Navigating the AI Era's Hardware Crunch: A Proactive Guide

The Unprecedented Strain on Global Memory Supply

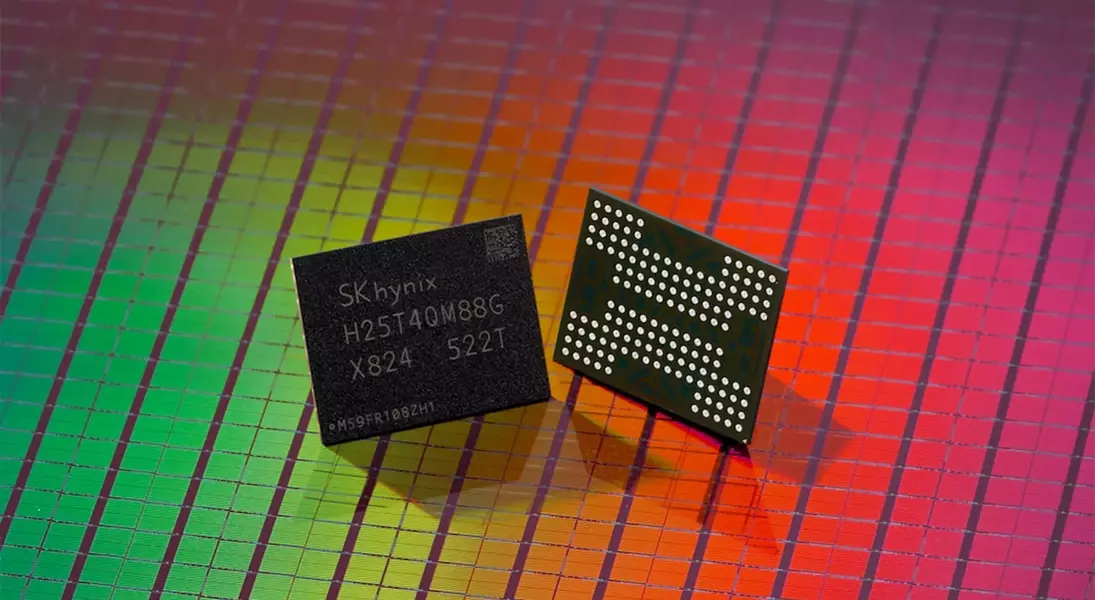

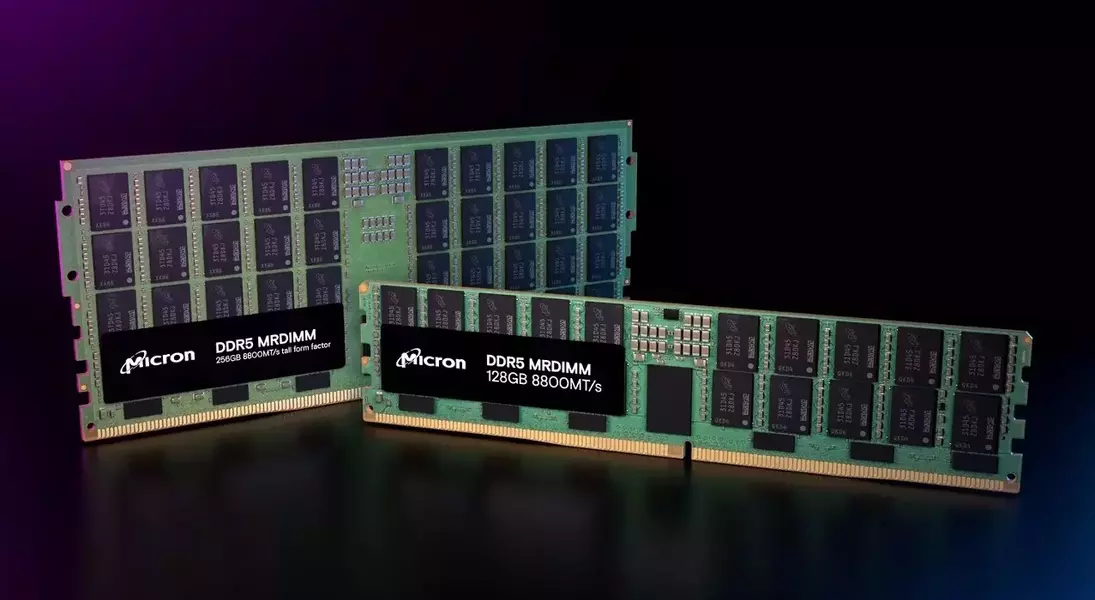

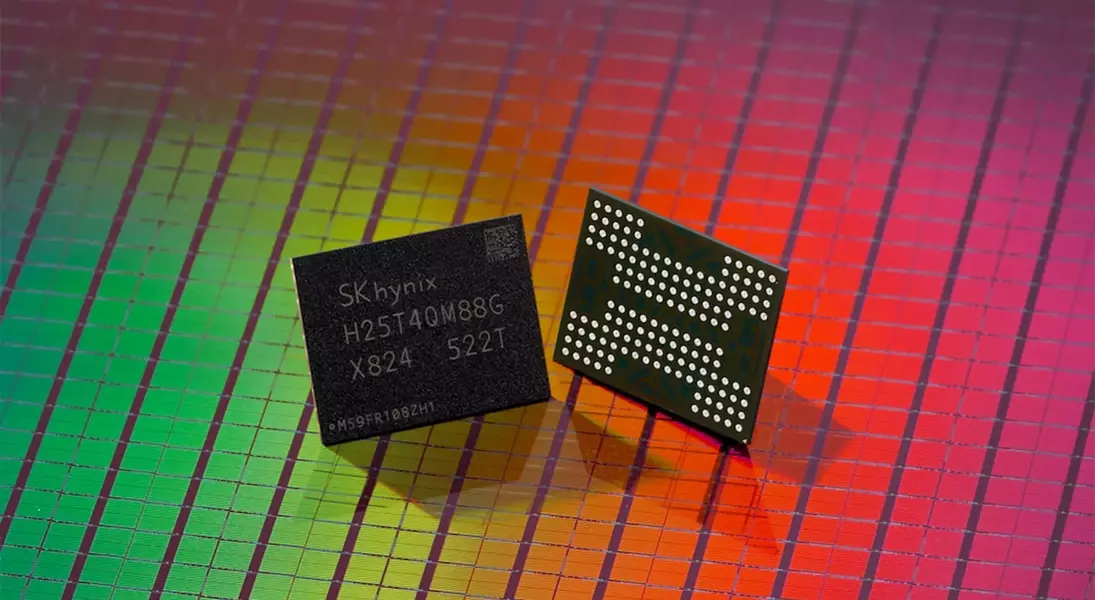

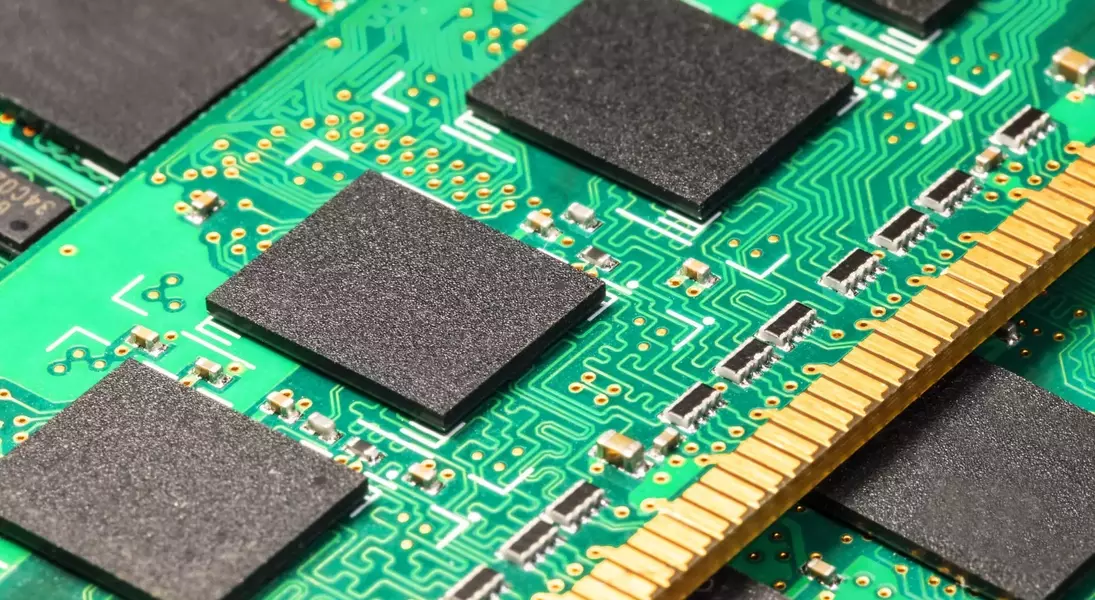

An extraordinary surge in the cost of memory components has recently become apparent, primarily stemming from an ongoing scarcity in the market. This supply deficit is largely attributed to the immense consumption of DRAM modules by AI servers. Concurrently, there's also a significant scarcity of NAND flash. As articulated by the CEO of Silicon Motion, Wallace C. Kou, in a recent earnings discussion, the industry is grappling with a never-before-seen situation where HDDs, DRAM, HPE, HBM, and NAND are all experiencing critical shortages, with capacity fully booked through 2026.

AI's Dominance in Resource Allocation

Kou further elaborated that discussions with other leading manufacturers revealed specific allocation strategies, with certain percentages of memory production being earmarked for smartphones, personal computers, and the automotive industry. However, he clarified that the predominant portion of these resources would invariably be directed towards AI and AI server applications. He emphasized the importance of maintaining a delicate balance to ensure the continuous advancement of the entire technology sector.

