In the ever-evolving world of financial markets, the futures arena has emerged as a dynamic and multifaceted landscape, offering investors a wealth of opportunities to diversify their portfolios and capitalize on market trends. From the tech-driven Nasdaq 100 to the stability of government bonds, the allure of precious metals, the volatility of energy commodities, and the global currency markets, this comprehensive report delves into the intricate details of these key futures segments, providing invaluable insights and actionable strategies for discerning investors.

Unlocking the Potential of Futures Trading: A Comprehensive Exploration

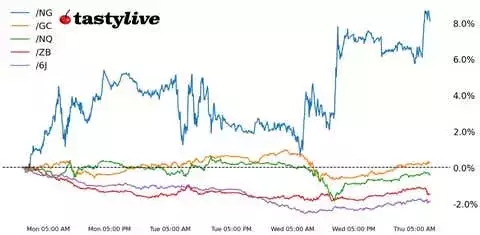

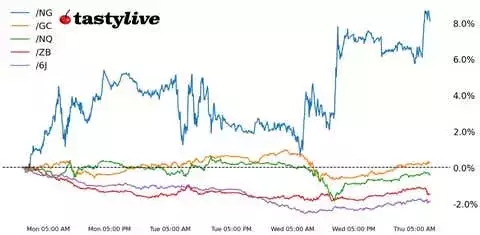

Nasdaq 100: Riding the Tech Wave

The Nasdaq 100 futures (/NQZ4) have been the talk of the town, surging 0.86% as investors eagerly await the impact of Tesla's (TSLA) impressive earnings report. The electric vehicle giant's projected 20% sales growth for the coming year has ignited a sense of optimism, with the stock soaring nearly 15% in pre-market trading. This development has the potential to revive market sentiment, as investors seek opportunities in the tech-driven Nasdaq 100 index. However, the market landscape remains dynamic, with Boeing (BA) facing a setback as its machinist union rejected the company's latest wage offer, while American Airlines (AAL) and Southwest Airlines (LUV) have managed to impress investors with their quarterly earnings.Bonds: Navigating the Yield Curve

The bond market has seen a resurgence, with the 30-year T-Bond futures (/ZBZ4) rising 0.29% despite the release of the weekly U.S. jobless claims report. This gain comes amidst a broader trend of falling yields, as the ebb and flow of geopolitical tensions have provided a tailwind for bond prices. Investors should closely monitor the yield curve, as the recent rise in bond prices may signal a shift in market sentiment and a potential opportunity to capitalize on the changing dynamics.Precious Metals: Shining Amidst Volatility

Gold futures (/GCZ4) have reclaimed some of their lost ground, rising 0.89% as traders take advantage of a weaker dollar and lower yields. The technical landscape suggests that both gold and silver have returned to trend support levels, which could ultimately define the legitimacy of the recent breakouts. However, investors should keep a close eye on the performance of Newmont (NEM), the world's largest gold producer, as the company's disappointing earnings and sales figures for the third quarter of 2024 may have implications for the broader precious metals market.Energy: Navigating the Volatility

Crude oil prices (/CLZ4) have been on a rollercoaster ride, with the commodity trimming its overnight strength as U.S. traders came online. The surprise build in crude oil inventories reported by the Energy Information Administration (EIA) has added to the market's complexity, although this could be attributed to the impact of the recent hurricane in the Gulf of Mexico. Investors should closely monitor the geopolitical tensions between Israel and Iran, as any escalation could have significant implications for the energy markets.Currency Markets: Shifting Tides

The foreign exchange (FX) markets have seen a respite from the prolonged U.S. dollar strength, with a pullback in U.S. Treasury yields providing some relief. The Australian dollar (/6AZ4) has emerged as the top performer, while the Japanese yen (/6JZ4) has posted its first daily gain this week, potentially signaling a return of the carry trade. Investors should closely monitor the dynamics of the global currency markets, as the interplay between macroeconomic factors and geopolitical events can have a significant impact on the performance of various currency pairs.Navigating the complex and ever-evolving futures landscape requires a keen understanding of market dynamics, technical analysis, and the ability to identify and capitalize on emerging trends. By staying informed, diversifying their portfolios, and employing strategic trading approaches, investors can position themselves to navigate the futures markets with confidence and potentially unlock new avenues for growth and wealth creation.