Despite significant market movements triggered by recent trade actions, municipal bonds maintained stability. The imposition of tariffs by the U.S. government on goods from Canada, Mexico, and China led to fluctuations in bond yields and economic concerns. However, municipal bonds remained relatively unaffected, with only minor adjustments in yield curves. Analysts noted that while short-term treasury yields increased slightly, long-term yields saw a decrease, contributing to this steady performance.

A key development occurred when Mexico agreed to delay tariffs for a month in exchange for deploying additional troops to secure borders. This agreement provided temporary relief to markets, allowing municipal bonds to avoid major disruptions. Market participants observed that munis were fairly priced, offering investors flexibility in structuring their portfolios to maximize returns without significant risk. Certain states, particularly those heavily reliant on imports from affected countries, might experience varying impacts, but overall, the municipal bond market demonstrated resilience.

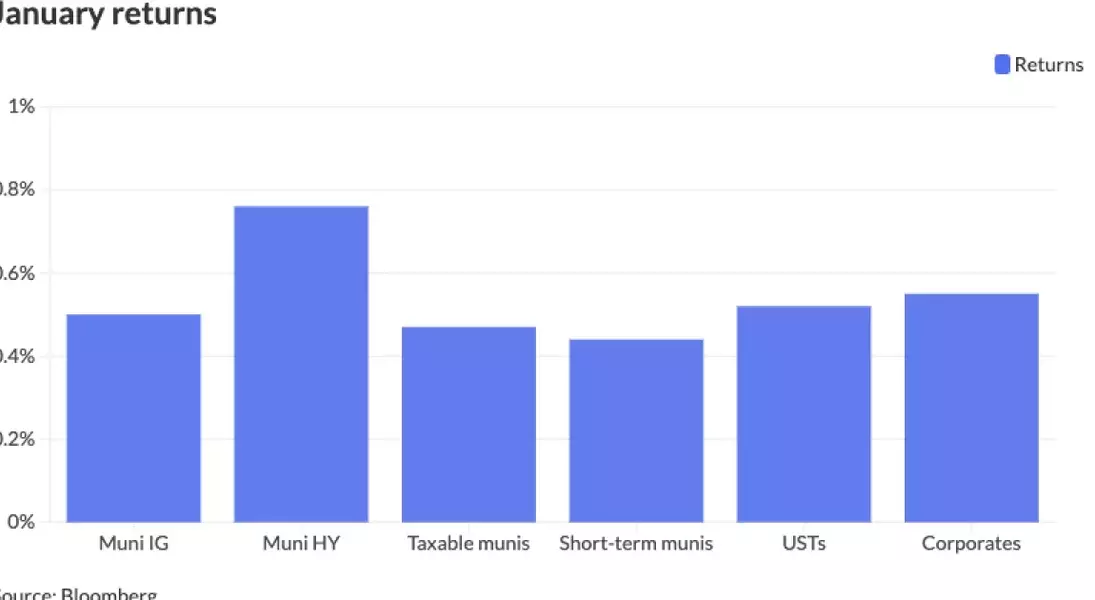

The municipal bond market's robust performance can be attributed to strong demand and a favorable issuance calendar. January saw a remarkable turnaround, with munis ending the month positively after an initial downturn. A series of large-scale deals generated substantial interest, driving a mid-month rally. Investors added significant capital to muni mutual funds, further bolstering market activity. While future economic policies may introduce volatility, the current momentum suggests continued strength in the sector. Municipal bonds have proven their ability to withstand external pressures, providing a stable investment option in uncertain times.