Unraveling the Stock Market's Intricacies with Dow Jones Insights

Pre-Earnings Report Scenario

Before Nvidia's earnings report, the stock market was in a state of anticipation. Palantir Technologies (PLTR) and Tesla (TSLA) showed significant divergence. Palantir tumbled nearly 7% from last week's all-time high, while Tesla rebounded 5.6% on news of President-elect Donald Trump's transition team's interest in a federal framework for self-driving vehicles. This week also brings key earnings reports from retailers Walmart (WMT) and Target (TGT). Additionally, investors are awaiting a lighter week of economic news, with a focus on housing data such as housing starts and building permits for October on Tuesday and existing home sales on Thursday. S&P Global's preliminary indexes for the manufacturing and services sector on Friday provide an early indicator of November's economic growth pace.

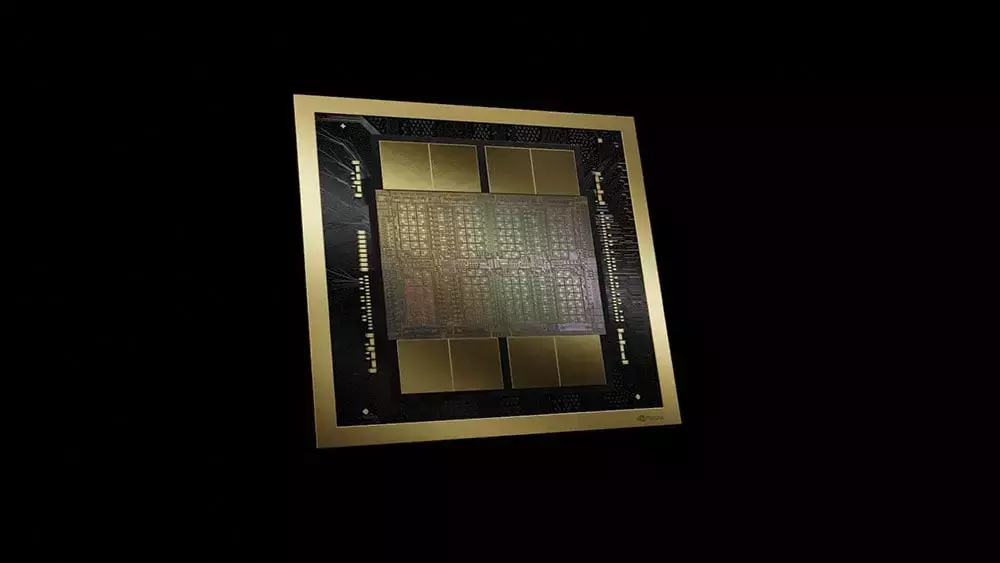

Nvidia, a major player in the AI space, has been a topic of great interest. Savvy investors can't get enough of this AI behemoth. Its performance and earnings report will likely have a significant impact on the market. On Monday, the Dow Jones Industrial Average fell 0.1%, while the S&P 500 gained 0.4% and the tech-heavy Nasdaq advanced 0.6%. Among the best companies to watch are Broadcom (AVGO), Costco Wholesale (COST), Deckers Brands (DECK), and FanDuel parent Flutter Entertainment (FLUT). Dow Jones components like Amazon.com (AMZN), Apple (AAPL), Microsoft (MSFT), and Walt Disney (DIS) also made notable moves. Disney slipped 1.3% on Monday, snapping a nine-day win streak and is building a cup base.

Industry Group and IPOs

This industry group and 4 IPOs have polished 20 'perfect' gems. Ahead of Tuesday's opening bell, Dow Jones futures, along with other major futures, were little changed vs. fair value. The 10-year U.S. Treasury yield ticked lower to 4.41%, and oil prices rallied more than 3%, with West Texas Intermediate futures settling around $69.20 a barrel. Now is an important time to read IBD's The Big Picture column. After Monday's session, be sure to check out today's The Big Picture and updated exposure level. On "IBD Live" show, the team discussed the current trading conditions. IBD MarketSurge's "Breaking Out Today" list is an essential resource for daily breakouts, showing MarketSurge Growth 250 stocks breaking out past buy points. The MarketSurge "Near Pivot" list shows more stocks nearing buy points in bases.

Among Magnificent Seven stocks, Alphabet (GOOGL) rallied 1.6% on Monday, still below a 182.02 buy point in a cup with handle after a short-lived breakout attempt. Meta Platforms (META) remains below its 50-day moving average line, a key level to watch, and has formed a flat base with a 602.95 buy point. Among Dow Jones components in the Magnificent Seven, Amazon stock declined 0.5% on Monday, barely above a 201.20 buy point. Apple shares closed above their 50-day line, continuing to consolidate after the October 31 earnings report. Microsoft shares rose 0.2% on Monday, still below the 50-day line, and its RS line remains near its lows.

Stock Market Highlights

These are four stocks in or near buy zones in today's stock market. Ferrari (RACE) has a 498.23 flat base buy point. Costco Wholesale (COST) has a 923.83 flat base buy point. Broadcom (AVGO) has a 186.42 flat base buy point. Deckers Brands (DECK) has a 172.57 handle entry buy point. These stocks offer potential investment opportunities in the current market environment.

To stay informed and make informed investment decisions, it is crucial to follow resources like IBD. It provides various tools and lists such as IBD 50, Big Cap 20, and Stocks Near A Buy Zone to identify bullish patterns and buy points. By following these, investors can better navigate the stock market and potentially capitalize on market trends.