Currencies Collide: A Tale of Two Central Banks

Diverging Paths, Converging Challenges

The European Central Bank (ECB) and the Bank of Canada (BoC) are both expected to embark on a rate-cutting journey in the latter half of 2024, a move that could have significant implications for the EUR/CAD exchange rate. As the central banks seek to address the lingering effects of the COVID-19 crisis and manage inflationary pressures, their synchronized policy decisions are creating a unique dynamic in the foreign exchange market.The relative level of interest rates set by central banks is a crucial driver of exchange rates, as it impacts the flow of capital. Typically, currencies with higher interest rates tend to attract more investment, all other factors being equal. However, in the case of EUR/CAD, the impending rate cuts by both the ECB and BoC are creating a scenario where neither currency is particularly outperforming the other, leading to a prolonged period of range-bound trading.

This synchronized monetary policy approach is a reflection of the similar economic challenges faced by the Eurozone and Canada. Both regions are grappling with the aftermath of the pandemic, as well as broader global economic headwinds, which are putting pressure on their respective central banks to take action to support their economies.

The Surprise Factor: BoC's Aggressive Move

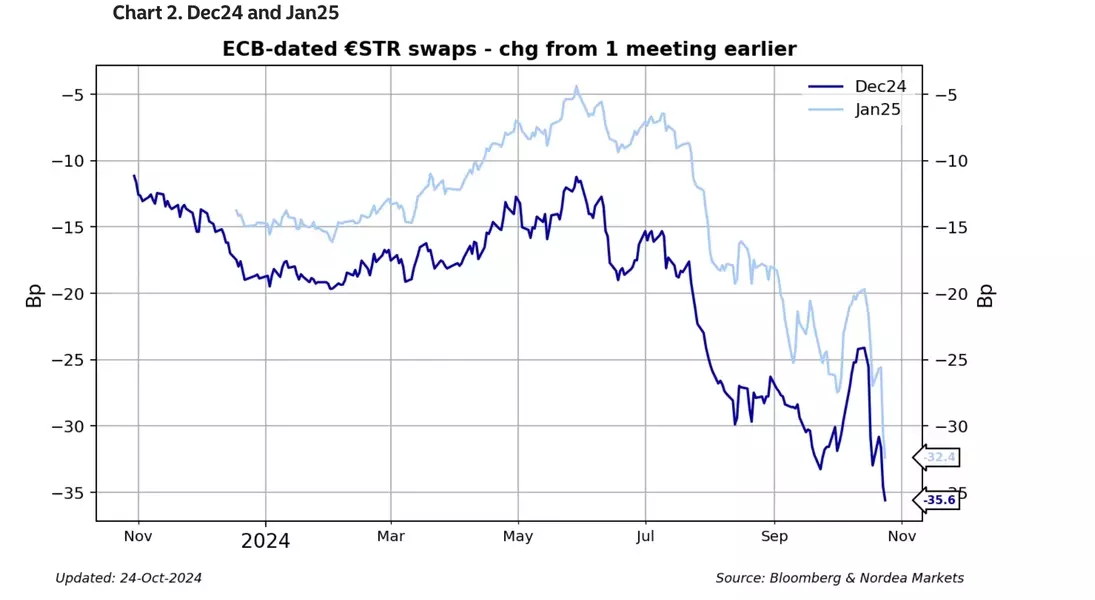

In its recent October meeting, the BoC surprised markets by slashing its official interest rate by a more aggressive 50 basis points (bps), bringing the overnight rate down to 3.75% from 4.25% previously. This decision, which was more substantial than the 25 bps cut that many analysts had anticipated, had a muted impact on the EUR/CAD pair, with the currency pair actually closing marginally higher on the day.The reason for this relatively subdued reaction can be attributed to the concurrent speculation surrounding the ECB's own monetary policy plans. Reports emerged that the ECB was considering cutting interest rates to below the "neutral" rate, a theoretical level at which inflation should remain unchanged. This news intensified market expectations of a more aggressive rate-cutting cycle from the ECB, potentially offsetting the negative impact of the BoC's decision on the Canadian dollar.

The ECB's Dilemma: Balancing Inflation and Growth

The ECB's upcoming policy decisions will be closely watched, as the central bank navigates the delicate balance between taming inflation and supporting economic growth. Recent Eurozone data, including the October Purchasing Managers' Indexes (PMIs), have painted a mixed picture, with manufacturing activity remaining in contraction territory while the services sector showed modest expansion.The employment and wage dynamics in the Eurozone will be a key factor in determining the ECB's approach. If wage inflation remains elevated, as suggested by the central bank's Chief Economist, Martin Lane, the ECB may opt for a more cautious 25 bps rate cut in December, rather than the more aggressive 50 bps reduction that the market is currently pricing in. Such a move could provide some upside potential for the EUR/CAD pair.

Conversely, if the ECB decides to go for a more substantial "Christmas slasher" rate cut, it could further weigh on the euro and contribute to the EUR/CAD's range-bound trading. The central bank's decision will be heavily influenced by the latest economic data and the evolving labor market conditions in the Eurozone.

Factors Weighing on the Canadian Dollar

The Canadian dollar is also facing its own set of challenges, which could potentially tilt the EUR/CAD balance in favor of the euro. The increased likelihood of a Republican victory in the upcoming US presidential election, led by former President Donald Trump, poses a risk for the Canadian economy.Trump's protectionist policies and his vow to impose tariffs on foreign imports could negatively impact Canada, which enjoys a free trade agreement with the US and Mexico. The potential renegotiation or even withdrawal from this deal could reduce demand for the Canadian dollar, further weakening its position against the euro.

Additionally, the decline in crude oil prices, Canada's largest export, is another factor weighing on the Canadian dollar. As the global economy navigates uncertain times, the demand for commodities like oil has been impacted, putting downward pressure on the CAD.

A Resilient German Economy: A Potential Lifeline for the Euro

Amidst the broader economic challenges, there are some positive signs for the euro. The recent rebound in the German IFO Business Climate Index, a closely watched indicator of economic sentiment, provided a glimmer of hope for the Eurozone's largest economy.Germany, often seen as the engine of the Eurozone, has faced its own set of headwinds in recent times. However, the better-than-expected IFO reading in October may have contributed to the EUR/CAD pair's nudge higher towards the end of the week, as it suggests a more resilient outlook for the German economy.

This resilience in the German economy could be a crucial factor in determining the euro's performance against the Canadian dollar, as it may help offset some of the negative pressures stemming from the ECB's potential rate cuts and the broader economic uncertainties facing the Eurozone.