The recent drop in oil prices has had a significant impact on various sectors, with shares of companies tied to the price of crude oil experiencing notable movements. The article delves into the market dynamics and the implications for different industries.

Navigating the Shifting Oil Landscape

Crude Futures Sink Amid Geopolitical Developments

The price of West Texas Intermediate (WTI) crude oil plunged nearly 6% in late-morning trading on Monday, as the market reacted to a weekend retaliatory strike by Israel against Iran. Surprisingly, the targeted attack did not hit Iran's oil facilities, easing concerns about a potential escalation in the Middle East that could further disrupt global supply. This development led to a significant drop in crude futures, with the oil market adjusting to the reduced risk of supply disruptions.Drillers and Oilfield Services Firms Face Headwinds

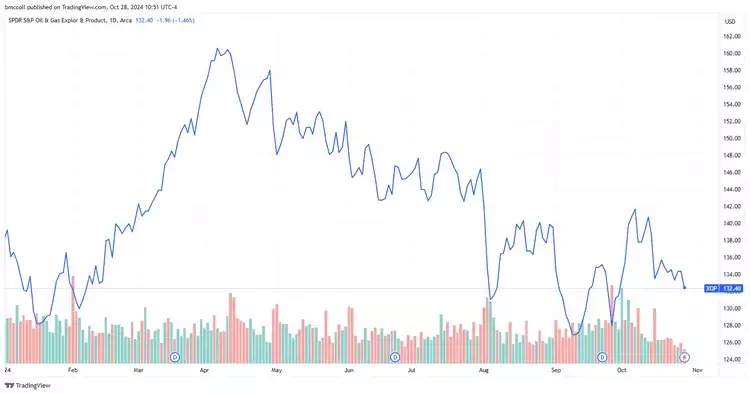

The decline in oil prices had a direct impact on the shares of companies involved in the exploration and production of oil, as well as those providing oilfield services. Stocks of drillers such as APA, Diamondback Energy, and Devon Energy fell, along with those of oilfield services firms like Halliburton and SLB. The SPDR S&P Oil & Gas Exploration and Production exchange-traded fund (ETF) also declined to its lowest level this month, reflecting the broader industry sentiment.Cruise Lines and Airlines Poised to Benefit

In contrast, the drop in oil prices presented an opportunity for industries that rely heavily on fuel, such as cruise lines and airlines. Shares of companies like Carnival Corp., Delta Air Lines, Norwegian Cruise Line Holdings, and Royal Caribbean Cruises saw a surge in value. Analysts at Bank of America noted that Carnival had been "very constructive on booking trends" when the company reported in September, and they expect Royal Caribbean Cruises and Norwegian Cruise Line Holdings to echo similar positive commentary as they look ahead to 2025.Navigating the Volatility in the Oil Market

The fluctuations in oil prices can have far-reaching implications across various sectors, as evidenced by the market movements observed on Monday. Companies and investors must closely monitor the evolving dynamics in the oil market and be prepared to adapt their strategies accordingly. The ability to anticipate and respond to these shifts can be crucial in maintaining a competitive edge and capitalizing on emerging opportunities.Diversification and Risk Management Strategies

In an environment characterized by oil price volatility, diversification and risk management strategies become increasingly important. Companies and investors may consider diversifying their portfolios to include a mix of industries and assets that are less directly tied to the price of oil. Additionally, implementing effective hedging strategies and closely monitoring market trends can help mitigate the risks associated with the fluctuations in the oil market.You May Like