Micron's Ambitious Expansion: A Glimmer of Hope for Memory Supply

Micron's Strategic Investment in Taiwan's Foundry Landscape

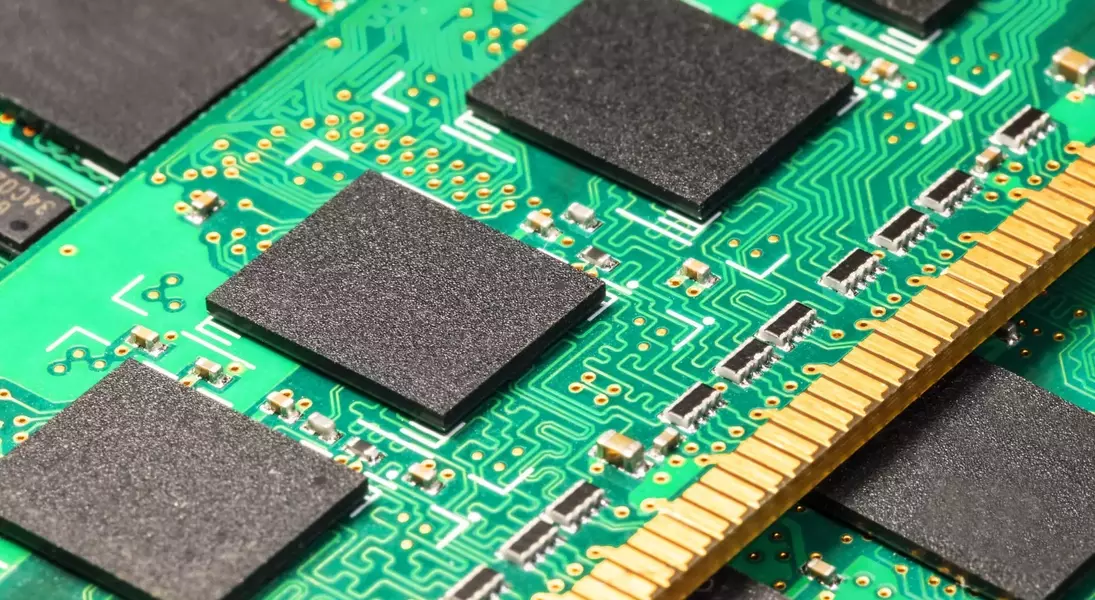

Amidst the escalating global shortage of memory components, a prominent memory manufacturer, Micron, has signaled its intent to significantly bolster its operational capabilities. The company recently entered into an agreement to acquire a key chip manufacturing facility in Taiwan from Powerchip Semiconductor Manufacturing Corporation (PSMC). This substantial investment, valued at $1.8 billion, includes a state-of-the-art 300 mm wafer cleanroom, spanning an impressive 300,000 square feet, although it does not encompass the existing production machinery within the site. This strategic move is also intended to cultivate an enduring collaborative relationship between Micron and PSMC.

Addressing the Persisting Memory Shortage: A Gradual Recovery

This recent announcement from Micron aligns with previous statements from its marketing vice president, Christopher Moore, who highlighted the severe scarcity of memory components currently available. Despite the significant scale of this transaction, which is anticipated to be finalized by the second quarter of 2026, and Micron's subsequent immediate control over the facility, a meaningful increase in DRAM wafer output is not projected until the latter half of 2027. Consequently, industry observers should temper expectations for an immediate resolution to the memory supply challenges within the current year, even considering similar expansion efforts by other key players like SK Hynix.

