Lithium Prices Fluctuate Amid Shifting Market Dynamics

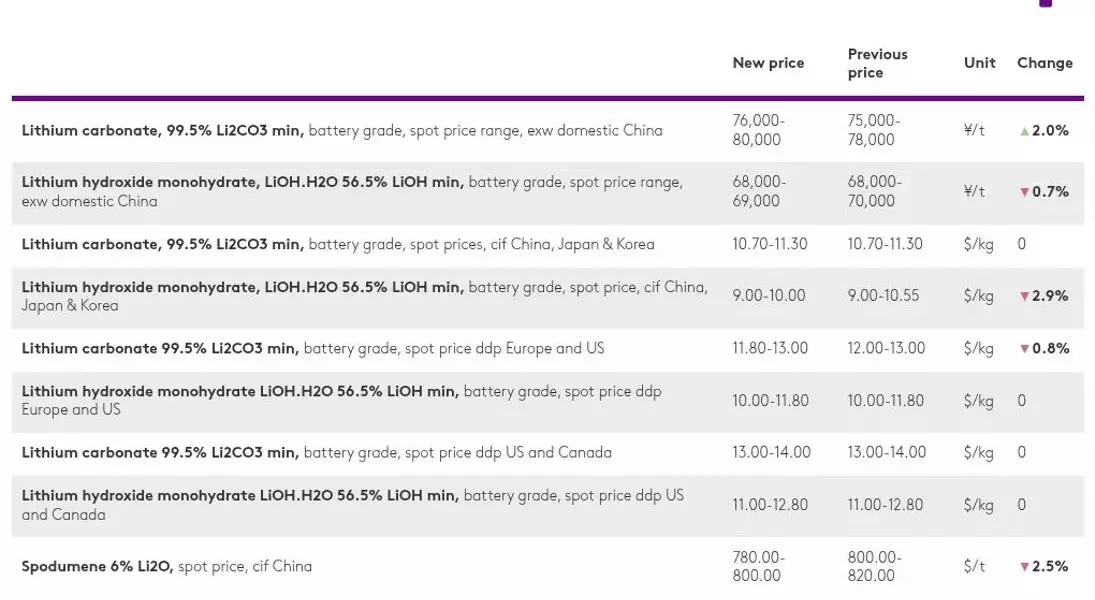

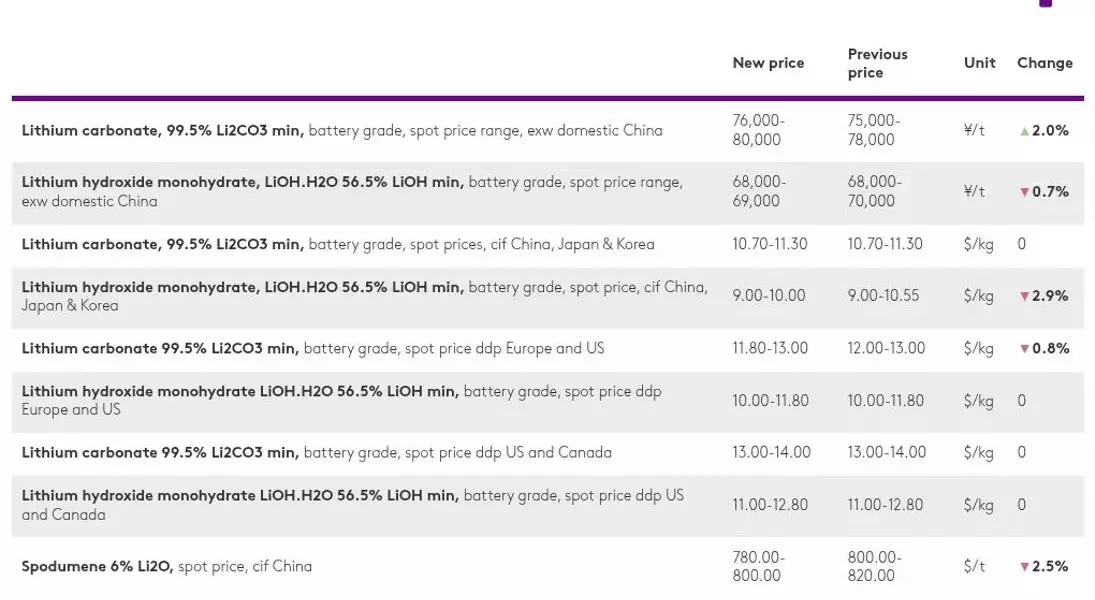

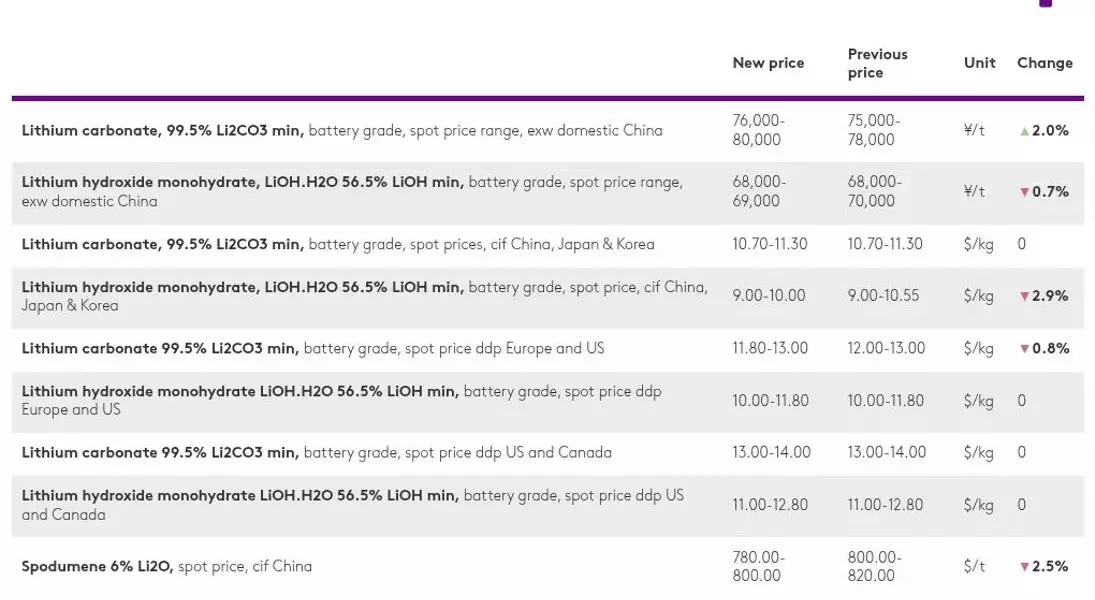

The global lithium market has been experiencing a period of volatility, with prices for both lithium carbonate and lithium hydroxide fluctuating in response to shifting supply and demand dynamics. While the carbonate market has seen some stability, the hydroxide segment has faced downward pressure amid muted spot demand, particularly in the key Chinese market. Meanwhile, the US and European markets have remained relatively flat, with some slight declines in European carbonate prices due to falling freight rates from Asia.Navigating the Lithium Landscape: Insights and Outlooks

China's Lithium Carbonate Prices Ride the Volatility Wave

China's lithium carbonate prices have experienced a rollercoaster ride in recent weeks, edging up after the National Day holiday but then facing a steady downtrend. The volatility has been largely driven by fluctuations in the futures market, with the most active 2411 (November) lithium carbonate contract on the Guangzhou Futures Exchange (GFEX) opening at 81,500 yuan ($11,516) per tonne on October 8 and then rising to 84,800 yuan per tonne before falling to 73,700 yuan per tonne by the end of the week.Market participants attribute the downward trend to the waning impact of China's stimulus policies announced prior to the holiday, as well as ongoing oversupply concerns. Despite the volatility, the spot lithium carbonate market saw increased activity after the holiday, with producers actively selling units when futures prices were high and consumers starting to buy when prices fell.However, sources indicate that consumer demand remains limited, with buyers only purchasing on a hand-to-mouth basis. Market participants are also cautious about the near-term outlook, as they expect lithium iron phosphate (LFP) cathode production in China to remain flat month-on-month in October.Lithium Hydroxide Prices Face Downward Pressure

In contrast to the carbonate market, lithium hydroxide prices have remained under downward pressure amid ongoing muted spot demand. Chinese lithium producers have reported that they are not quoting offers for spot lithium hydroxide, as current demand levels are insufficient to cover their production costs.One producer source noted that the company is only concluding deals in very small volumes for testing purposes, as spot demand from consumers remains subdued. Fastmarkets' weekly assessment of the lithium hydroxide monohydrate price in China narrowed downward by 1,000 yuan per tonne, reflecting the weaker market conditions.Spodumene Prices Face Downward Pressure