Impact on Personal Computing and Future Hardware Outlook

The clear implication is that the strong prioritization of the AI sector is expected to continue, leaving consumers and PC enthusiasts with limited access to these critical components. This paints a challenging picture for those planning to upgrade their system RAM or internal storage in 2026, and it also raises concerns about potential ripple effects on upcoming graphics card releases. Manufacturers like Silicon Motion are experiencing substantial revenue growth, with a reported 22% year-over-year increase, while major players like Samsung are reportedly implementing price hikes of up to 60% on some chips.

Industry Reactions and Strategic Stockpiling

Recent reports highlight the current state of affairs as 2025 draws to a close. Memory module producers and their associated suppliers, including Transcent, ChipMOS, Hua Tung, and Formosa Plastics, have all reported record financial achievements in recent months. Meanwhile, prominent brands such as Asus and MSI are reportedly engaging in aggressive stockpiling of memory modules to mitigate the anticipated harsh market conditions ahead. The general consensus suggests that the scarcity in memory and SSD markets, along with corresponding price increases, could extend well into 2027 if the AI boom continues its current trajectory.

Uncertainties and Potential Market Shifts

However, the future trajectory of this shortage is intrinsically linked to the evolution of AI demand. A potential 'AI bubble burst,' as some financial experts have suggested, could significantly decelerate the extensive data center expansion that has been observed in recent years. Furthermore, advancements in AI model efficiency, potentially leading to a substantial reduction in RAM requirements, could alleviate hardware demands considerably, offering much-needed relief to other segments of the industry. Nevertheless, these remain speculative possibilities for now. The current reality is marked by exceedingly high memory prices and steadily rising SSD costs, with the shortage expected to persist for the foreseeable future. The prospect of resource-intensive software releases, such as a new Microsoft Flight Simulator in the near term, only adds to the apprehension of PC users.