As the dust settles on the recent U.S. presidential election, investors are closely monitoring the markets, bracing for potential shifts and adjustments in the wake of Donald Trump's victory. With the Dow Jones Industrial Average and S&P 500 futures retreating on Wednesday, it appears traders are taking a step back to assess the implications of the election outcome on the broader economic landscape.

Charting a New Course: Investors Weigh the Potential Impact of Trump's Policies

Dow Jones and S&P 500 Futures Decline Amid Cautious Optimism

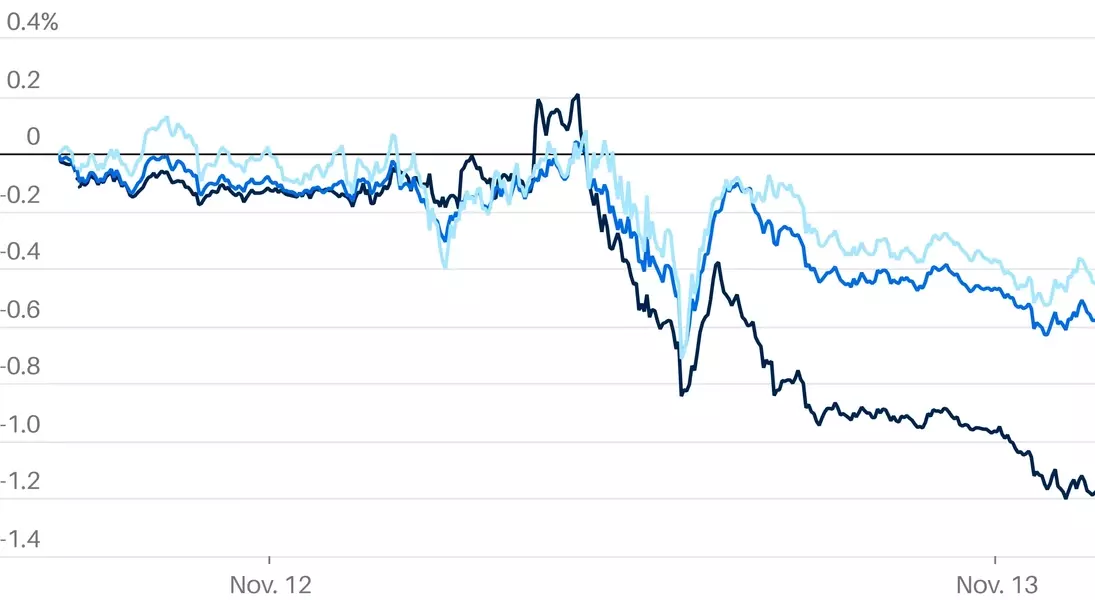

Dow Jones Industrial Average futures lost 47 points, or 0.1%, following a decline from the record close on Monday. Similarly, S&P 500 futures retreated 0.1%, while contracts tied to the technology-heavy Nasdaq 100 also declined by the same margin. This pullback suggests that investors are taking a more cautious approach, potentially seeking to better understand the potential ramifications of the Trump administration's policies on the markets.Despite the initial dip, the markets have generally remained optimistic about the prospects of a Trump presidency. Investors are closely watching for any indications of how the incoming administration plans to address key economic issues, such as tax reforms, trade agreements, and regulatory changes. The anticipation of these policy shifts has fueled a sense of cautious optimism, as traders attempt to position themselves for the potential impact on corporate profits and the broader economic landscape.Inflation Data and the Federal Reserve's Monetary Policy Decisions

Another factor that could influence market sentiment in the coming days is the release of new inflation figures. Analysts expect these data to show that price gains remain above the Federal Reserve's target, which may cast doubt on the central bank's plans for another interest rate cut in December.The Federal Reserve's monetary policy decisions have been a significant driver of market movements in recent years, and any indication of a potential shift in the central bank's approach could have far-reaching implications for investors. As the markets navigate this period of uncertainty, traders will be closely monitoring the Fed's actions and statements for clues about the future direction of interest rates and their potential impact on the broader economy.Navigating the Uncertainty: Investors Seek Clarity on Trump's Policy Agenda

With limited news to drive significant market movements in the immediate aftermath of the election, investors are primarily focused on speculating about the potential impact of Trump's policies on corporate profits and the overall economic outlook. This uncertainty has led to a more cautious approach, as traders seek to better understand the implications of the incoming administration's agenda.As the new administration begins to take shape, investors will be closely watching for any concrete policy proposals or executive actions that could provide greater clarity on the direction of the markets. The ability of the Trump team to effectively communicate their vision and implement their agenda will be a crucial factor in shaping investor sentiment and market performance in the coming months.Adapting to a Changing Landscape: Investors Prepare for Potential Volatility

In the wake of the election, investors are bracing for potential volatility as the markets adjust to the new political landscape. The uncertainty surrounding the Trump administration's policies and their potential impact on the economy has created an environment where traders must be nimble and adaptable.To navigate this shifting landscape, investors may need to reevaluate their investment strategies, diversify their portfolios, and closely monitor market trends and economic indicators. The ability to quickly adapt to changing conditions will be essential for investors seeking to capitalize on the opportunities and mitigate the risks that may arise in the post-election market environment.As the markets continue to grapple with the implications of the election, investors will need to remain vigilant, stay informed, and be prepared to make informed decisions in the face of ongoing uncertainty. The road ahead may be filled with challenges, but those who can navigate the shifting tides may find opportunities to position themselves for long-term success.You May Like