As the nation holds its collective breath, the highly anticipated showdown between Vice President Kamala Harris and former President Donald Trump has taken center stage, captivating the attention of traders and investors alike. With a flurry of earnings reports and a crucial Federal Reserve interest-rate decision looming, the stage is set for a dramatic day on Wall Street.

Charting the Course: Investors Brace for Election Day Uncertainty

Navigating the Shifting Tides of the Dow and Beyond

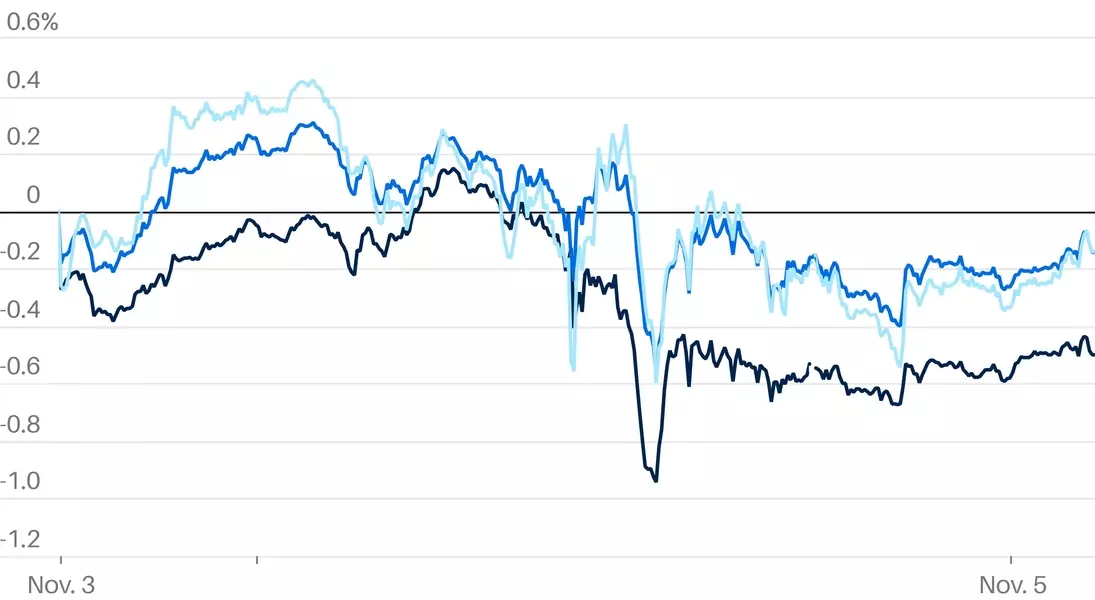

Futures for the Dow Jones Industrial Average have added a modest 40 points, or 0.1%, signaling a cautious start to the trading day. Similarly, S&P 500 futures have risen 0.2%, while those attached to the Nasdaq 100 have climbed 0.3%. However, these modest gains come on the heels of Monday's downward close for all three major indexes, underscoring the uncertainty that permeates the markets.As investors eagerly await the outcome of the election, they find themselves in uncharted territory. The race between Vice President Harris and former President Trump has captivated the nation, and the reverberations of the result are poised to ripple through the financial landscape. Traders will be closely monitoring the situation, seeking to understand how the election's outcome might impact their portfolios.Earnings Highlights and the Fed's Next Move

Amidst the political drama, the markets will also be focused on a slate of earnings reports and the impending Federal Reserve interest-rate decision. Tuesday's earnings highlights include tech powerhouse Super Micro Computer, energy giant Devon Energy, fast-food conglomerate Yum! Brands, and luxury automaker Ferrari.The Fed's announcement on Thursday will be particularly scrutinized, as investors seek clues about the central bank's monetary policy direction. With inflation remaining a persistent concern, the Fed's decision on interest rates could have far-reaching implications for the broader economy and financial markets.Navigating the Uncertainty: Strategies for Savvy Investors

As the nation holds its collective breath, savvy investors are employing a range of strategies to navigate the turbulent waters. Some are opting for a more cautious approach, diversifying their portfolios and seeking safe-haven assets to weather the potential volatility. Others are taking a more proactive stance, closely monitoring the political and economic landscape for opportunities to capitalize on market shifts.Regardless of their approach, one thing is clear: the coming days will be a true test of investors' resilience and adaptability. With the stakes high and the outcome uncertain, the ability to make informed decisions and respond swiftly to changing conditions will be paramount.The Calm Before the Storm: Preparing for the Aftermath

While the final results may not be known until Tuesday evening or Wednesday, the markets are already bracing for the potential fallout. Analysts and experts are closely examining the potential policy shifts and economic implications of each candidate's victory, seeking to identify the potential winners and losers in various sectors and industries.For investors, the coming days will require a delicate balance of vigilance and patience. The ability to stay informed, adapt to changing circumstances, and make strategic decisions will be the hallmark of those who navigate this pivotal moment with success.As the nation holds its collective breath, the financial world stands poised, ready to respond to the seismic shifts that may unfold in the wake of this historic election. The stage is set, and the future remains uncertain – but one thing is clear: the decisions made in the coming days will reverberate through the markets for years to come.You May Like