Stocks Soar to New Heights as Investors Ride the Wave of Optimism

The markets are abuzz with excitement as stocks continue their remarkable ascent, poised to secure their sixth consecutive weekly gain. Traders are closely monitoring a flurry of high-profile earnings reports, while the tech sector is being buoyed by the strong demand for Nvidia's Blackwell chip. Despite some volatility in the early trading session, the major U.S. benchmarks are on track to extend their impressive winning streak, showcasing the resilience and adaptability of the financial markets.Riding the Wave of Optimism: Stocks Poised for Sixth Straight Weekly Gain

Navigating the Shifting Tides: Market Volatility and Earnings Reports

The markets are experiencing a mix of emotions this morning, with the Dow Jones Industrial Average (DJI) futures trading lower, while the S&P 500 Index (SPX) futures and Nasdaq-100 (NDX) futures are showing modest gains. Traders are closely monitoring a slew of high-profile earnings reports, which are shaping the market's direction. The standout performer is Nvidia (NVDA), whose shares are rallying on the back of strong demand for its Blackwell chip. Despite the fluctuations, the three major U.S. benchmarks are poised to extend their impressive winning streak, marking their sixth consecutive weekly gain.Charting the Course: Strategies for Navigating Earnings Season

As the earnings season continues to unfold, savvy investors are exploring various options trading strategies to capitalize on the market's volatility. The Cboe Options Exchange (CBOE) saw a surge in trading activity on Thursday, with over 1.8 million call contracts and 1.4 million put contracts exchanged. The single-session equity put/call ratio rose to 0.77, while the 21-day moving average remained at 0.64, indicating a shift in investor sentiment.Streaming Ahead: Netflix Soars on Earnings Beat

One of the standout performers in the earnings season is Netflix Inc (NASDAQ:NFLX), whose stock is up 6.4% in pre-market trading. The streaming giant reported third-quarter revenue of $9.83 billion and a total of 282.7 million paid subscribers, both of which exceeded Wall Street's expectations. Adding to the positive sentiment, the company's fourth-quarter guidance also surpassed analysts' forecasts. This strong performance has propelled Netflix's stock to a remarkable 98.6% year-over-year gain, underscoring the company's resilience and ability to adapt to the evolving market landscape.Amex Adjusts Guidance: American Express Reports Earnings

In contrast, American Express Company (NYSE:AXP) stock is trading 2.3% lower ahead of the open, as the credit card company's third-quarter earnings report failed to meet expectations. While the company reported earnings of $3.49 per share, its revenue of $16.6 billion fell short of Wall Street's estimates. However, American Express did lift its full-year earnings guidance, indicating its confidence in the company's long-term prospects.Apple's China Surge: iPhone 16 Sales Soar

Adding to the positive sentiment in the tech sector, shares of Apple Inc (NASDAQ:AAPL) are trading 1.7% higher in electronic trading, following an uplifting report from China. According to the research note from Wedbush, Apple's iPhone 16 sales have surged by 20% in the first three weeks of release, compared to the previous year's model. This strong performance in the Chinese market is seen as a harbinger of a broader "AI-driven super cycle" for the tech giant, further bolstering investor confidence in Apple's future growth.Earnings Season Continues: More Blue Chip Earnings on the Horizon

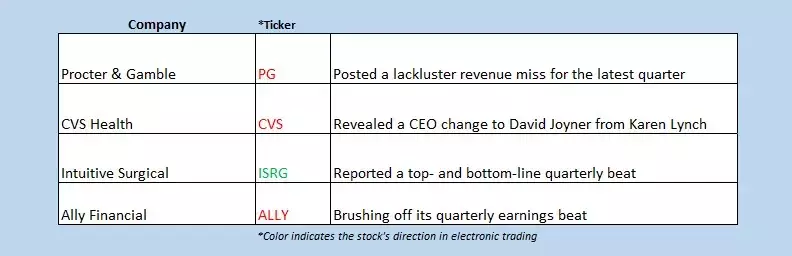

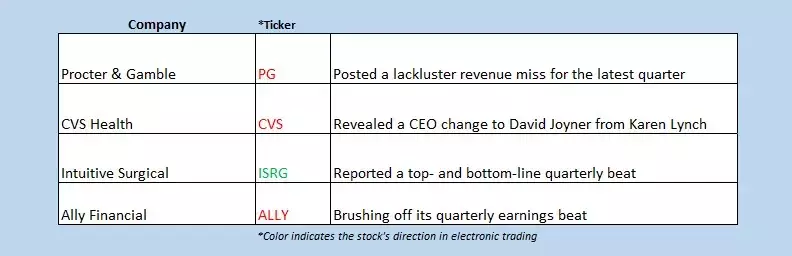

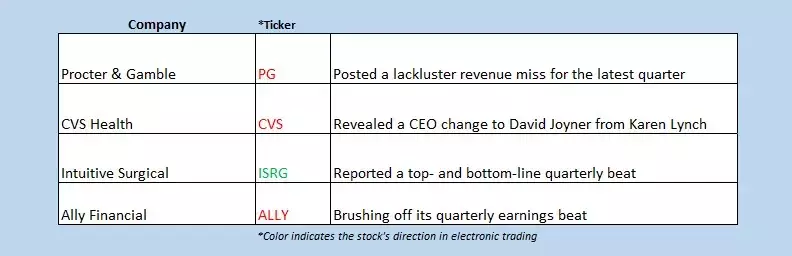

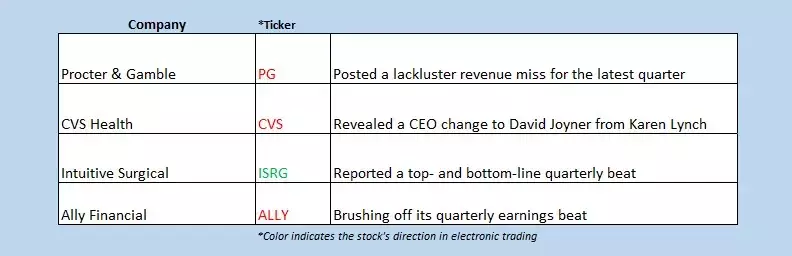

As the earnings season progresses, investors can look forward to a steady stream of reports from blue-chip companies next week. This upcoming slate of earnings announcements is sure to keep the markets on their toes, as traders and analysts alike scrutinize the financial performance and outlooks of these industry leaders.You May Like