Unlock Your Financial Potential: Exploring the 2025 Tax Bracket Adjustments

Raising the Bar: Increased Tax Bracket Thresholds

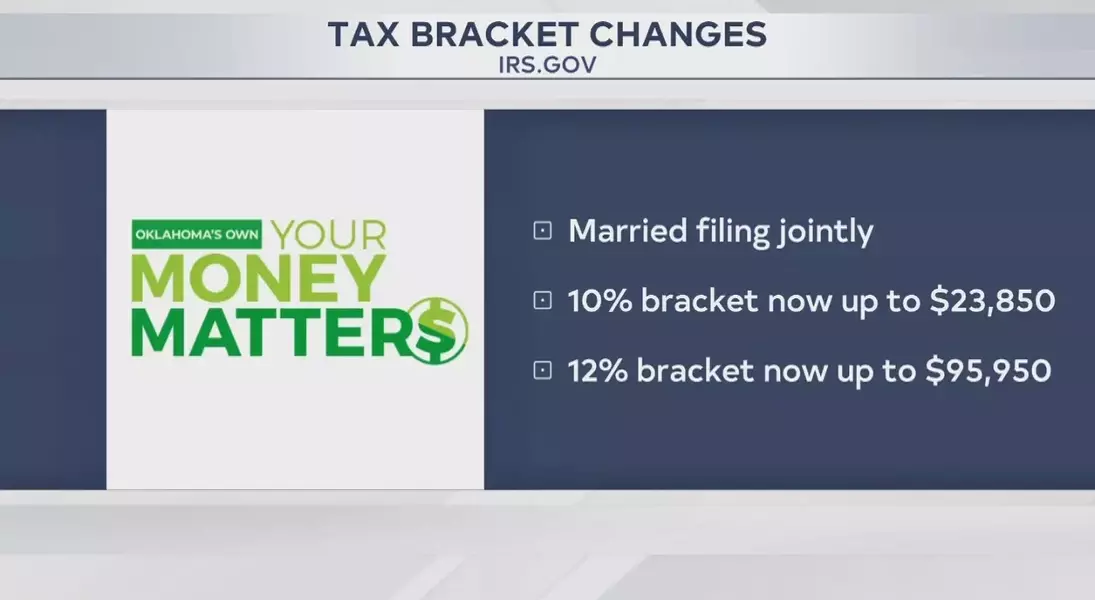

The two lowest tax brackets are set to experience notable increases, with the threshold for married couples filing jointly rising by $650 and $1,650, respectively. This means that individuals could earn more in the upcoming year compared to the previous one, yet still be taxed at the same rate, potentially allowing them to retain a larger portion of their earnings.The adjustments to the tax bracket thresholds are a strategic move by the IRS to prevent the unintended consequences of "bracket creep." This phenomenon can occur when taxpayers' incomes rise due to factors such as cost-of-living adjustments, rather than a genuine increase in their earning power. By raising the bracket thresholds, the IRS aims to ensure that individuals are not unfairly pushed into higher tax brackets, enabling them to keep more of their hard-earned money.

Expanding the Standard Deduction: A Boon for Taxpayers

In addition to the changes in tax brackets, the standard deduction is also set to increase, now reaching $30,000. For married couples filing jointly, this means that they could earn up to $100,000 together, but only be taxed on $70,000 of that income. The standard deduction figures are lower for single filers, but the overall increase represents a significant financial benefit for taxpayers.The expansion of the standard deduction is a strategic move by the IRS to provide greater tax relief for individuals and families. By increasing the amount of income that can be excluded from taxation, the IRS aims to alleviate the tax burden on taxpayers, allowing them to retain more of their earnings and potentially invest or allocate those funds towards other financial priorities.

Unchanged Child Tax Credit: Maintaining Support for Families

While the tax bracket and standard deduction changes offer financial relief, it's important to note that the child tax credit will remain at $2,000 for the upcoming tax year. This credit, which helps offset the costs associated with raising children, will continue to provide valuable support for families, even as other aspects of the tax system undergo adjustments.The decision to maintain the child tax credit at its current level reflects the IRS's commitment to supporting families and recognizing the financial challenges they face. By preserving this credit, the IRS aims to ensure that families with children can continue to benefit from this important tax relief measure, even as other changes are implemented in the tax system.

Navigating the Evolving Tax Landscape: Strategies for Maximizing Savings

As taxpayers navigate the evolving tax landscape, it's crucial to stay informed and proactive in managing their financial affairs. By understanding the changes to tax brackets, standard deductions, and credits, individuals can develop strategies to optimize their tax savings and ensure they are taking full advantage of the available benefits.Consulting with tax professionals, staying up-to-date on the latest tax regulations, and carefully planning one's financial decisions can all contribute to maximizing the potential savings offered by the 2025 tax changes. By taking a proactive approach, taxpayers can position themselves to retain more of their hard-earned income and allocate those resources towards their personal and financial goals.