As the economic landscape for 2025 remains uncertain, investors find themselves at a crossroads. The potential for both inflationary and deflationary trends has led to diverging strategies. One approach gaining traction is managed futures, offering versatility in navigating volatile markets.

Unlock Financial Stability Amidst Market Volatility

The Dual Economic Forecast

In the current financial climate, investor sentiment is sharply divided between two opposing views. On one side, there are those who foresee an era of escalating inflation. This group anticipates significant increases driven by expanding fiscal deficits and weakening confidence in the U.S. dollar. They point to pressures from central banks and global commodity price hikes as additional catalysts. Conversely, others predict a period of intense deflation. These investors expect substantial cuts to federal spending and anticipate disruptions in emerging markets due to USD gains and falling commodity prices. Both scenarios present unique challenges and opportunities for investment.The polarization of these economic forecasts reflects broader uncertainties. Investors are grappling with unprecedented volatility, exacerbated by influential figures like President Trump and Elon Musk, whose actions can significantly impact market stability. This unpredictability underscores the need for adaptable investment strategies that can thrive in any economic environment.Managed Futures: A Versatile Investment Vehicle

Managed futures offer a compelling solution for investors seeking flexibility in uncertain times. These strategies allow for both long and short positions across various asset classes, including commodities, currencies, and bonds. In an inflationary scenario, managed futures can capitalize on rising commodity prices and declining bond values. Conversely, in a deflationary setting, they can benefit from falling commodity prices and strengthening currency positions.One of the key advantages of managed futures is their ability to respond dynamically to changing market conditions. By adjusting positions based on real-time data and trends, these strategies can provide exposure to shifts that are difficult to predict or access through traditional investments. For instance, managed futures can go long on gold and crude oil during periods of inflation, while shorting these assets during deflationary cycles. This adaptability makes them a valuable tool for diversifying portfolios and mitigating risk.Exploring the KraneShares Mount Lucas Managed Futures Index Strategy ETF (KMLM)

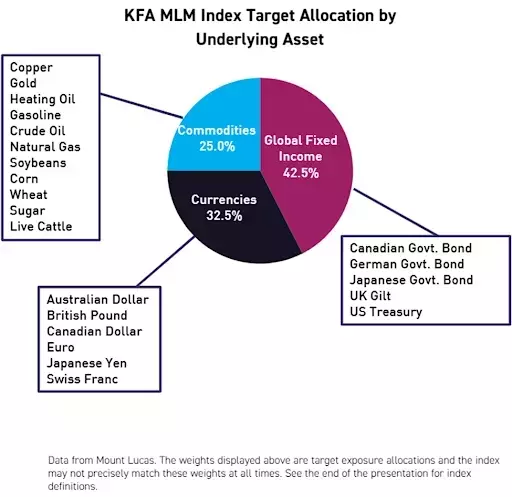

The KraneShares Mount Lucas Managed Futures Index Strategy ETF (KMLM) exemplifies this versatile approach. KMLM invests in a diverse range of futures contracts, spanning commodities, currencies, and global bond markets. Its benchmark, the KFA MLM Index, employs a trend-following methodology that evaluates daily trading signals and rebalances monthly. This systematic approach ensures that the ETF remains responsive to evolving market dynamics.The index's weighting system further enhances its effectiveness. It allocates funds based on historical volatility, ensuring that each asset class is proportionally represented. Within each category, markets are equally weighted, providing balanced exposure. Additionally, KMLM invests in securities with maturities up to 12 months, often through ETFs, to gain exposure to debt instruments. With an expense ratio of 0.90%, KMLM offers a cost-effective way to incorporate managed futures into investment portfolios.Preparing for an Uncertain Future

Investors face a complex and unpredictable economic landscape in 2025. Whether inflation or deflation prevails, managed futures provide a robust framework for navigating these challenges. By leveraging the flexibility and responsiveness of managed futures, investors can position themselves to capitalize on market trends and mitigate risks. As volatility continues to shape the financial world, the strategic use of managed futures becomes increasingly vital for achieving long-term financial stability.You May Like