The 2024 presidential race and recent port strikes have brought renewed focus on America's dependence on foreign goods and U.S. trade policy more broadly. Both President Trump and Vice President Harris have signaled a shift away from long-standing support for free trade, though their approaches differ. As the nation grapples with these evolving policies, the potential impact on American consumers, particularly when it comes to food prices and availability, has become a pressing concern.

Uncovering the Hidden Costs of Protectionism: Navigating the Complexities of Trade Policy

The Shifting Sands of U.S. Agricultural Trade

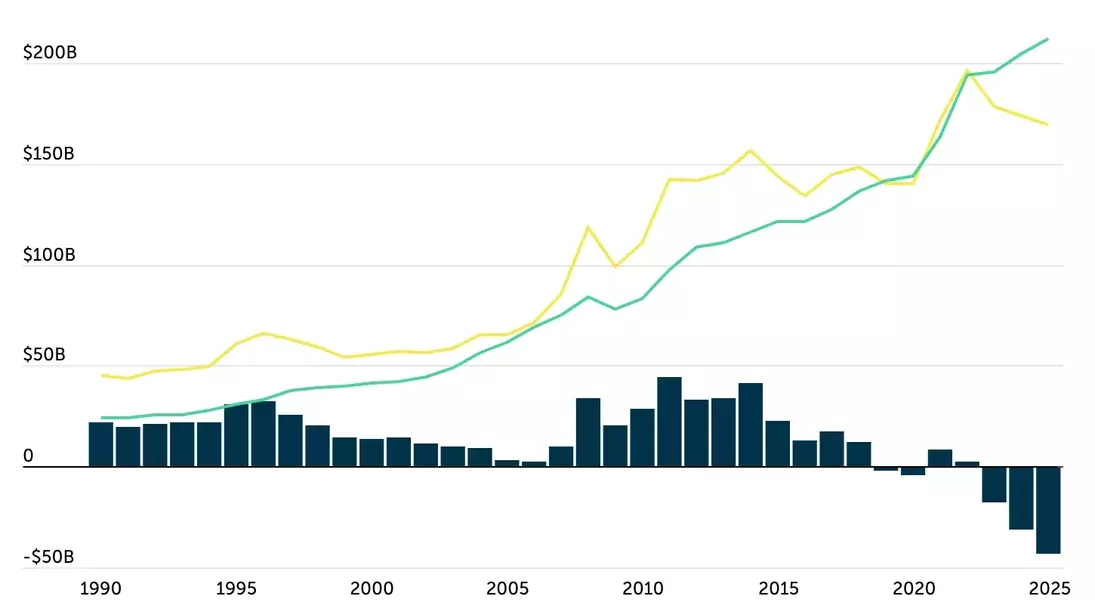

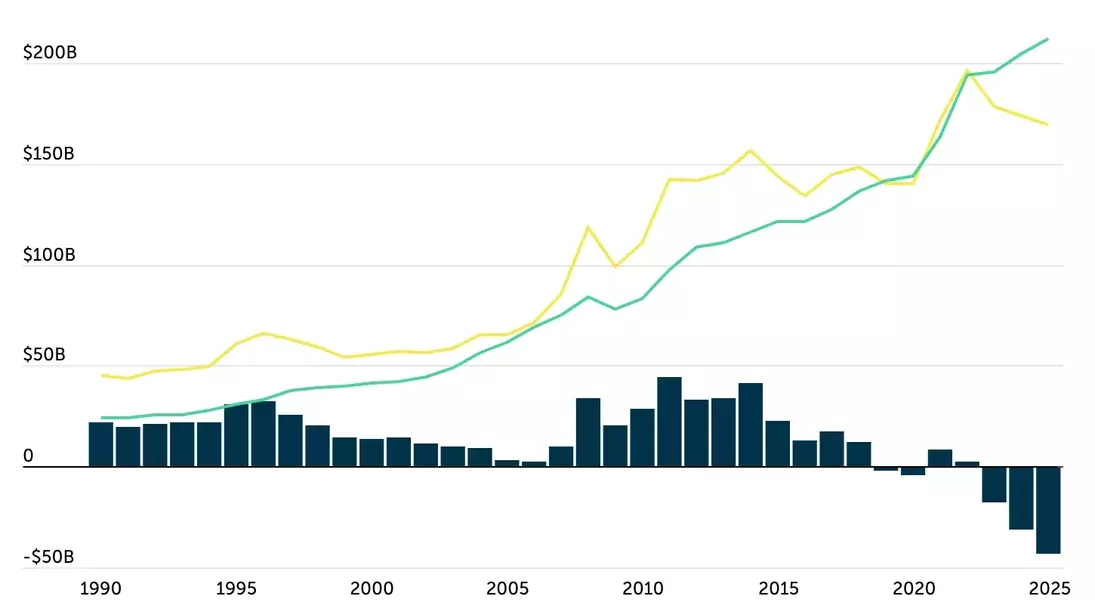

The United States has traditionally been a net exporter of agricultural goods, but this balance has shifted in recent years as import growth has outpaced exports. The USDA forecasts a $42 billion agricultural trade deficit in 2025, the largest on record in at least the past three decades. This shift is driven by factors such as a strong U.S. dollar and consumer preferences for year-round access to fresh produce, leading to a surge in demand for imported goods.As the U.S. becomes increasingly reliant on foreign sources for its food supply, the potential impact of trade policy changes, such as tariffs or supply chain disruptions, becomes more pronounced. Experts warn that American households could face shortages and higher retail prices if the dockworkers' strike had continued, underscoring the fragility of the current system.The Growing Dependence on Imported Foods

