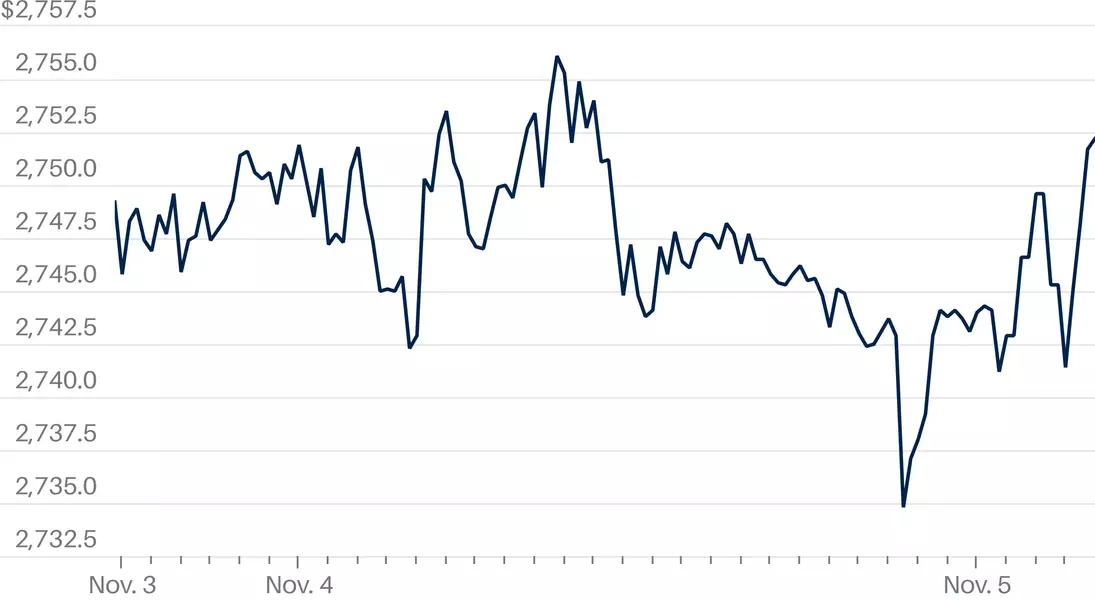

As the world watches the unfolding drama of the U.S. presidential election, gold investors find themselves in a delicate dance, balancing the potential implications of the outcome on the precious metal's performance. In the face of this political uncertainty, the gold market has remained broadly flat, with futures trading around $2,747.20 a troy ounce. However, the shifting tides of the election race have not gone unnoticed, as analysts closely monitor the potential impact on the gold market.

Betting on the Future: Tracking the Ebb and Flow of Election Odds

The race for the White House has been a closely watched affair, with the betting markets reflecting the ebb and flow of the candidates' fortunes. Former President Donald Trump's lead in these markets has narrowed considerably, a development that has caught the attention of industry analysts. Commerzbank, in a recent note, has highlighted the potential implications of this shift on the gold market.The Trump Factor: Inflation and its Impact on Gold

According to the analysts, a Trump victory could potentially lead to higher inflation compared to a Kamala Harris presidency. This is a crucial consideration for gold investors, as the precious metal is often seen as a hedge against rising prices. The narrowing of Trump's lead in the betting markets, therefore, reduces the potential upside for gold, as the likelihood of an inflationary environment under a Trump administration has diminished.Navigating the Uncertainty: Strategies for Gold Investors

In the face of this political uncertainty, gold investors are faced with the challenge of navigating the shifting sands of the market. While the overall market sentiment remains broadly flat, the potential implications of the election outcome on inflation and, consequently, the gold market, cannot be ignored. Investors must carefully weigh the various scenarios and adjust their strategies accordingly, staying vigilant and adaptable in the face of the evolving political landscape.Diversification and Hedging: Safeguarding Portfolios in Turbulent Times

As the election race continues to unfold, gold investors may find solace in the time-tested principles of diversification and hedging. By allocating a portion of their portfolios to gold and other safe-haven assets, investors can potentially mitigate the risks associated with political uncertainty and market volatility. This approach not only provides a measure of stability but also allows for the potential upside should the gold market respond favorably to the election outcome.The Broader Implications: Geopolitics and the Global Gold Market

The U.S. presidential election is not just a domestic affair; its reverberations can be felt across the global stage. Investors must also consider the potential geopolitical implications of the election outcome and how they might impact the broader gold market. Changes in foreign policy, trade agreements, and international relations can all influence the demand and supply dynamics of the precious metal, requiring a nuanced understanding of the global landscape.Staying Informed and Adaptable: The Key to Navigating the Gold Market

In the face of the ongoing political uncertainty, gold investors must remain vigilant, staying informed and adaptable in their approach. By closely monitoring the evolving election landscape, analyzing the potential implications for inflation and the gold market, and diversifying their portfolios, investors can position themselves to weather the storm and potentially capitalize on the opportunities that may arise.As the world waits with bated breath for the outcome of the U.S. presidential election, the gold market continues to be a focal point of attention. With the shifting tides of the race and the potential impact on inflation, gold investors must navigate this uncertain terrain with a keen eye and a steady hand, leveraging their knowledge and adaptability to navigate the challenges and seize the opportunities that lie ahead.