Uncover the Market's Movements as Fed Week Begins

Broadcom's Market Valuation Milestone

Broadcom has achieved a remarkable milestone by crossing the $1 trillion market valuation. This significant achievement showcases the company's strength and influence in the market. It highlights its ability to generate substantial value and drive growth. With this landmark, Broadcom continues to solidify its position as a key player in the industry.

The crossing of the $1 trillion mark is a testament to Broadcom's strategic decisions, innovative products, and strong market performance. It sets a new benchmark and attracts the attention of investors and industry observers alike. This achievement is likely to have a positive impact on the company's future prospects and further enhance its standing in the market.

Analyst's Take on Outperforming Upstart Stock

An analyst has expressed a bullish stance on the Outperforming Upstart stock, recommending it as a "buy." The analyst believes that the stock has significant growth potential and is undervalued in the current market. This recommendation is based on a thorough analysis of the company's fundamentals, industry trends, and competitive landscape.

The Outperforming Upstart stock has shown promising signs of growth and has outperformed its peers in recent times. The analyst's positive outlook is likely to attract the attention of investors looking for opportunities in the market. It provides a compelling case for considering an investment in the stock and highlights its potential for future returns.

MSTR's Joining of NDX and SMCI's Delisting Fears

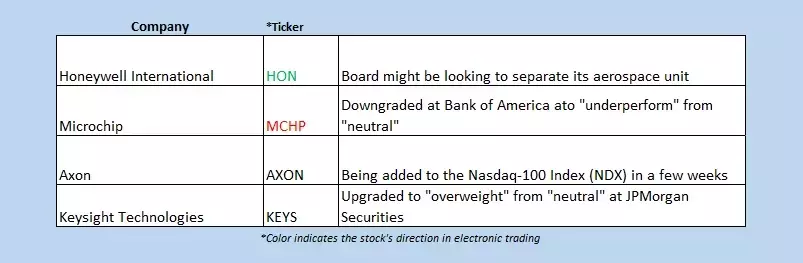

MicroStrategy Inc (NASDAQ:MSTR) is making headlines as its shares are up 4.3% in premarket trading. The crypto-adjacent stock will be joining the NDX, adding to its market presence. This move is seen as a significant development for MSTR and is likely to attract more attention from investors.

On the other hand, Super Micro Computer Inc (NASDAQ:SMCI) is facing delisting fears. Bloomberg reported that the tech concern is trying to raise equity and debt capital with the help of Evercore ISI. Additionally, the company missed its earnings report deadline and is leaving the NDX. Despite these challenges, SMCI is still up 28.2% this year, indicating some underlying strength in the business.

Jefferies' Downgrade of Ford Motor Co Stock

Jefferies has downgraded Ford Motor Co (NYSE:F) stock from "hold" to "underperform." The firm has raised concerns about the automaker's inventory overhang and valuation. These factors have led the analyst to take a more cautious stance on the stock.

Ford Motor Co's stock is down 3.2% before the bell, adding to its 13.5% year-to-date deficit. The downgrade highlights the challenges faced by the automaker in the current market environment. It will be interesting to see how the company responds to these concerns and whether it can turn around its performance.

Retail Sales Data and Fed's Interest Rate Decision

Retail sales data will precede the Federal Reserve's interest rate decision this week. This data is crucial as it provides insights into the health of the consumer sector and can influence the Fed's monetary policy decisions. Investors will be closely watching these figures to gauge the direction of the economy.

The Federal Reserve's interest rate decision is highly anticipated as it can have a significant impact on the financial markets. A rate hike or cut can affect borrowing costs, stock prices, and overall economic activity. Traders and investors will be analyzing the Fed's statement and any accompanying economic projections to form their expectations.