In its latest Signals report, Mastercard has identified seven pivotal trends set to revolutionize the global payment landscape by 2030. The report highlights advancements in digital wallets, biometric authentication, and personalized checkout experiences, emphasizing a future where payments are faster, more secure, and seamlessly integrated across platforms and borders. As luxury brands increasingly adopt digital solutions, the payment industry is poised for significant transformation. This overview explores these trends and their implications for consumers and businesses alike.

The Path to a Seamless Payment Future

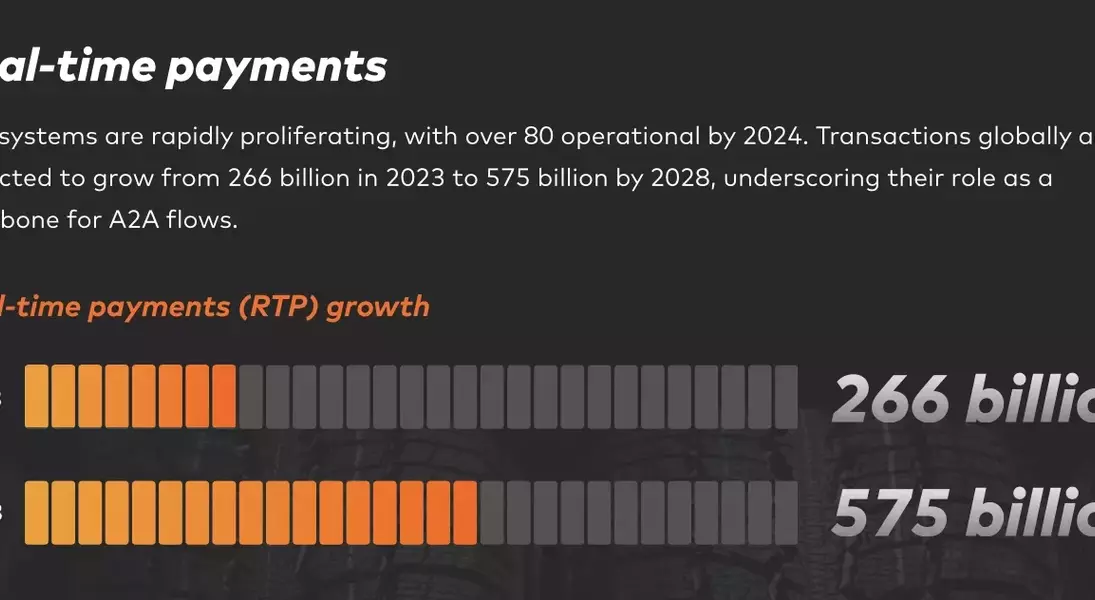

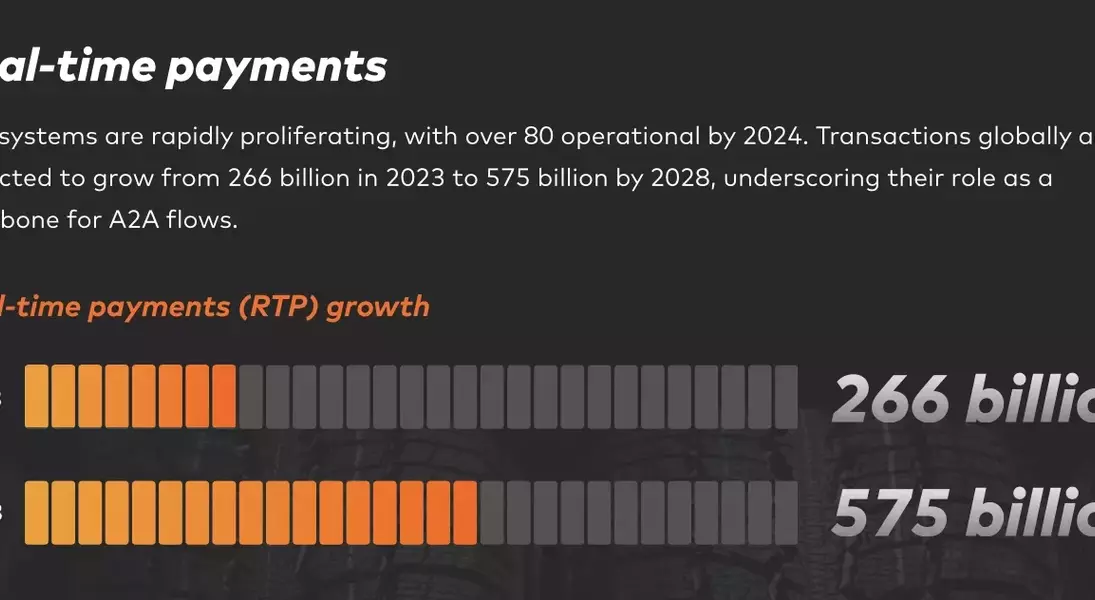

In the coming years, the way we exchange money will undergo profound changes. According to Mastercard’s Signals report, one of the most critical shifts will be achieving global interoperability, ensuring smooth transactions across different systems and regions. By 2030, real-time payments (RTP) systems are expected to grow rapidly, with their transaction value projected to soar from $266 billion in 2023 to $575 billion by 2028. These advancements will enhance account-to-account (A2A) transactions, making them more efficient and convenient.

Alternative payment methods (APMs), such as mobile wallets like Apple Pay and Google Pay, are also gaining traction, offering consumers greater flexibility. The rise of digital currencies promises to improve traceability in A2A transactions, reducing friction in cross-border exchanges. However, security remains a significant concern, with authorized push payment fraud losses expected to increase from under $2 billion in 2022 to over $3 billion by 2027. To combat this, AI-powered security measures and shared standards are being developed.

Biometric authentication is another key trend, with advances in technology enabling the widespread use of passkeys that rely on fingerprints or facial recognition. By 2026, the number of digital wallet users is expected to grow from 3.4 billion in 2022 to 5.2 billion, representing over 60% of the world’s population. Solutions like Click to Pay and Tap on Phone are becoming more common, addressing issues like cart abandonment due to complex checkouts.

Mastercard’s collaboration with cybersecurity firms like VikingCloud underscores the industry’s commitment to enhancing security and combating cybercrime. The report emphasizes that tomorrow’s payment ecosystem must prioritize security, assurance, and convenience, regardless of the payment method or jurisdiction.

From an identity authentication perspective, hyper-personalized checkout experiences and embedded finance solutions are among the trends driving a future defined by interoperability, security, and inclusivity. Mastercard’s vision is clear: the future of payments will be faster, safer, and more accessible to all.

As a journalist, it's evident that Mastercard’s Signals report offers valuable insights into the evolving payment landscape. The emphasis on innovation, security, and inclusivity is crucial for navigating the complexities of a rapidly changing financial world. By embracing these trends, businesses can not only enhance customer experiences but also contribute to global economic prosperity. The future of payments is indeed exciting, and Mastercard’s leadership in this space is paving the way for a more interconnected and secure financial ecosystem.