The Canadian automotive aftermarket is facing a period of transition, as the industry grapples with the shifting landscape of vehicle technology and consumer preferences. A recent forecast from DesRosiers Automotive Consultants has shed light on the potential challenges and opportunities that lie ahead, underscoring the need for the industry to adapt to the changing dynamics of the market.

Fueling the Future: The Decline of Gasoline Consumption and the Rise of Zero-Emission Vehicles

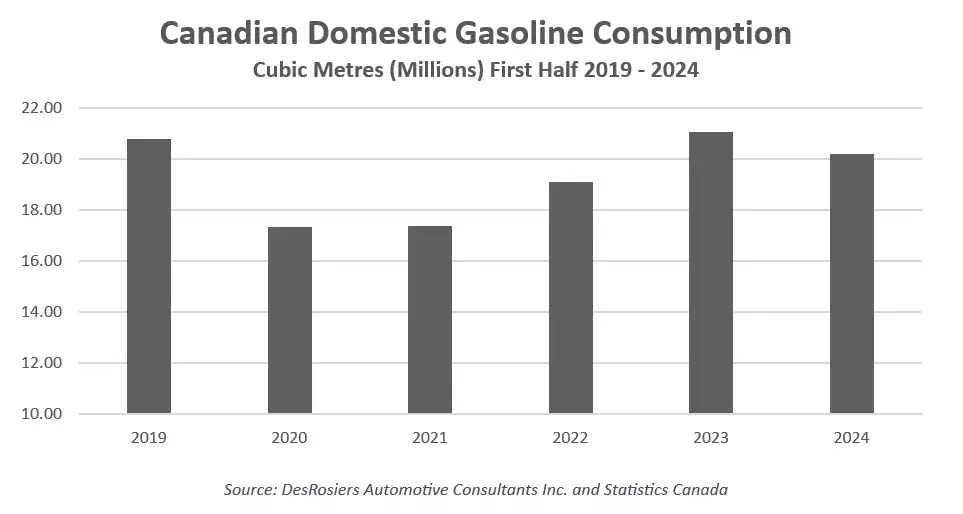

The report from DesRosiers Automotive Consultants highlights a notable decline in gasoline consumption in the first half of 2024, a trend that is partly attributed to the growing adoption of zero-emission vehicles (ZEVs) in Canada. Currently, ZEVs account for 2.6% of the total light vehicle fleet, but the second quarter of 2024 saw a significant increase in their share of new registrations, reaching 12.9%.This shift towards ZEVs is reshaping the demand for traditional automotive fuels, suggesting that the recent decline in gasoline use could be an early indicator of more profound changes to come. As the Canadian vehicle landscape continues to evolve, the aftermarket industry must adapt to these shifting consumer preferences and technological advancements.Adapting to the Changing Fuel Landscape

The decline in gasoline consumption has implications for the automotive aftermarket, as fewer vehicles will require traditional maintenance and repair services associated with internal combustion engines. This shift presents both challenges and opportunities for the industry, as it must find ways to cater to the unique needs of ZEV owners while maintaining its relevance in the changing market.One potential strategy for the aftermarket industry is to invest in the development of specialized services and products tailored to the maintenance and repair of ZEVs. This could include training technicians on the latest electric vehicle technologies, expanding the availability of charging infrastructure, and offering specialized diagnostic and repair services for electric drivetrains and battery systems.By proactively addressing the needs of ZEV owners, the aftermarket industry can position itself as a valuable partner in the transition towards a more sustainable transportation future, ensuring its continued relevance and growth.Weathering the Storm: Adapting to Economic Headwinds

Despite the challenges posed by the changing vehicle landscape, the report from DesRosiers Automotive Consultants suggests that Canadians continue to prioritize the upkeep and maintenance of their vehicles, even in the face of economic headwinds.The data shows a modest decrease in retail sales for automotive parts, accessories, and tire stores in the first half of 2024, with a 1.1% drop. However, the report emphasizes that sales remain 41.2% higher than the first half of 2019 in dollar terms, outpacing inflation and reflecting the strong consumer investment in vehicle maintenance and operation.This sustained spending suggests that the automotive aftermarket industry can still find opportunities for growth, even as it navigates the shifting landscape. By understanding and adapting to the evolving needs and preferences of Canadian consumers, the industry can position itself to weather the storm and emerge stronger in the years to come.Preparing for the Future: Addressing the Challenges of Lower Vehicle Sales

Looking ahead, the report from DesRosiers Automotive Consultants highlights a potential challenge for the aftermarket industry in the coming years. The lower vehicle sales from 2019 to 2023 could lead to a decline in the number of vehicles entering their prime aftermarket years, potentially impacting certain sectors of the industry.Andrew King, the managing partner at DesRosiers, cautioned that "the small volumes of vehicles sold in 2019-23 will start to work their way into their prime aftermarket years in the coming years." This underscores the need for the industry to proactively adapt and diversify its offerings to maintain its relevance and profitability.One potential strategy for the aftermarket industry could be to focus on the growing market for vehicle retrofits and upgrades. As consumers seek to extend the lifespan of their existing vehicles, the demand for aftermarket parts and services that enhance performance, fuel efficiency, or connectivity could increase. By positioning themselves as experts in vehicle customization and optimization, aftermarket businesses can tap into this emerging market and offset the potential decline in traditional maintenance and repair services.Additionally, the industry may need to explore new revenue streams, such as offering subscription-based services or expanding into the growing field of mobility solutions. By diversifying their offerings and exploring innovative business models, the automotive aftermarket can position itself to thrive in the face of changing market dynamics.