a top priority for policymakers.Earnings Season Brings Mixed Results

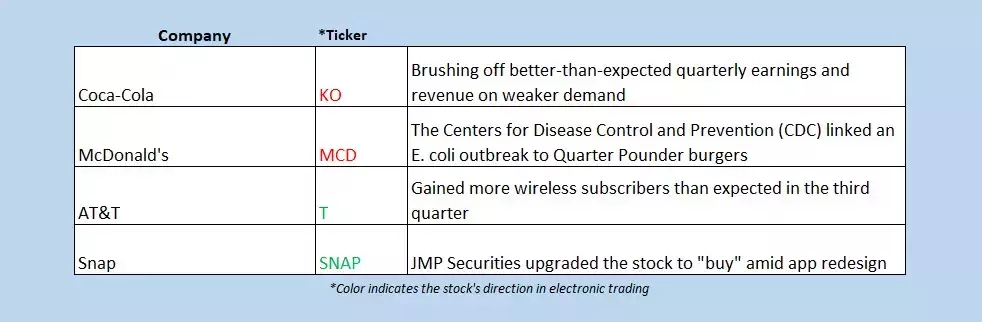

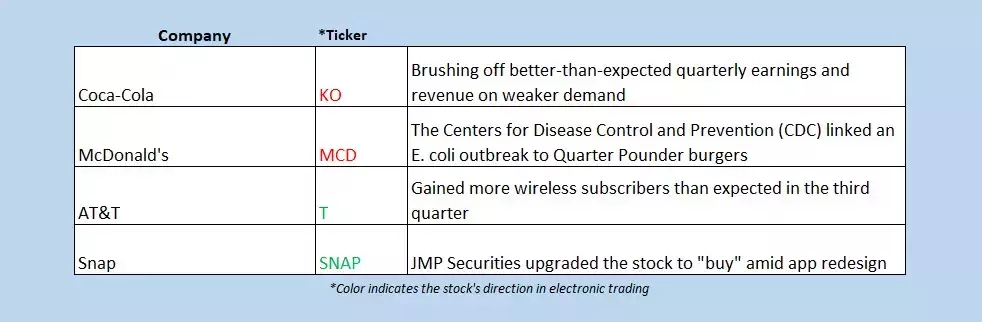

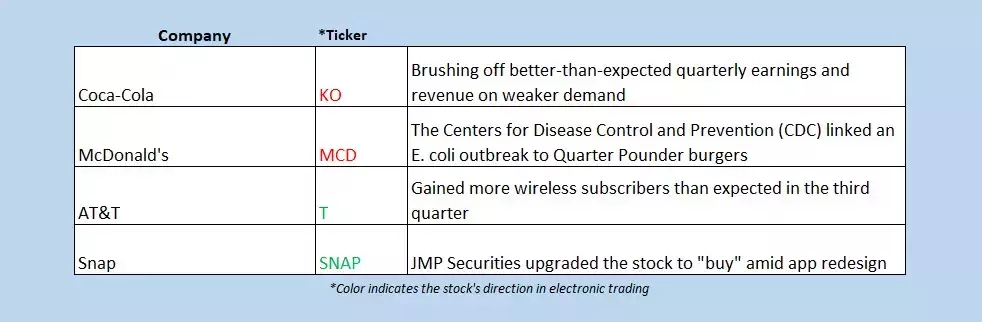

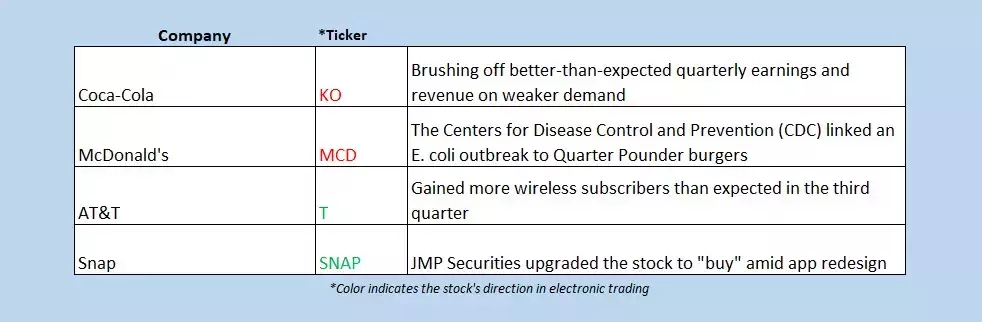

Alongside the rise in Treasury yields, investors are also closely following the ongoing corporate earnings season. The latest reports have presented a mixed bag, with some companies exceeding expectations while others have fallen short.Boeing Co (NYSE:BA), a Dow member, reported a third-quarter loss of $10.44 per share, which was wider than Wall Street had anticipated. The aerospace giant's production woes, stemming from an ongoing strike, have continued to weigh on its performance. However, investors remain hopeful that the situation could turn around when its machinists union votes on a new contract offer on Wednesday.On the other hand, AT&T Inc (NYSE:T) has seen its shares rise 3.3% ahead of the open, as the telecommunications company reported better-than-expected adjusted earnings, despite missing Wall Street's estimates for third-quarter revenue and postpaid phone net additions.These mixed earnings results underscore the complexity of the current market environment, where companies are navigating a range of challenges, from supply chain disruptions to labor shortages and inflationary pressures. Investors will continue to closely monitor the earnings landscape, seeking clues about the overall health of the economy and the potential impact on their portfolios.Arm's Feud with Qualcomm Heats Up

In other news, the semiconductor sector is also making headlines, as Bloomberg reported that Arm, a key player in the industry, is canceling a license that allowed Qualcomm Inc (NASDAQ:QCOM) to design chips using Arm's intellectual property. This move is seen as a significant escalation in the ongoing feud between the two companies.Qualcomm, which has seen its stock price rise nearly 60% over the last 12 months, is now facing a 2.8% decline in electronic trading as a result of this development. The dispute between Arm and Qualcomm highlights the competitive landscape within the semiconductor industry, where companies are vying for technological advantages and market share.Investors will be closely watching how this situation unfolds, as it could have broader implications for the semiconductor sector and the broader technology landscape. The outcome of this feud could potentially impact the availability and pricing of certain chip designs, ultimately affecting the products and services that consumers and businesses rely on.Global Markets Reflect Investor Uncertainty

The turbulence in the US market is also being felt across global markets. Asian markets finished mostly higher on Wednesday, with the exception of Japan's Nikkei, which dropped 0.8%. However, the Hong Kong Hang Seng rose 1.3%, while China's Shanghai Composite and the South Korean Kospi also saw gains of 0.5% and 1.1%, respectively.In Europe, the picture is more mixed, with investors closely monitoring the latest earnings reports and the rising Treasury yields in the US. London's FTSE 100 is down 0.5%, while the French CAC 40 drops 0.7%, and the German DAX sits 0.2% lower.This global market landscape reflects the broader uncertainty and volatility that investors are grappling with. As central banks continue to navigate the delicate balance between taming inflation and supporting economic growth, market participants are closely watching for any signs of stability or further turbulence.