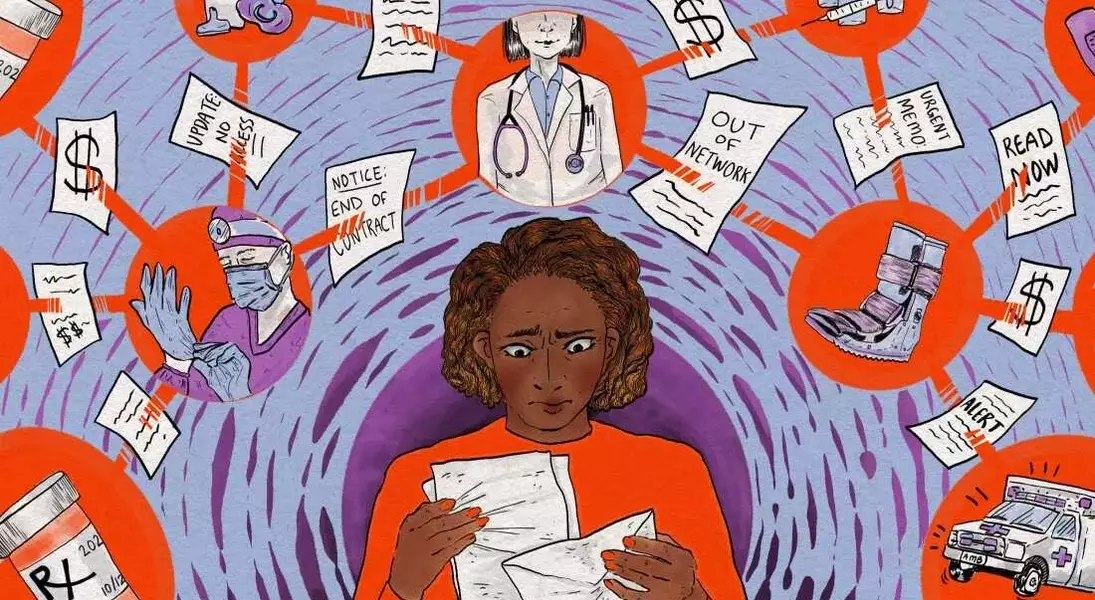

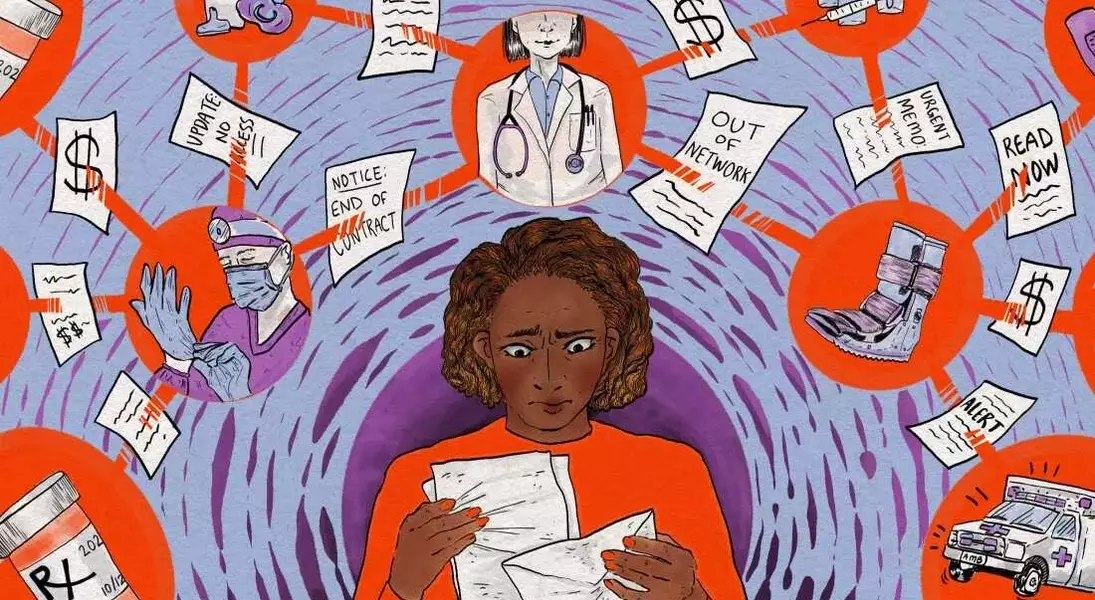

When healthcare providers are no longer covered by a patient's insurance, families often find themselves in a challenging situation, struggling to secure affordable care. This predicament frequently arises from contract disagreements between hospitals and insurance companies, leaving patients to navigate a complex system to maintain access to their doctors. For many, like Amber Wingler of Columbia, Missouri, the sudden change can be overwhelming, especially when managing the health needs of multiple family members. Facing the prospect of significant out-of-pocket expenses or extensive travel for in-network specialists, patients must learn how to protect their access to care and financial well-being.

Understanding the implications of an out-of-network situation is crucial for patients seeking to minimize disruption and costs. When a hospital or medical group exits an insurance network, patients typically face higher fees or full responsibility for their medical bills. However, there are strategies to mitigate these impacts, such as inquiring about cash discounts or hospital financial assistance programs. Research indicates that many disputes between healthcare providers and insurers are temporary, often resolving within a few months, leading to a reinstatement of coverage. Patients with chronic or complex conditions might also qualify for 'continuity of care' extensions, allowing them to continue seeing their current doctors at in-network rates, though this process can be time-consuming.

Beyond immediate financial concerns, patients should consider long-term planning and advocacy. While switching insurance plans due to a doctor leaving the network is usually not possible outside of annual open enrollment periods or qualifying life events, being informed about policy details is vital. If a permanent split appears likely, exploring new in-network providers through the insurer's online tools becomes necessary, despite the potential inconvenience of establishing new patient relationships or traveling further. Moreover, keeping meticulous records of all medical appointments and payments during a network dispute is essential, as retroactive agreements between insurers and hospitals can lead to reimbursement for previously out-of-pocket expenses. By being proactive and informed, patients can better navigate these challenging healthcare scenarios and advocate for their rights.

In the evolving landscape of healthcare, where contract disagreements between providers and insurers are increasingly common, patients often bear the brunt of these disputes. The experiences of individuals like Amber Wingler underscore the importance of resilience, informed decision-making, and proactive engagement with both healthcare providers and insurance companies. While the system can be complex and frustrating, equipping oneself with knowledge and understanding of available options can empower patients to overcome obstacles, secure necessary medical attention, and advocate for fair treatment. This ongoing vigilance and informed action are not just about personal health but also about contributing to a more transparent and patient-centered healthcare environment for all.