The financial architecture of higher education is undergoing significant transformation, posing new challenges and opportunities for students and institutions alike. Recent policy enactments have fundamentally reshaped the landscape of student aid and borrowing, compelling a reevaluation of college affordability and access, particularly for marginalized communities. This evolving environment necessitates a closer examination of how individuals can pursue academic and professional development amidst these shifts, highlighting the critical role of financial planning and understanding the revised parameters of educational funding.

Amidst a growing demand for higher education, the conversation around student financing has intensified. Readers expressed keen interest in the intricacies of college funding, with a particular focus on student loans, institutional settlements, and the presence of international students within academic frameworks. This widespread inquiry underscores a collective concern about the future of educational accessibility and the economic burden on students and their families. To address these pressing questions, leading experts from The Times offered their insights, shedding light on the complexities of the current financial climate in academia.

Tara Siegel Bernard, a distinguished reporter specializing in personal finance, provided in-depth responses to queries regarding student debt. She elaborated on the implications of a new federal policy bill on Pell Grants and the broader spectrum of higher education access for students from low-income backgrounds. A key takeaway from her analysis is that while certain provisions, such as the eligibility of Pell Grants for non-degree programs, aim to broaden access, other changes introduce new hurdles. Notably, students who previously relied on parental loans will encounter revised borrowing limits, and graduate students face more stringent caps on their federal loans. Furthermore, new work requirements for Medicaid recipients could complicate the balance between employment and academic pursuits for many students. Conversely, a significant alteration dictates that students receiving other comprehensive grants can no longer secure a Pell Grant, potentially affecting their overall financial aid package.

A specific point of concern raised by Matt Kleinman from Washington, D.C., pertained to the new federal loan caps for graduate and professional education programs, including medical and law schools. Effective July 2026, these programs will be subject to an annual loan cap of $50,000, with a cumulative limit of $200,000. As reported by Roni Caryn Rabin, this financial ceiling is considerably lower than the actual expenses associated with highly specialized fields such as dentistry or medicine. This discrepancy raises questions about how educational institutions and prospective students will adapt. It is anticipated that some students might increasingly resort to private lenders to bridge the funding gap, potentially leading to higher interest rates and less favorable repayment terms.

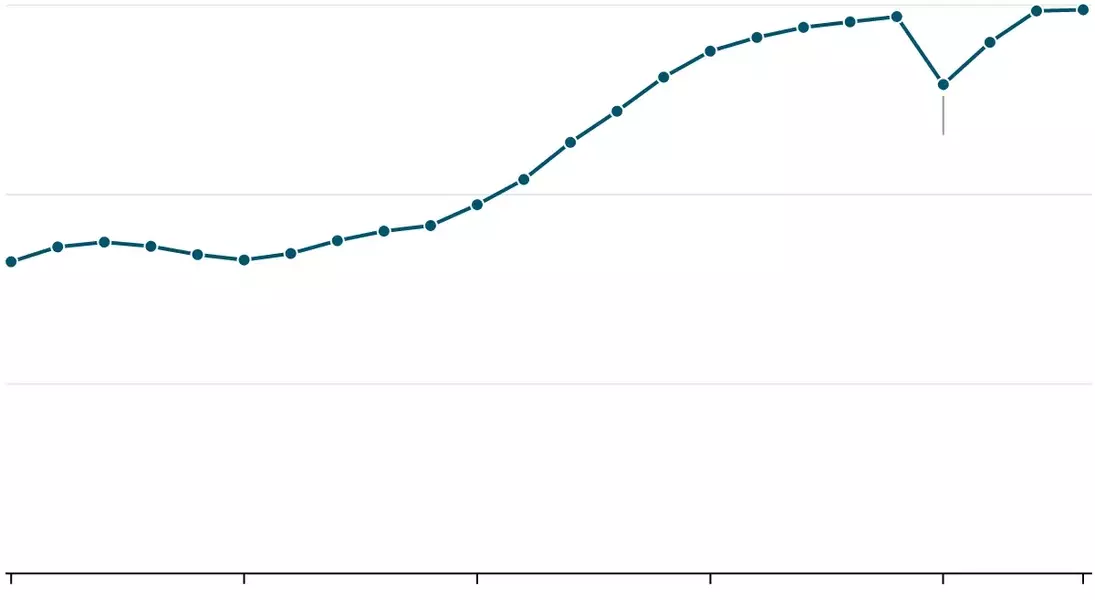

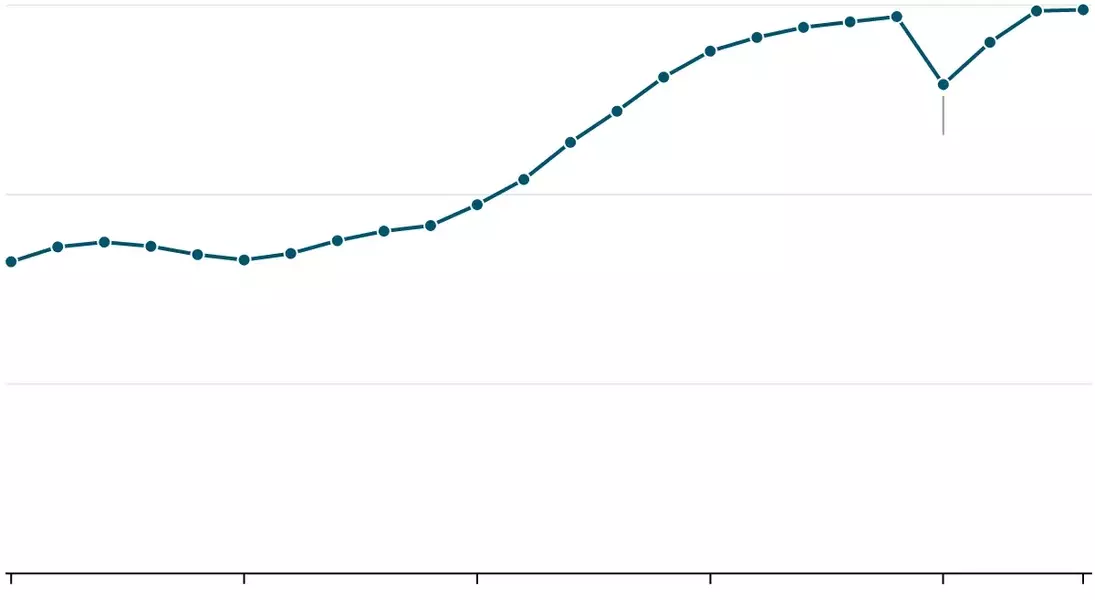

Looking ahead, the landscape of educational finance will continue to evolve, requiring constant adaptation from students, families, and policy-makers. The rising cost of public higher education, as illustrated by the doubling of average expenses since the 1970s, coupled with shifts in international student enrollment, reflects a dynamic and complex environment. Stakeholders must remain vigilant and proactive in navigating these changes to ensure equitable and sustainable access to quality education for all.