Navigating the Shifting Tides: A Comprehensive Market Outlook

The financial markets have been in a state of flux, with a range of asset classes experiencing significant movements. From equities to bonds, commodities to currencies, the landscape has been dynamic and ever-changing. In this comprehensive market analysis, we delve into the key trends, strategies, and insights that can help investors navigate the shifting tides and capitalize on the opportunities that arise.Unlocking the Potential Amidst Volatility

Equities: Riding the Wave of Optimism

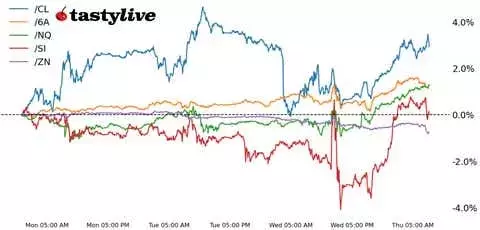

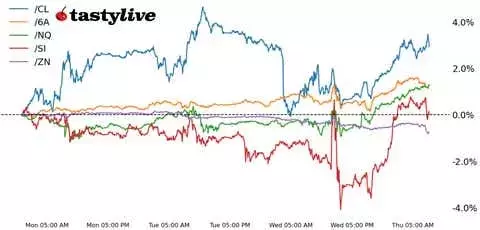

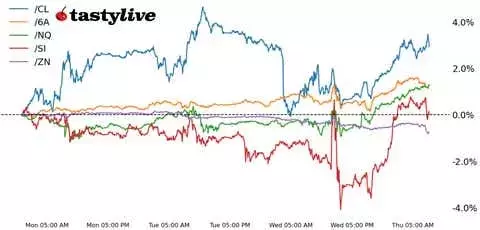

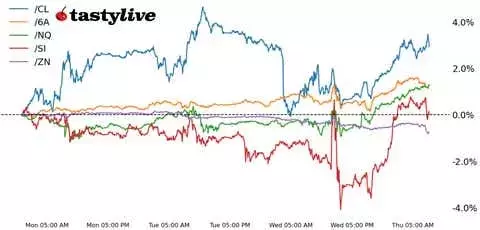

The equity markets have been on a rollercoaster ride, with the Nasdaq 100 E-mini futures (/NQ) leading the charge with a robust 2.34% gain. This surge in optimism can be attributed to the Federal Reserve's decision to initiate a rate cut cycle, which has been widely interpreted as a growth-positive move. The S&P 500 (/ESZ4) has also reached its highest level since July, reflecting the market's confidence in the underlying economic conditions.Investors should closely monitor the performance of the Russell 2000 (/RTYZ4) and the Nasdaq 100 (/NQZ4), as these indices have demonstrated significant upside potential, rising by more than 2.3% each. The volatility index (VIX) has also seen a notable decline, dropping below 17, indicating a reduction in market uncertainty.Bonds: Navigating the Shifting Landscape

The bond market has experienced a mixed performance, with the 10-year T-note futures (/ZN) declining by 0.38%. This movement can be interpreted as a reflection of the market's perception of the Federal Reserve's actions. If the economy continues to show resilience, the prescribed path of rate cuts may already be priced in, leading to a potential rise in inflation and growth expectations at the long-end of the curve.Investors should closely monitor the upcoming 10-year TIPS auction, as it may provide valuable insights into the market's inflation expectations. Additionally, the performance of other bond futures, such as the 2-year (/ZTZ4), 5-year (/ZFZ4), and 30-year (/ZBZ4), will be crucial in understanding the broader bond market dynamics.Commodities: Shining Bright Amidst Shifting Tides

The commodities market has been a bright spot, with precious metals and energy futures posting notable gains. Gold (/GCZ4), silver (/SIZ4), and copper (/HGZ4) have all made efforts to set fresh monthly highs, benefiting from the onset of the Federal Reserve's easing cycle and the prospect of improved global liquidity.Crude oil futures (/CLZ4) have also risen, driven by a resilient U.S. economy and the potential for higher fuel demand as interest rates fall. However, the weak spot in the oil complex remains China, where refinery activity remains rather weak. Traders will be closely monitoring the upcoming rig count data to gauge the overall sentiment in the energy market.Currencies: Navigating the Global Landscape

The currency markets have also seen some notable movements, with the Australian dollar futures (/6AZ4) rising as market sentiment improved overnight. The Australian dollar is facing resistance at the 0.68215 level, a level carved out by swing highs from July and August.Investors should keep a close eye on the People's Bank of China's (PBOC) upcoming interest rate decision, as it could have a significant impact on the Australian dollar, given China's importance as a trading partner for Australia. The Federal Reserve's decision to implement a 50-basis-point rate cut could also pave the way for further stimulus by the PBOC, potentially leading to a strengthening of the yuan against the U.S. dollar.Strategies: Capitalizing on the Opportunities

As the markets continue to evolve, investors should consider a range of strategies to navigate the shifting tides. The article outlines several options, including iron condors, short strangles, and short put verticals, across various asset classes.These strategies offer the potential for attractive returns, with varying levels of risk and probability of success. Investors should carefully evaluate their risk tolerance, market outlook, and investment objectives before implementing any of these strategies.By staying informed, adaptable, and disciplined, investors can position themselves to capitalize on the opportunities that arise in the ever-changing financial landscape.