In this comprehensive exploration, we delve into the pressing financial topics that are shaping the investment and consumer landscapes. From analyzing Tesla's earnings report to providing personal finance guidance, this article offers a multifaceted perspective on the ever-changing financial world.

Unlock the Potential: Unraveling the Implications of Tesla's Performance

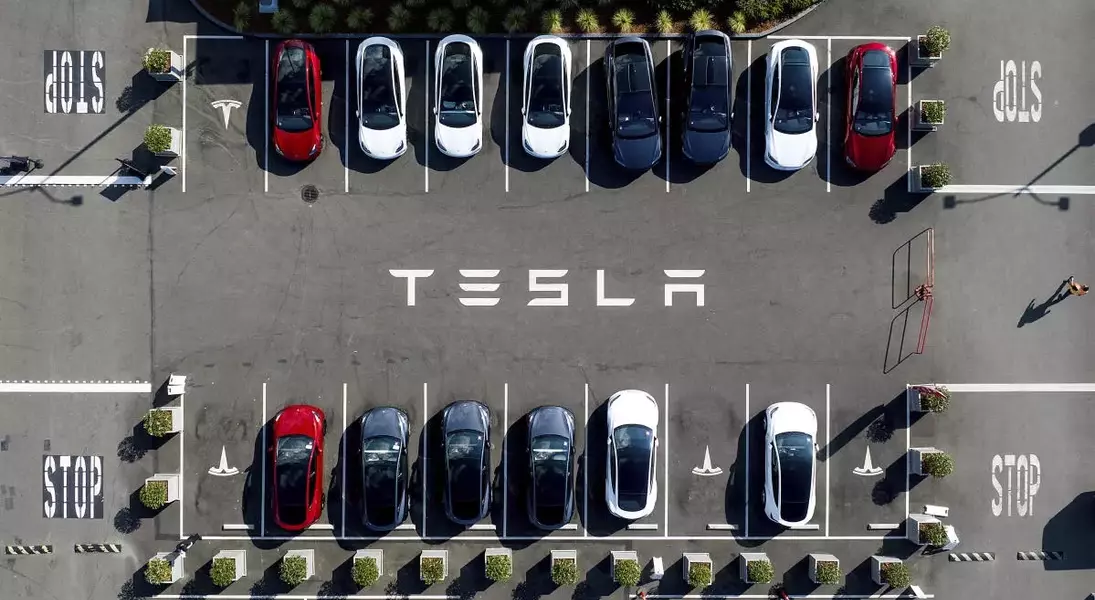

Tesla's Earnings Report: A Harbinger of Broader Sector Trends

The recent release of Tesla's (TSLA) third-quarter earnings report has sent ripples through the technology sector, with the company's growth forecast of 20% to 30% in 2025 serving as a potential harbinger of things to come. EquitySet CEO Tony Zipparro joins us to provide an in-depth analysis of the report and its potential impact on the broader industry.Zipparro's insights shed light on the intricate interconnections within the technology sector, as he explores the ways in which Tesla's performance could reverberate across the landscape. By delving into the nuances of the report, he offers a comprehensive understanding of the factors driving Tesla's growth and the potential implications for other players in the field.Through a detailed examination of the data and industry trends, Zipparro paints a vivid picture of the evolving dynamics within the technology sector. His analysis not only illuminates the current state of affairs but also provides valuable foresight into the potential trajectories of the industry, empowering investors and consumers to make informed decisions.Navigating the Shifting Tides: Adapting to the Evolving Technology Landscape

