The cryptocurrency market has been on a wild ride, with Bitcoin leading the charge. The digital asset has continued its bullish momentum, reaching a new all-time high on November 13 and triggering a surge of activity across the crypto landscape. This article delves into the factors driving this remarkable performance, the impact on the futures market, and the potential risks associated with the heightened volatility.

Unleashing the Crypto Frenzy: Bitcoin's Meteoric Rise and Market Implications

Soaring Futures Trading and Binance's Dominance

The futures market has been significantly impacted by Bitcoin's recent surge, with a notable increase in trading volume for the BTC/USDT pair. This surge in activity has highlighted an intense period of market engagement, with leading exchanges, particularly Binance, playing a central role in this trading frenzy.The trading volume for the BTC/USDT pair has reached staggering levels, with the cumulative figure across all major platforms amounting to roughly $129 billion. Binance, the prominent cryptocurrency exchange, has contributed a substantial $50.2 billion to this figure, underscoring its dominant position in the market.Overheated Futures Market and Volatility Risks

The surge in futures trading activity has raised concerns about market stability and the potential for heightened volatility. According to a CryptoQuant analyst, Crazzyblockk, the futures market for Bitcoin has become "exceptionally overheated," with trading volume skyrocketing across both spot and futures markets on major centralized exchanges.This rapid growth in the derivatives market, particularly in the futures segment, often leads to increased market fluctuations. As Crazzyblockk explained, while this can briefly boost demand, it often results in minor pullbacks and sharp price swings.The analyst emphasized the need for caution among investors and traders, advising them to refrain from rushed speculation and await a period of price stability before making further moves. The "overheated" state of the market warrants a prudent approach to navigate the potential volatility risks.Bitcoin's Price Correction and Realized Profits

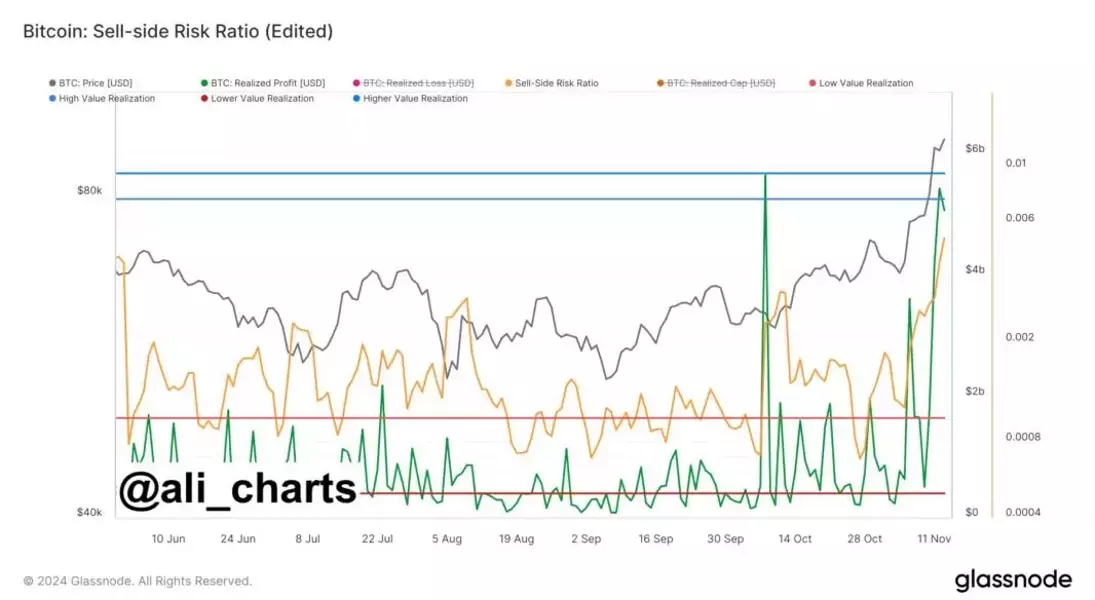

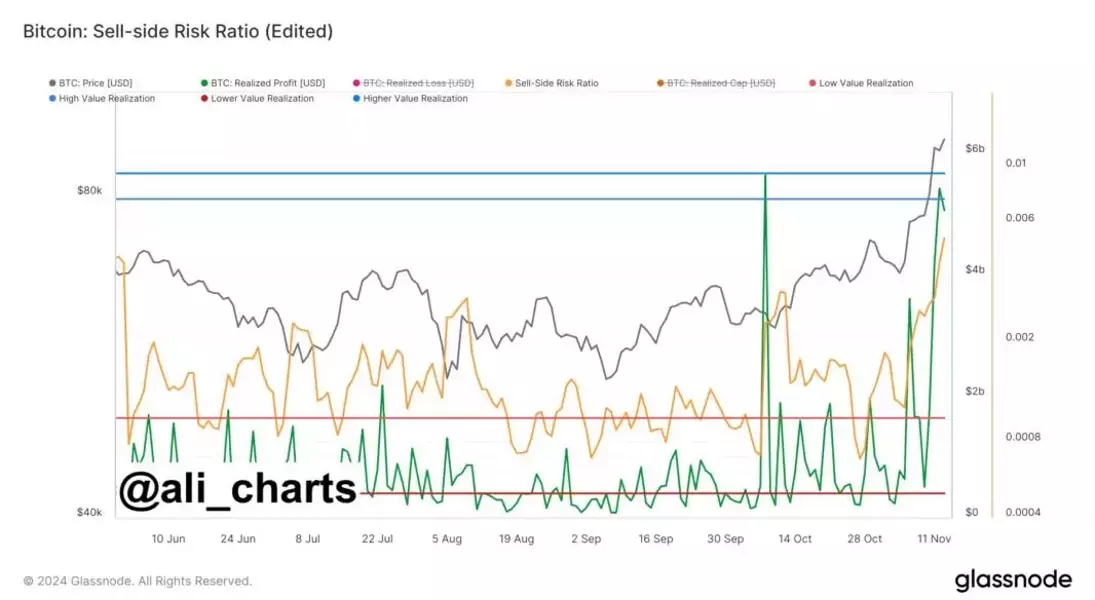

The recent surge in Bitcoin's price has been followed by a noticeable decline, with the asset dropping by 6.1% in the past day to a current trading price of $87,977. This ongoing correction comes after Bitcoin reached a new all-time high above $93,000, as recorded on November 13.With BTC trading below the $88,000 region, the asset has now decreased 5.9% away from its peak. While the exact reasons behind this correction are not entirely clear, renowned crypto analyst Ali has highlighted an interesting trend in the market.According to Ali's analysis, roughly $5.42 billion of Bitcoin profits have now been realized, pushing the asset's sell-side risk ratio to 0.524%. The analyst has warned investors to "stay alert and proceed with caution" as this trend unfolds.Bullish Outlook and Potential Targets

Despite the recent price correction, some analysts remain optimistic about Bitcoin's long-term trajectory. Analyst Javon Marks has noted that while the asset has experienced a pullback, further upward momentum is still being witnessed, with Bitcoin hitting a new peak yesterday.Marks has identified a potential target of $116,652 for Bitcoin, suggesting that this level could be reached "at even greater speeds and with greater power than the first" surge. This bullish outlook underscores the ongoing confidence in Bitcoin's ability to continue its upward climb, despite the current volatility.As the cryptocurrency market continues to evolve, investors and traders must navigate the complex landscape with a keen eye on the risks and opportunities presented by Bitcoin's remarkable performance. By staying informed, exercising caution, and making well-informed decisions, market participants can better position themselves to capitalize on the dynamic nature of the crypto ecosystem.