Unraveling the Market's Intricacies in a Time of Uncertainty

Stock Futures and Market Volatility

Futures on the Dow Jones Industrial Average (DJIA) are down 400 points this morning, indicating a bearish sentiment. The escalating tensions between the two countries have created a sense of unease among investors, leading to a sell-off in the stock market. This volatility is likely to continue in the short term, as the situation remains fluid.As tensions between Ukraine and Russia continue to escalate, investors are closely monitoring the situation. The uncertainty surrounding the conflict has led to a flight to safety, with investors pouring money into gold and other safe-haven assets. This has pushed gold prices higher, as traders seek to protect their portfolios from market volatility.

Corporate Earnings Reports and Market Impact

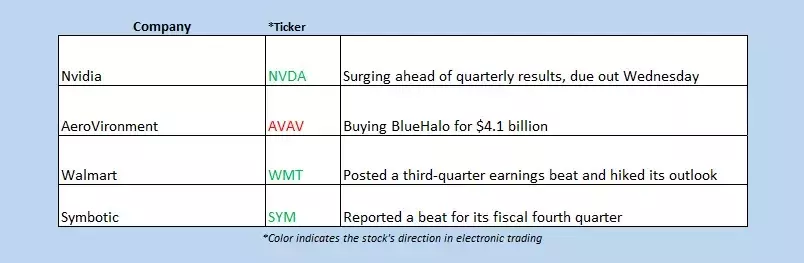

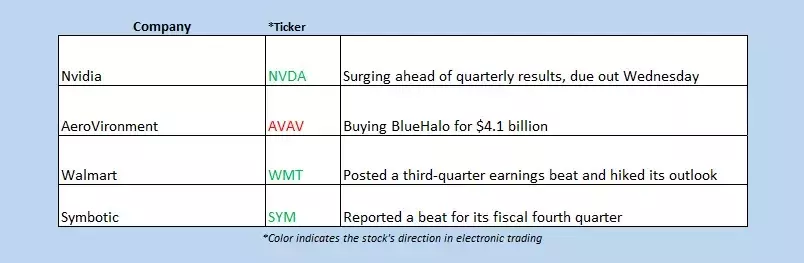

Wall Street has a plethora of corporate earnings reports to unpack this morning. BioNTech SE (NASDAQ:BNTX) stock is up 0.7% premarket after an Evercore ISI upgrade to "outperform" and a price-target hike. Berenberg also initiated coverage with a "buy" rating and a $130 price objective. Despite the positive news, BNTX is down just 3.5% year to date.Lowe's Companies Inc (NYSE:LOW) stock is down 1.4% before the bell, despite better-than-expected third-quarter results and raised guidance. The company still expects sales to fall this year from last year. Since the start of the year, the equity is up 22.1%. This shows that while the company is performing well, the overall market sentiment is still negative.

Super Micro Computer Inc and Market Recovery

The shares of Super Micro Computer Inc (NASDAQ:SMCI) are extending last session's 15.9% rise, up 26% in electronic trading. The IT company hired BDO as an independent auditor to avoid its scheduled Nasdaq delisting and also submitted a detailed plan. The stock has been on a downturn since March and still carries a 24.2% year-to-date deficit.This shows that despite the challenges faced by the company, there is some hope for a recovery. The hiring of an independent auditor and the submission of a detailed plan may give investors confidence in the company's future prospects. However, it remains to be seen whether the company can turn things around in the short term.

Asia and European Markets in the Wake of Tensions

Asian markets took positive cues from China today after Vice Premier He Lifeng expressed support for Hong Kong's innovation reform. Hong Kong's Hang Seng added 0.4% and the Shanghai Composite added 0.7%. Rounding out the region, Japan's Nikkei added 0.5% and the South Korean Kospi tacked on 0.1%.However, European bourses have pivoted lower as tensions between the U.S. and Russia bubble. London's FTSE 100 is 0.4% lower, while the French CAC 40 is off by 1.2% at last check. The DAX is 1.1% lower after the Bundesbank called the economic outlook "weak" in Germany. This shows that the impact of the tensions is not limited to the U.S. and Russia, but is also being felt in other parts of the world.

Data on Tap This Week and Market Outlook

Manufacturing and services data is set to be released this week, which could provide some insights into the health of the economy. This data will be closely watched by investors as they try to gauge the impact of the tensions on the global economy.Overall, the market remains volatile and uncertain in the wake of the tensions between Ukraine and Russia. Investors will need to closely monitor the situation and be prepared for further market movements. While there are some signs of hope for certain companies and regions, the overall outlook remains cautious.