As the technology sector continues to evolve, investors and consumers must be prepared to navigate the shifting tides. Zipparro's insights into Tesla's performance serve as a springboard for a broader discussion on the strategies and considerations necessary to thrive in this dynamic environment.By exploring the potential ripple effects of Tesla's growth, Zipparro highlights the importance of staying attuned to the broader industry trends. He emphasizes the need for investors and consumers to adopt a holistic approach, one that considers the interconnected nature of the technology ecosystem and the potential for cross-pollination of ideas and innovations.Moreover, Zipparro delves into the importance of adaptability, underscoring the necessity for investors and consumers to be nimble and responsive to the ever-changing landscape. He encourages a proactive mindset, one that embraces the opportunities presented by the evolving technology sector while mitigating the risks.Through Zipparro's expert analysis and forward-looking perspective, this section empowers readers to navigate the complexities of the technology industry with confidence, positioning them to capitalize on the emerging trends and opportunities.Unlocking the Future: Exploring the Potential Implications of Tesla's Growth Forecast

The growth forecast of 20% to 30% in 2025 that Tesla has outlined in its recent earnings report holds significant implications for the broader technology sector. Zipparro's analysis delves into the potential ripple effects of this projection, shedding light on the ways in which it could shape the industry's trajectory.By examining the underlying factors driving Tesla's growth, Zipparro offers a nuanced understanding of the company's position within the technology landscape. He explores the innovative technologies, strategic partnerships, and market dynamics that have contributed to Tesla's rise, providing valuable insights for investors and consumers alike.Moreover, Zipparro's exploration extends beyond Tesla, as he examines the potential impact on other industry players. He investigates the ways in which Tesla's performance could influence the competitive landscape, the adoption of emerging technologies, and the overall direction of the sector.Through this comprehensive analysis, Zipparro empowers readers to anticipate and adapt to the evolving technology landscape. By understanding the potential implications of Tesla's growth forecast, investors and consumers can position themselves to capitalize on the opportunities that arise, while also mitigating the risks associated with the shifting industry dynamics.Navigating the Personal Finance Landscape: Strategies for Homebuyers, Credit Card Transitions, and Money Market Accounts

Alongside the exploration of Tesla's earnings report and its broader implications, this article also delves into the realm of personal finance, offering guidance and insights to help investors and consumers navigate the ever-changing landscape.Homebuyers Navigating Rising Mortgage Rates: Strategies for Success

The article addresses the challenges faced by homebuyers in the current environment of rising mortgage rates. By providing practical advice and actionable strategies, it empowers readers to make informed decisions and successfully navigate the complexities of the housing market.The section explores the factors contributing to the rise in mortgage rates, offering a comprehensive understanding of the economic and market forces at play. It then delves into the specific strategies and considerations that homebuyers should keep in mind, such as exploring alternative financing options, negotiating with lenders, and optimizing their financial profiles.Through this in-depth exploration, the article equips readers with the knowledge and tools necessary to make well-informed decisions, ultimately positioning them for success in their homebuying endeavors.Managing the Transition Between Credit Card Issuers: A Seamless Approach

The article also addresses the challenges associated with transitioning between credit card issuers, providing guidance and insights to help readers navigate this process with ease.By exploring the nuances of credit card issuers, the article sheds light on the factors to consider when making a switch, such as interest rates, rewards programs, and customer service. It offers a step-by-step approach to the transition process, empowering readers to minimize disruptions and ensure a smooth transition.Moreover, the article delves into the potential benefits and drawbacks of changing credit card issuers, equipping readers with the knowledge to make informed decisions that align with their financial goals and preferences.Unlocking the Potential of Money Market Accounts: Maximizing Your Savings

Finally, the article delves into the world of money market accounts, providing a comprehensive understanding of the benefits and considerations associated with these financial instruments.By exploring the unique features and characteristics of money market accounts, the article highlights their potential as a valuable savings tool. It examines the factors that contribute to the appeal of these accounts, such as competitive interest rates, liquidity, and safety.The article also addresses the nuances of money market accounts, including the various types, investment strategies, and regulatory considerations. This in-depth exploration empowers readers to make informed decisions about incorporating money market accounts into their overall financial portfolio, ultimately maximizing their savings and achieving their financial objectives.