Navigating the Shifting Tides: Decoding the Treasury Futures Unwinding Saga

The unwinding of positions in Treasury futures is poised to reignite a popular bond-market wager that has been scorched as traders pare back expectations for aggressive Federal Reserve interest-rate cuts. This recalibration is pushing firms to unwind leveraged positions, with some closing out bets against short-dated Treasuries and others unwinding bullish trades on longer-dated bonds. The resulting shifts are expected to keep fueling buying of shorter bonds and sales of longer-maturity ones, widening the gap between the two.Unlocking the Secrets of the Treasury Futures Unwinding Saga

The Steepening Yield Curve Conundrum

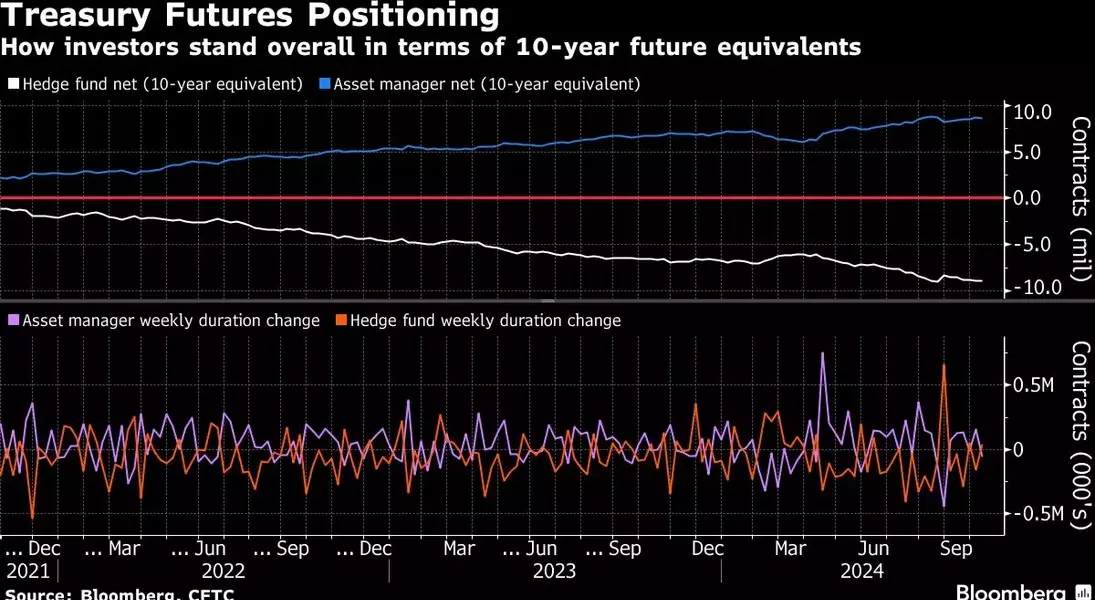

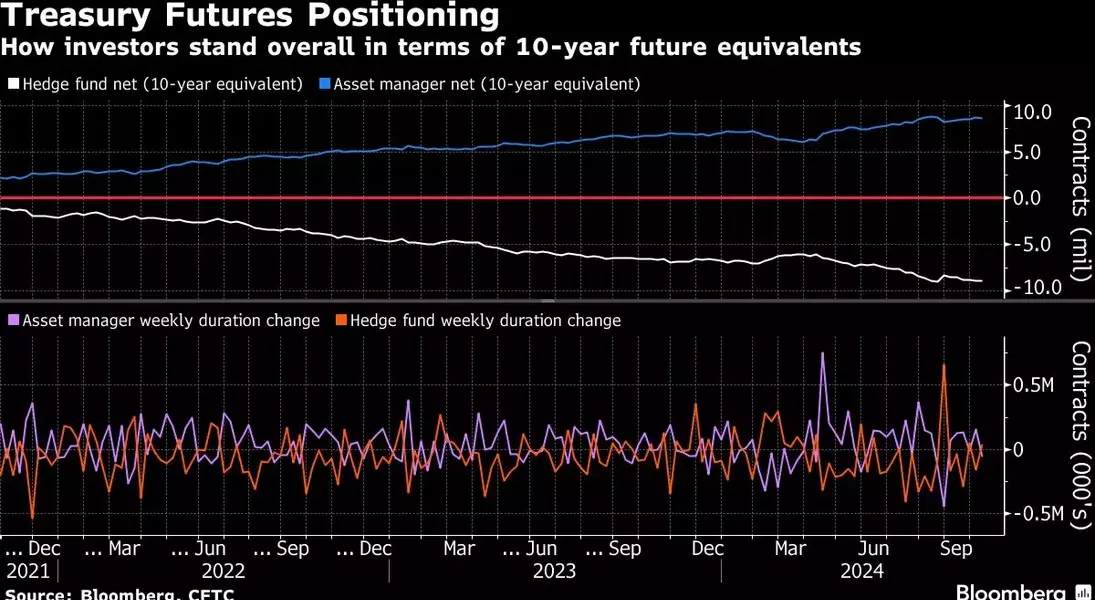

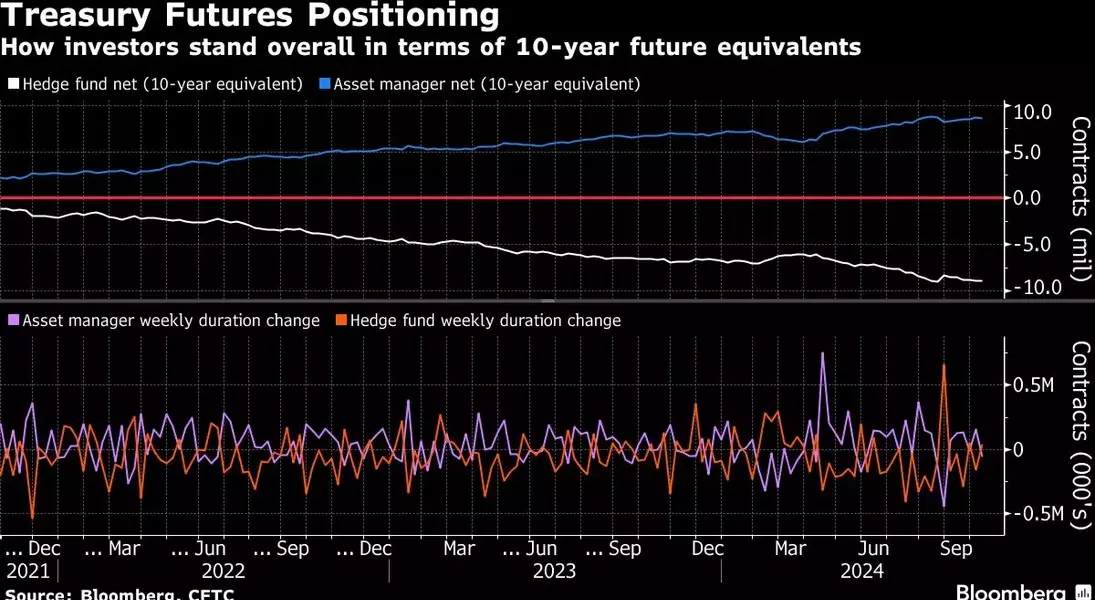

The steepening of the yield curve had been happening steadily until late last month, as short-term interest rates usually slide the most when the Fed is easing monetary policy. However, this move stalled after the monthly employment report underscored the strength of the economy, casting doubt on how quickly the central bank will continue to cut rates. This shift has prompted investors to wind down leveraged bets over the past couple of weeks, "driving positioning to be rapidly cut from the extremes," according to Citigroup Inc. strategist David Bieber.The unwinding can be seen in open interest shifts over the past week, with risk dropping sharply in both 5- and 10-year note contracts, a signal that traders are closing-out positions. This, along with similar moves in longer-dated tenors, can support a steeper curve by fueling outperformance in shorter-term bonds.Positioning Indicators Across the Rates Market

The latest positioning indicators across the rates market provide insights into the ongoing shifts. The JPMorgan Chase & Co. survey of clients' Treasury positions showed net longs rose 9 percentage points to the highest in five weeks, while neutrals rose 2 percentage points and short positions dropped 11 percentage points.In the SOFR options market, the largest shifts in open interest over