Weathering the Storm: First American Financial's Quarterly Performance

Revenue Decline and Earnings Miss

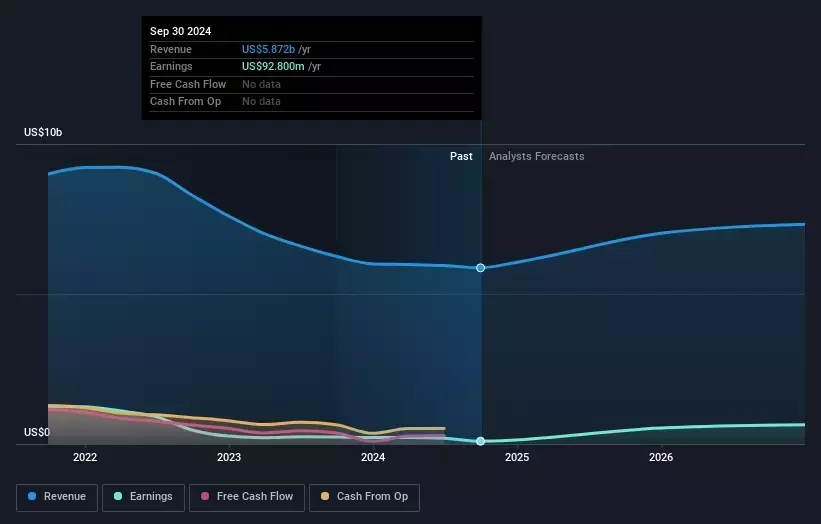

First American Financial's third-quarter 2024 results paint a picture of a company facing significant headwinds. The company's revenue declined by 5.1% compared to the same period in 2023, falling short of analyst estimates by 4.6%. This revenue miss underscores the challenges the company is facing in maintaining its market share and profitability.Moreover, the company's net loss widened by a staggering $102.3 million, reaching a total of $104 million. This deterioration in the company's bottom line is a clear indication of the financial strain it is experiencing. The resulting loss per share of $1.00 further highlights the company's struggle to maintain its financial footing in the face of these challenges.

Industry Outlook and Competitive Landscape

Despite the challenges faced by First American Financial, the broader insurance industry in the United States is forecasted to experience a more positive trajectory. Industry analysts predict an average annual growth rate of 11% over the next three years, outpacing the 5.2% growth forecast for the overall insurance industry.This disparity in growth projections suggests that First American Financial may need to reevaluate its strategies and adapt to the changing market dynamics to remain competitive. The company's ability to capitalize on the industry's potential growth will be crucial in determining its long-term success.

Shareholder Sentiment and Risk Factors

The market's reaction to First American Financial's quarterly results has been less than favorable, with the company's shares declining by 4.9% from the previous week. This drop in share price reflects the concerns of investors regarding the company's ability to navigate the current challenges and maintain its competitive edge.Furthermore, the article highlights the need for investors to consider the inherent risks associated with investing in First American Financial. The company has been identified as having two "warning signs" that warrant careful consideration by those looking to invest in the firm. Understanding and addressing these risk factors will be crucial for the company's long-term success and the confidence of its shareholders.