The market for August 2025 Class III milk futures has recently experienced a notable downturn, shedding nearly three dollars in value since its peak in late May. This significant adjustment is primarily a consequence of escalating milk output within the United States. While the dairy sector benefits from robust consumption of milk products, particularly cheese, both domestically and internationally, the persistent growth in supply exerts considerable downward pressure on prices. Industry participants are now closely monitoring key technical support thresholds, especially the $17 mark, to gauge the potential for further market shifts. The interplay between surging production and sustained demand will dictate the short-term trajectory of milk prices, with potential implications for producers and consumers alike.

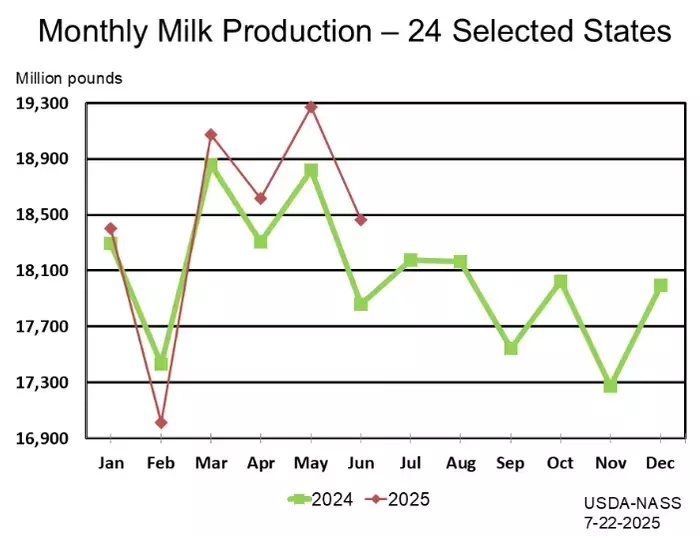

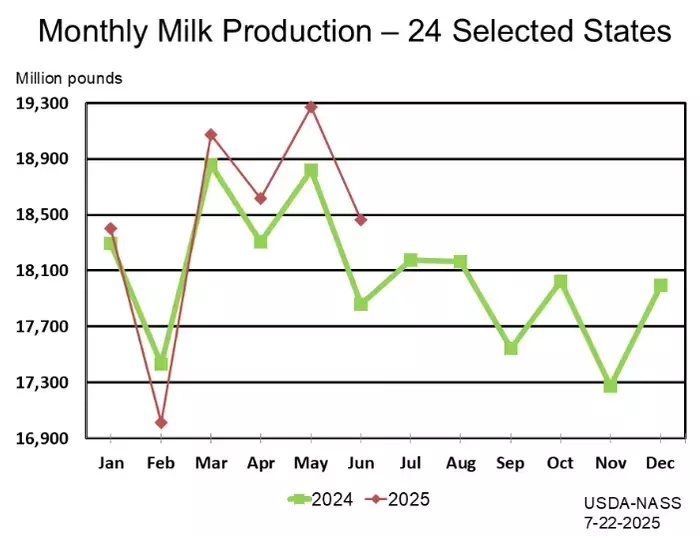

Previously, market analyses indicated that despite strong demand for dairy commodities, an anticipated rise in U.S. milk production could introduce a bearish bias, pushing prices lower. This prediction has unfortunately materialized, as confirmed by recent production figures. The June milk production report revealed a substantial 3.3% year-over-year increase, reaching a total of 19.233 million pounds. Moreover, the USDA revised May's production estimates upwards to 20.072 million pounds, reinforcing the trend of growing supply. This surge is a result of both an expanded dairy herd, with cow numbers rising to 9.469 million head from 9.323 million in June 2024, and enhanced productivity per cow, which climbed to 2,031 pounds from 1,998 pounds a year ago.

A significant portion of this increased milk supply is being channeled into cheese production. The latest data indicates that U.S. cheese output in May 2025 reached 1.25 billion pounds, marking a 3.3% increase from May 2024 and a 1.4% rise compared to April 2025. Fortunately, strong demand for cheese, both within the country and globally, has helped absorb a considerable amount of this increased production. Furthermore, U.S. dairy product exports have remained robust, totaling 228,179 metric tons in May 2025, an increase of 3% from the previous month. Cheese exports, specifically, saw a 7% rise from the prior year, reaching 51,549 metric tons. These export figures are crucial in mitigating the impact of high domestic supply.

However, the sustained upward trend in milk production is expected to keep futures prices on the defensive in the near term. The Class III front month contracts currently find technical support around the $17 level. Market participants are eagerly awaiting the release of the monthly Cold Storage report, which will provide insights into butter and cheese inventories. Additionally, any new developments regarding international trade agreements could significantly influence export demand for U.S. dairy products, potentially offering a much-needed boost to prices. The critical question for the market remains whether the $17 technical support can withstand the pressure of increasing supply, or if a further decline towards the next support level of $16 is inevitable.

The current market landscape underscores the delicate balance between supply and demand in the agricultural sector. Producers and traders must remain vigilant, adapting their strategies to navigate these volatile conditions. The ability of the market to absorb the growing milk supply, supported by strong demand and potential new trade avenues, will be crucial in determining price stability moving forward.