Keen Footwear's proactive strategy to decentralize manufacturing and reduce reliance on China highlights the complex realities faced by global businesses amidst escalating trade tensions. Despite significant investments in establishing production facilities across Asia and the Americas, the company finds itself continuously grappling with the unpredictable nature of international trade tariffs. This scenario underscores a broader dilemma for many enterprises striving for resilience and cost-efficiency in a volatile global economy, demonstrating that even diversified supply chains are not immune to the disruptive influence of shifting geopolitical landscapes.

The company's experience exemplifies the intricate balance between domestic production aspirations and the indispensable nature of global sourcing. While Keen has successfully brought some manufacturing back to the U.S., particularly to its highly automated Kentucky facility, the economics of producing components like shoelaces, threads, and specialized linings remain overwhelmingly tilted towards overseas suppliers. This reveals that, despite political pressures to localize production, the fundamental cost disparities and logistical efficiencies of a globally integrated supply chain continue to make complete onshore manufacturing economically unfeasible for many industries. The ongoing adjustments by companies like Keen illustrate the constant adaptations required to navigate an evolving and often unpredictable international trade environment.

The Shifting Sands of Global Manufacturing

Keen Footwear, a company that designs and manufactures rugged sandals and hiking boots, recognized the inherent risks of relying heavily on a single manufacturing hub, particularly China, long before the recent surge in trade conflicts and the unprecedented disruptions caused by the Covid-19 pandemic. A decade ago, the company embarked on a strategic initiative to diversify its global footprint, systematically moving production away from its Chinese factories. This forward-thinking approach led to the establishment of new manufacturing facilities in various locations across Southeast Asia, India, and the Dominican Republic. Most recently, in a significant move underscoring its commitment to domestic production, Keen opened a state-of-the-art factory in Kentucky, proudly branding its products as “American Built.” However, this strategic foresight has not entirely insulated Keen from the persistent turbulence of global trade. The company, like the vast majority of modern businesses, remains intrinsically linked to a complex global supply chain for a myriad of parts and raw materials. Despite actively seeking local suppliers to mitigate risks, a significant portion of components still traverses international borders before final assembly.

This reliance on a global network means Keen is continuously exposed to an ever-changing array of American tariffs, a situation that has been particularly exacerbated by the trade policies of the Trump administration. Hari Perumal, Keen’s chief operating officer, is on the front lines of this battle, constantly wrestling with the complexities of new trade barriers, such as the recently elevated tariffs on imports from India, which have surged to an impactful 50 percent. Furthermore, he meticulously analyzes the nuances of new trade agreements, like the one recently announced with Vietnam, where Keen also maintains production. The constant recalculation of operational strategies extends to contemplating significant shifts, such as transferring the production of boot uppers from its Thai factory, currently subjected to a 20 percent tariff, to the Dominican Republic, where a more favorable 10 percent tariff applies. While Perumal expresses confidence in Keen's ability to navigate these challenges through its flexible and diversified manufacturing approach, the sheer unpredictability and frequent alterations in trade policy create an ongoing, burdensome distraction. This volatile environment forces the company to absorb additional costs, which, despite Keen's commitment to holding prices steady this year, contribute to a broader inflationary trend observed across the footwear industry, ultimately impacting consumers.

Domestic Production vs. Global Realities

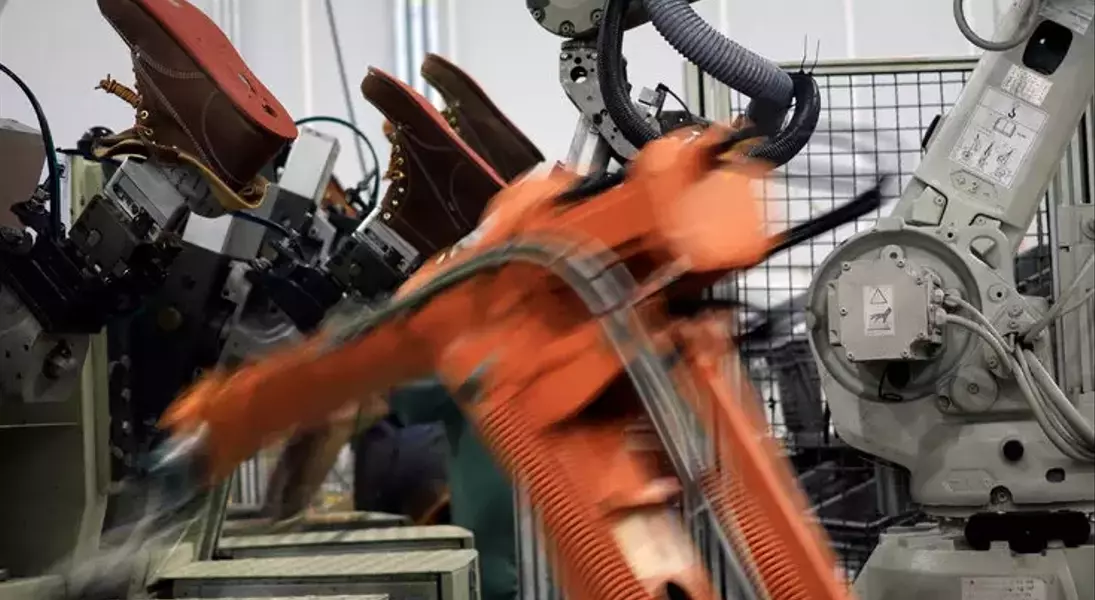

Despite Keen Footwear's strategic efforts to increase its American manufacturing presence, with a goal to elevate domestic production from 5 percent to 9 percent of global sales within the next 18 months, and further to 15 percent by 2030, the company acknowledges the inherent limitations of a full-scale return to onshore production. The recently opened Kentucky factory, a highly automated facility that can churn out a pair of construction boots every 22 seconds, represents a significant step towards serving a market that increasingly values domestic goods. This facility, equipped with machinery relocated from Keen’s former Portland, Oregon site due to labor availability challenges, benefits from its proximity to the company's national distribution center and a major air cargo hub in Louisville. This co-location not only streamlines logistics but also aligns with Keen's environmental commitments by reducing carbon emissions. Yet, Hari Perumal, Keen’s chief operating officer, candidly views this domestic manufacturing capability as a specialized niche rather than a comprehensive solution for the entire footwear industry.

Perumal argues that the vast price disparities between U.S. and Asian manufacturing, coupled with a lack of available labor willing to accept factory wages in America, pose insurmountable barriers to a mass repatriation of production. He cites compelling examples, such as the company’s red-white-and-blue shoe boxes, which despite tariffs, are still one-third the cost when sourced from Cambodia compared to U.S.-made alternatives. Similarly, while Keen has identified domestic leather suppliers in Mississippi, the total cost of manufacturing boot uppers in the U.S.—considering the need to import other essential components like shoelaces, thread, eyelets, and waterproof linings, predominantly from Asia—would be five to six times higher than overseas production. These economic realities drive Keen's continued reliance on global supply chains and its interest in leveraging regional trade agreements, such as the one with the Dominican Republic. This agreement allows components to be shipped from Asia to the Dominican Republic for manufacturing and then exported duty-free to the U.S. However, despite these adaptive strategies, Perumal remains under no illusions that Keen is fully insulated from the ever-changing variables introduced by global trade policies, recognizing that the scope of what the company can truly control is progressively diminishing.