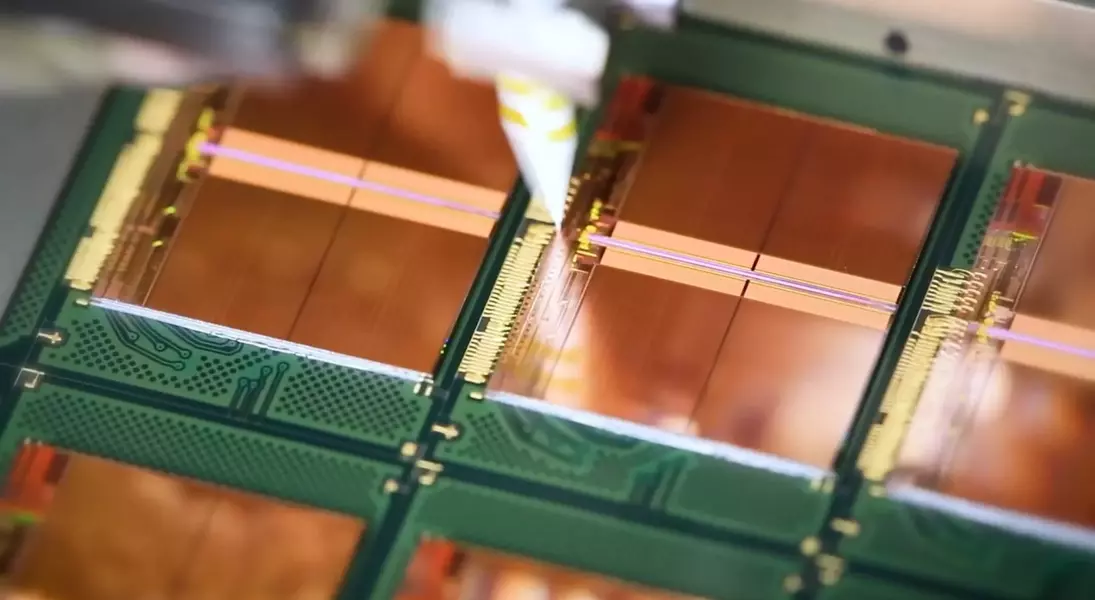

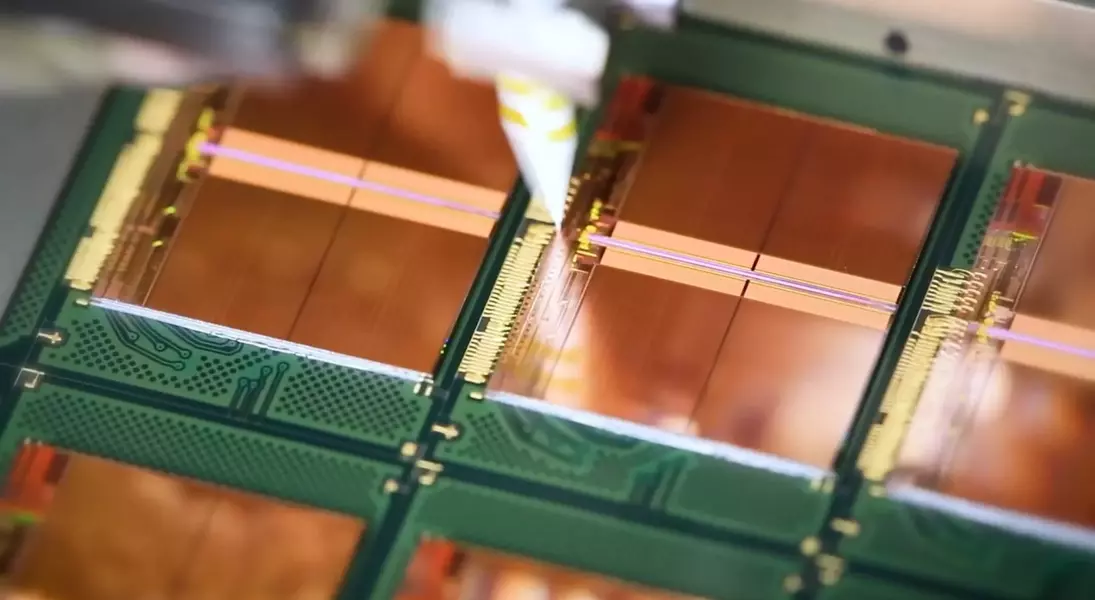

Integrating New Assets for Enhanced Production

Given that the acquisition of the Tongluo facility does not include manufacturing equipment, Micron is set to implement a multi-phase strategy for integrating both novel and existing chip fabrication technologies. The geographical proximity of the Tongluo fab to Micron's established Taichung site is expected to facilitate seamless integration, enhancing Micron's post-wafer assembly processes and providing support for PSMC's legacy DRAM product lines.

Micron's Proactive Stance in a Dynamic Market

Industry analysis from TrendForce indicates that Micron has been actively engaged in expanding its manufacturing footprint through a series of acquisitions, including facilities from AU Optronics, AUO Crystal, and Glorytek, prior to the Tongluo deal. Furthermore, Micron is strategically reallocating some of its NAND flash production assets in Singapore towards DRAM metallization. These efforts are particularly noteworthy in light of the recent decision to scale back its consumer-focused sub-brand, Crucial, thereby recalibrating its market presence in the consumer segment.

The Unyielding Demand from the AI Sector

Despite Micron's robust efforts to augment its production capabilities, the insatiable demand emanating from the artificial intelligence industry continues to pose a formidable challenge. A representative from a leading memory module manufacturer recently estimated that approximately 40% of global wafer production has been absorbed by the AI sector. This staggering figure underscores the complexities of the current market dynamics, explaining why Micron CEO Sanjay Mehrotra has candidly expressed the company's disappointment in being unable to fully satisfy the extensive demand across various market segments, despite their best endeavors.