The weakening of GFEX prices has also put downward pressure on spodumene prices. Fastmarkets assessed the spodumene min 6% Li2O, spot price, cif China at $780-800 per tonne on Thursday, narrowing downward by $20 per tonne from the previous day and $20 per tonne from a week earlier.Sources indicate that as GFEX prices started to weaken, spodumene buyers became more cautious, as many of them buy spodumene and have it produced into carbonate to sell into the GFEX market. This direct link between spodumene and GFEX prices has led to softening offer prices from miners, although concluded deals remain limited.Muted Demand in the CJK Market

The CIF China, Japan, and Korea (CJK) market has seen limited trading and scarce demand, with both lithium carbonate and lithium hydroxide prices remaining stable or edging down. Sources attribute this to the public holidays in China and South Korea, as well as the fact that some Japanese and Korean consumers are still using their existing inventories.One international lithium producer source noted that there is no demand for lithium carbonate, and it may not be until the first quarter of next year that these consumers can finally finish their inventories. Additionally, multiple market participants reported that there is no buying interest in lithium hydroxide if the prices are above $10 per kg, reflecting the weak spot demand in the region.Mixed Signals in the European Market

The European lithium market has presented a mixed picture, with lithium carbonate prices dipping while lithium hydroxide prices remained steady. The decline in lithium carbonate prices is attributed to lower freight rates from Asia to Europe, which have made exporting more competitive for producers.However, despite the more favorable shipping costs, European demand remains slow, and there are no reports of supply shortages in the region. As a result, the lower offers for lithium carbonate did not lead to a significant uptick in sales.Fastmarkets' assessments show that the weekly price for lithium carbonate 99% Li2CO3 min, technical and industrial grades, spot price ddp Europe fell to $11.00-11.70 per kg, while the battery-grade lithium carbonate price also declined to $11.80-13.00 per kg. In contrast, the lithium hydroxide monohydrate prices in Europe remained unchanged at $10-11 per kg for technical and industrial grades and $10.00-11.80 per kg for battery grade.Stability in the US Lithium Spot Market

The lithium spot market in the United States has remained relatively stable over the past week, with no changes in the assessed prices for both lithium carbonate and lithium hydroxide. Fastmarkets' weekly assessments for the technical and industrial grades of lithium carbonate and lithium hydroxide, as well as the battery-grade versions, all remained unchanged.A small deal for battery-grade lithium carbonate was reported within the existing price range but was discarded because it was below the required minimum tonnage per Fastmarkets' methodology. This suggests that while the US market remains relatively steady, there is still limited trading activity and cautious sentiment among market participants.