This report explores the apparent disconnect between certain underlying market indicators and the generally optimistic consensus among financial analysts. It suggests that despite widespread bullish sentiments, significant risks such as economic downturns and elevated stock valuations warrant a more cautious investment approach. Drawing parallels with a renowned investor's philosophy, the article encourages individuals to conduct thorough independent research and consider maintaining liquidity, rather than blindly following conventional Wall Street advice. While acknowledging the possibility of error in its own assessment, the piece ultimately questions the absolute certainty of the prevailing market optimism.

Dissecting Wall Street's Outlook Amidst Shifting Sands

In the bustling financial hubs, a quiet unease simmers beneath the surface of seemingly buoyant market predictions. While many esteemed analysts paint a picture of continued prosperity, a deeper examination of economic currents reveals potential vulnerabilities. On September 11, 2025, a critical look at current market conditions challenges the widely held belief that the landscape is as robust as it appears.

A notable point of concern stems from economic policies, such as tariffs, which experts broadly agree can detrimentally impact corporate profitability and consumer spending. Despite the S&P 500's impressive performance throughout the year, this underlying economic reality persists, with leading institutions like UBS, JPMorgan Chase, and Goldman Sachs all assigning considerable probabilities to an impending economic contraction. Furthermore, some foresee a period of 'stagflation'—a challenging blend of economic stagnation and inflationary pressures.

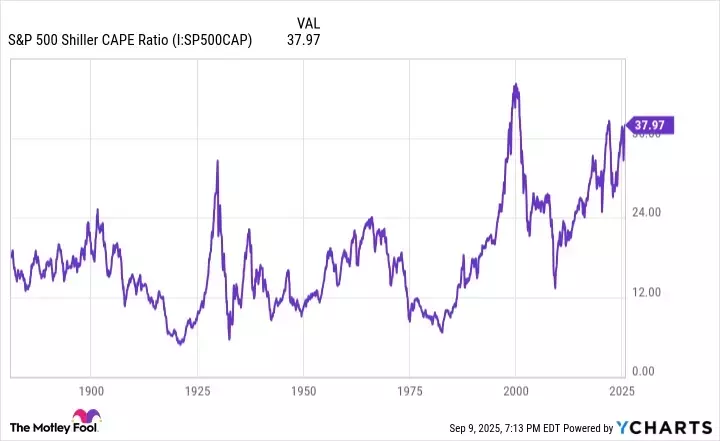

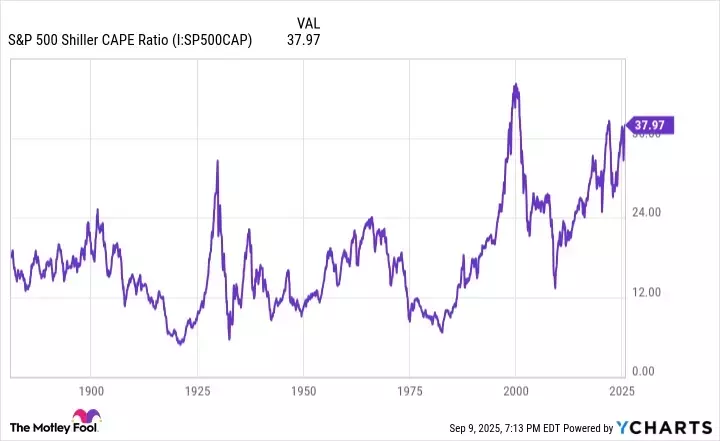

Adding to these complexities are the alarmingly high stock valuations. Key metrics like the Shiller CAPE ratio, which measures cyclically adjusted price-to-earnings, are at historic peaks, signaling a potentially overextended market. The Buffett indicator, another crucial valuation tool comparing total market capitalization to GDP, also flashes a warning sign, sitting at an unprecedented level that previously prompted cautious advisories from investment titans.

Paradoxically, despite these ominous indicators, the vast majority of S&P 500 stocks still receive 'buy' recommendations from analysts, with only a handful designated for 'sell'. This inconsistency extends to specific stock targets; numerous companies possess consensus price targets below their current trading values, yet analysts continue to endorse buying them. Moreover, a significant number of S&P 500 constituents are projected to experience negative or minimal earnings growth over the next five years, yet many retain 'buy' ratings—a puzzling stance given the availability of safer, higher-yielding alternatives like U.S. Treasuries.

Embracing Prudence in Uncertain Times

The current market environment beckons investors to adopt a more independent and discerning perspective. Rather than solely relying on the often-conflicting signals from mainstream financial analysis, individuals might benefit from emulating the strategies of seasoned investors known for their long-term vision and rigorous fundamental analysis. Cultivating a robust cash position, as some investment legends have done, could serve as a strategic buffer against unforeseen market shifts, offering both protection and future opportunity. Ultimately, a diversified portfolio, built on careful research and an understanding of intrinsic value, remains a cornerstone for navigating the inevitable ebb and flow of the financial world.