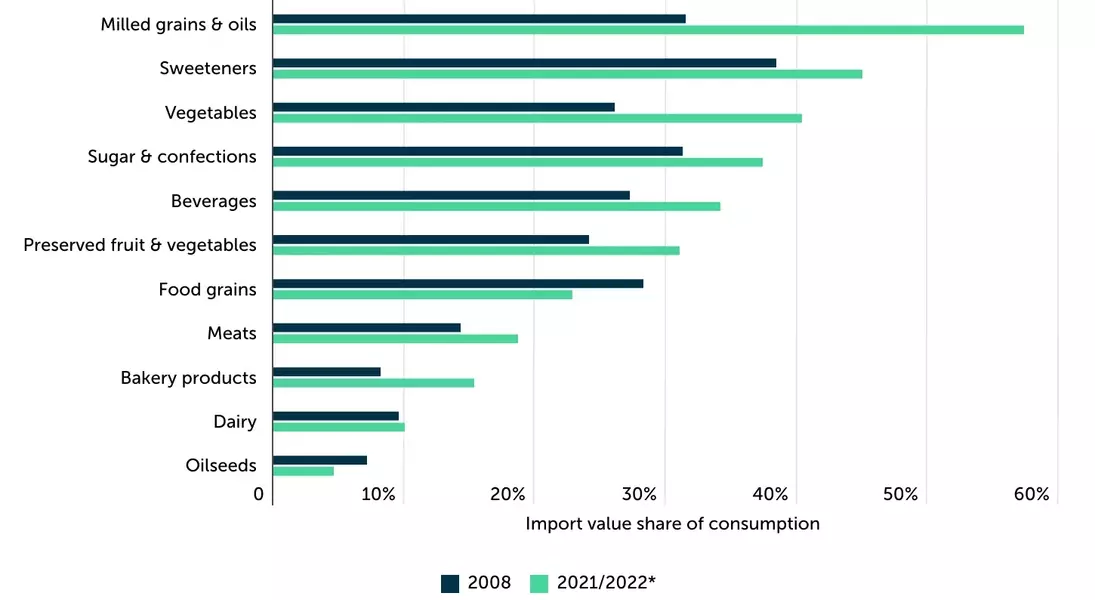

Imported foods have become an increasingly significant part of the American diet, with the share of imported goods rising across nearly every food category in recent years. Between 2008 and 2022, the percentage of total food and beverages consumed in the U.S. that were imported increased from 12.4% to 17.3%.This growing reliance on imported food is particularly pronounced in certain categories. Fruits and nuts stand out as one of the most import-dependent, with nearly 60% of the fruits and nuts consumed in the U.S. now coming from abroad, up from 35.8% in 2008. Similarly, imports of milled grains and oils have grown sharply, now accounting for 57.4% of consumption, compared to 31.5% in 2008. Other categories like sweeteners and vegetables have also seen notable increases, with imports now constituting 45.0% and 40.4% of consumption, respectively.The U.S. is also heavily reliant on imports for seafood, with an estimated 70–85% of seafood consumed domestically coming from international sources. As tariffs and trade policies potentially shift, these high levels of dependency on imported goods could have a direct impact on food prices at the consumer level.The Geopolitical Landscape of U.S. Food Imports

At the country level, Mexico and Canada account for 42% of total U.S. food and beverage imports. Mexico exported over $44 billion in food products to the U.S. in 2023, primarily beer, while Canada exported $38 billion, with bread and pastries as its leading category. Italy and France are among the top European exporters, with wine as their primary export to the U.S.Other significant trade partners include Chile, which supplies salmon, and Brazil, a major source of coffee. China, India, and Indonesia are key contributors from Asia, exporting a variety of products such as oils and shrimp. Australia and New Zealand are important suppliers of beef, while countries like Peru and Vietnam export grapes and cashews, respectively.The top food and beverage imports by state vary greatly, spanning everything from cooking oils and prepared foods to meats, seafood, fresh produce, and alcohol. Prepared foods, canola oil, and beef each claim the top spot in five states, while coffee ranks as the leading import in four states and bread and pastries dominate in three.The Potential Impact on American Households

With inflation already straining household budgets, additional tariffs and shortages of imported goods could drive up the cost of everyday necessities, including the cost of food. Currently, the U.S. imports nearly a fifth of its food supply from abroad, and the average American household spends nearly 14% of its annual budget on food and beverages. For many, this is already a burden, with 28% of U.S. adults reporting difficulty affording food and 13.5% of households classified as food insecure, meaning they lack reliable access to sufficient nutrition.As the nation grapples with the shifting tides of U.S. trade policy, the potential impact on American households, particularly when it comes to food prices and availability, has become a pressing concern. Policymakers and consumers alike must navigate the complexities of this evolving landscape, balancing the need for economic security with the realities of a globalized food system.