the past week have included gains seen in the 95.6875 and 95.75 strike in Dec24 puts, following recent flows including large buying of the SFRZ4 95.75/95.6875/95.625/95.5625 put condor. Additionally, the SFRZ4 95.8125/95.6875 1x2 put spread has also been bought in decent size.The SOFR options heatmap reveals that the 95.50 strike remains the most populated in terms of open interest, with specific amounts of risk held in both Dec24 calls and puts, along with Mar25 puts. There has been a recent uptick in activity around the 95.75 strike, the second most populated, following recent flows including buyer of the SFRZ4 95.75/95.6875/95.625/95.5625 put condor.Unwinding Leveraged Positions

The CFTC Futures Positioning data shows that leveraged funds covered around 38,000 10-year note futures equivalents to net duration short position across the Treasury futures strip in the week up to Oct. 8. Meanwhile, asset managers unwound approximately 57,000 10-year note futures to net long positioning over the same period.The elevated premium on puts vs. calls in the long-end of the Treasuries curve has captured last week's selloff, when 30-year yields topped at 4.42% and hit cheapest levels since the end of July. This higher premium has coincided with an uptick in implied volatility, which has seen the MOVE index peak this week to the highest since December last year.Navigating the Shifting Landscape

The unwinding of leveraged positions in Treasury futures is expected to continue fueling the steepening of the yield curve, as traders close out bets against short-dated Treasuries and unwind bullish trades on longer-dated bonds. This dynamic is likely to keep driving the outperformance of shorter-term bonds relative to their longer-dated counterparts.Investors and market participants will need to closely monitor the evolving positioning indicators and market dynamics to navigate the shifting tides in the Treasury futures market. As the Federal Reserve's policy decisions continue to shape the interest rate landscape, understanding the nuances of the unwinding saga will be crucial for making informed investment decisions.You May Like