Unlock the Potential of Stock Market Rebound on Friday

Impact of Inflation on Stocks

The lingering worry about sticky inflation has been a significant factor affecting stock markets in recent times. However, with signs of its subsiding, stocks seem to be finding their footing. This indicates that the market may be moving towards a more stable phase, where the impact of inflation on stock prices is less pronounced. Investors are closely monitoring these changes as they assess the overall health and direction of the market.

Historical data shows that when inflation shows signs of moderation, stocks often respond positively. This is because it reduces the uncertainty and potential headwinds that inflation can bring to the economy. As such, the recent easing of inflation concerns has given investors the confidence to look towards a potential rebound in stock prices.

Role of Job Market in Stock Performance

The weakness observed in the U.S. job market has also been a cause for concern among investors. A sluggish job market can lead to lower consumer spending and economic growth, which in turn can impact corporate earnings and stock prices. However, with the subsiding of these worries, stocks are now showing signs of recovery.

It is important to note that the job market is a crucial indicator of the overall health of the economy. A stable or improving job market can provide a boost to consumer confidence and spending, which can have a positive impact on corporate earnings. As such, the recent improvement in the job market outlook is seen as a positive sign for stock markets.

Futures and Index Movements

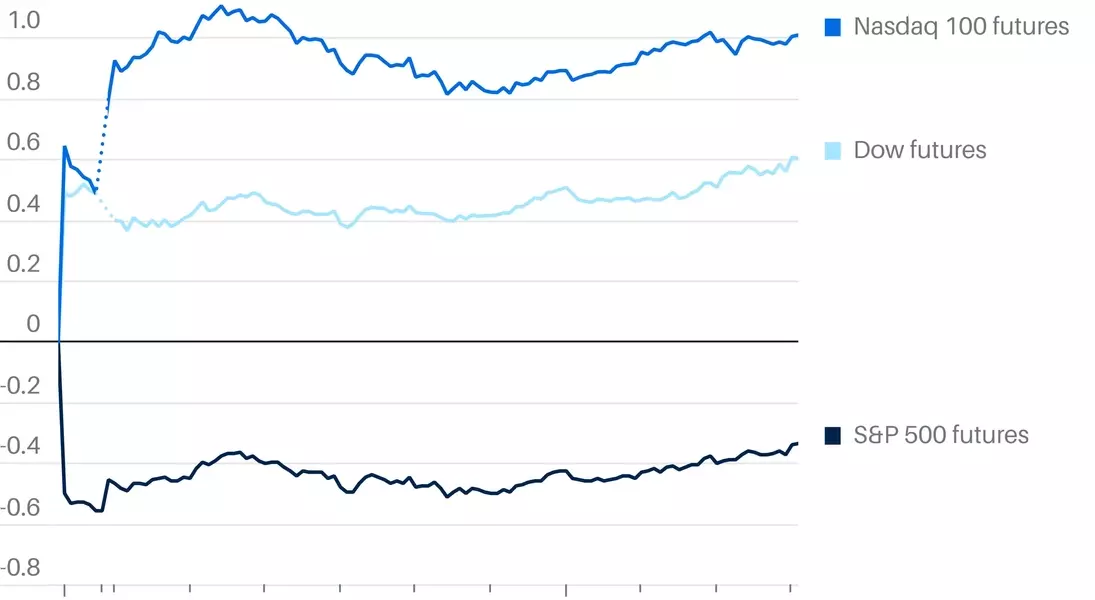

Futures tracking the Dow Jones Industrial Average rose 92 points, or 0.2%, indicating a potential end to the six-day losing streak. This upward movement suggests that investors are optimistic about the future performance of the index and are willing to take on more risk.

Similarly, futures for the benchmark S&P 500 climbed 0.3%, while contracts tracking the tech-heavy Nasdaq 100 were up 0.6%. These gains highlight the broad-based nature of the market recovery, with different sectors and indices showing signs of improvement. It is a positive sign for the overall market sentiment and indicates that investors are looking beyond the short-term fluctuations and focusing on the long-term prospects.

Chip Maker Broadcom's Performance

Chip maker Broadcom's better-than-expected quarterly earnings and strong sales guidance after Thursday's close have played a significant role in driving the Nasdaq futures' big gain. The company's strong performance has signaled to investors that demand for artificial intelligence-related products remains high, which is a positive development for the technology sector.

Broadcom's shares rose 14% in premarket trading, reflecting the market's confidence in the company's future prospects. This success story has not only boosted the Nasdaq futures but has also given other technology companies a boost of confidence. It shows that there are still opportunities for growth in the technology sector, despite the challenges faced by the industry.