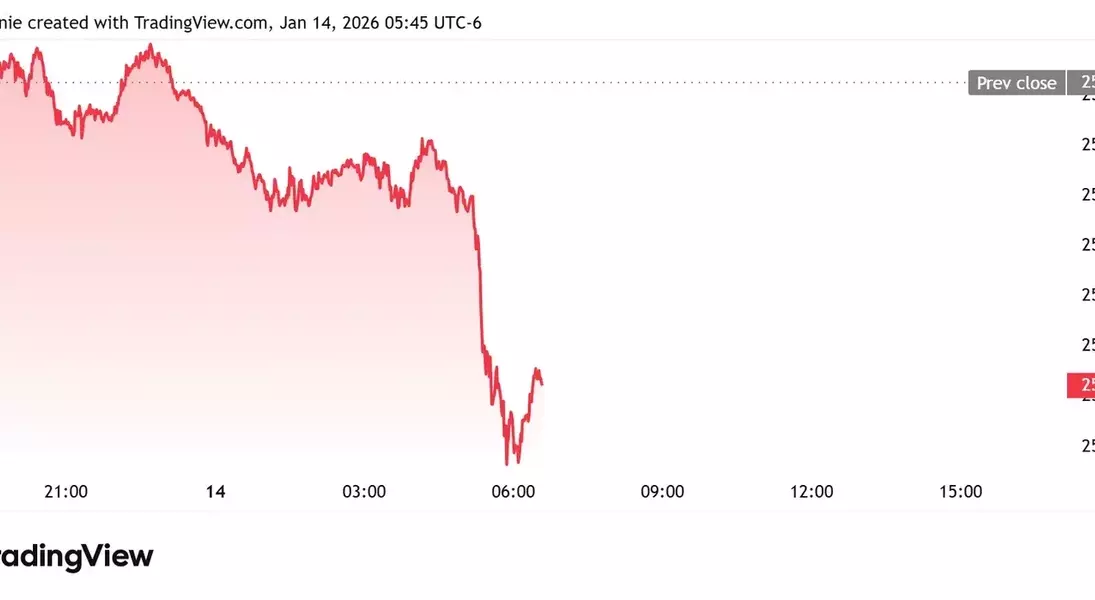

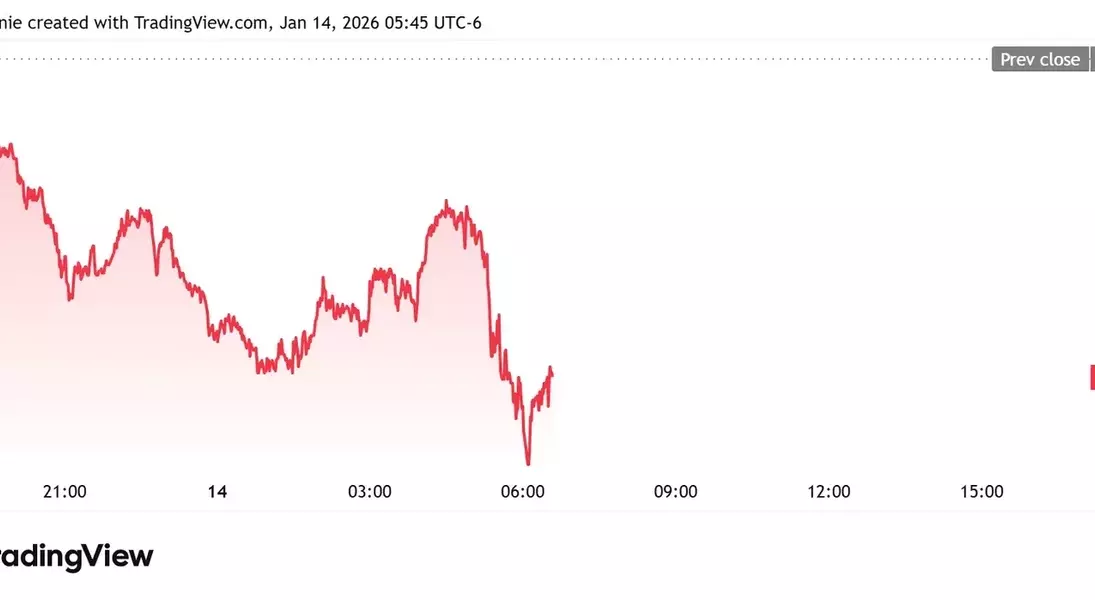

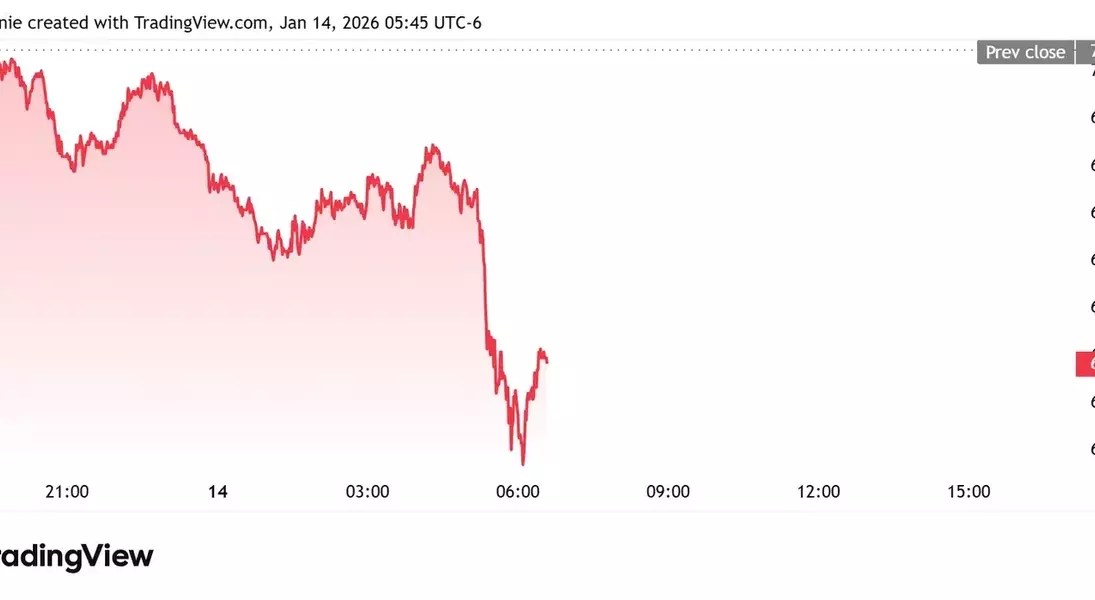

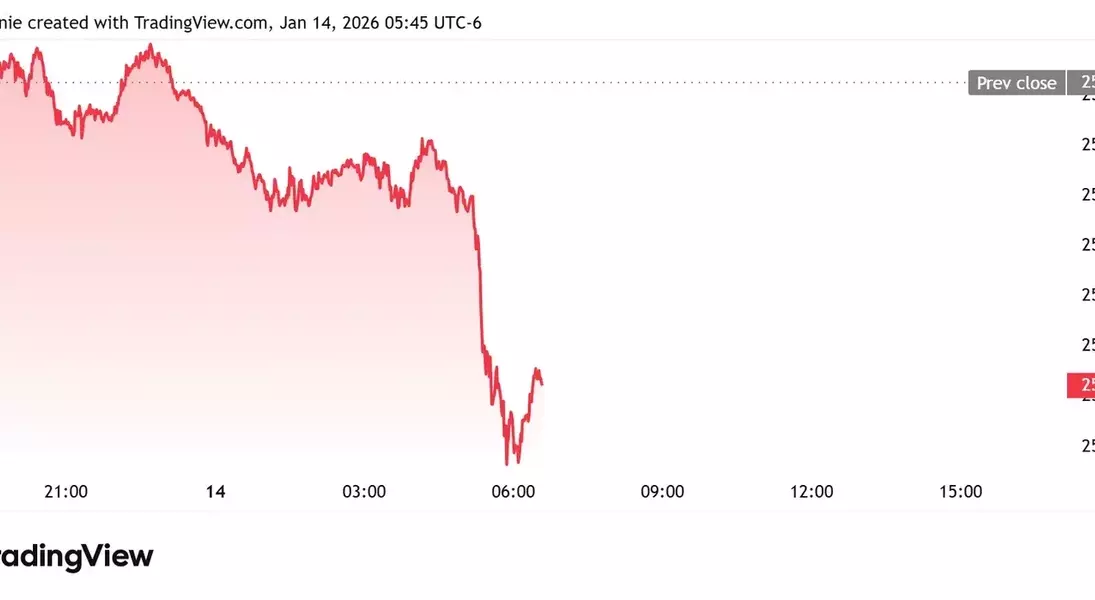

Market indicators showed a downward trend for stock futures on Wednesday, preceding forthcoming bank earnings announcements and an inflation report. Concurrently, the prices of gold and silver, typically considered safe-haven commodities, escalated to new peak values.

This market movement followed a day of decline for major stock indices, including the Dow Jones Industrial Average, which shed 400 points. This was influenced by a consumer inflation reading that met expectations and a mixed start to the bank earnings season, highlighted by JPMorgan Chase's performance. The financial sector experienced a second consecutive day of losses, partially due to a weekend proposal by President Donald Trump to cap credit card interest rates at 10%. Nvidia's shares also saw a slight dip despite approval for exporting its H200 AI chips to China, contingent on new security protocols. In contrast, Netflix's stock gained momentum following reports of its potential all-cash offer for Warner Bros. Discovery's HBO Max and studios. Meanwhile, West Texas Intermediate crude oil futures saw a modest increase, and Bitcoin traded relatively stable after a slight recovery from its daily low.

Investors are closely monitoring the release of the delayed Producer Price Index report for November by the Bureau of Labor Statistics. Economists project a 0.3% increase in wholesale prices from September, prior to the U.S. government shutdown. In anticipation of this data, the 10-year Treasury yield, which impacts various loan interest rates, edged down to 4.16%.

In the dynamic world of finance, where market movements are influenced by a myriad of factors, it is crucial for investors to remain informed and adapt to changing conditions. The resilience of precious metals in times of uncertainty, coupled with the strategic decisions of major corporations, underscores the complex interplay of global economic forces. By staying vigilant and making judicious choices, participants can navigate the market's ebb and flow, striving for growth and stability in their financial endeavors.