Following a period of market downturn, U.S. stock futures indicated a positive open on Friday. The Nasdaq and S&P 500, having previously experienced notable weekly declines, were looking to recover, while the Dow Jones Industrial Average showed a marginal uptick. This shift comes amidst diverse performances from major technology companies and a re-evaluation of the bond market's role in investment strategies, with experts suggesting a renewed appeal for fixed-income assets.

This week has been marked by volatility, particularly in the tech sector, influencing the broader market. Despite a challenging week for some segments, the overall outlook for Friday's trading suggests a cautious optimism. The evolving landscape of corporate earnings, coupled with expert opinions on long-term investment viability in both equities and bonds, underscores a pivotal moment for investors navigating current market dynamics.

Market Rebound and Tech Sector Dynamics

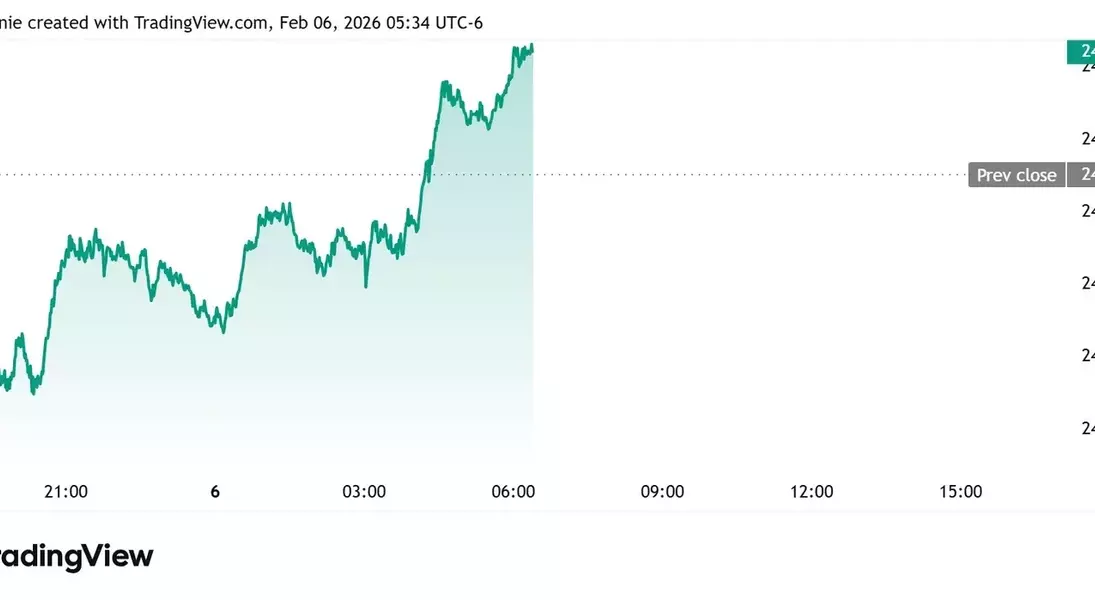

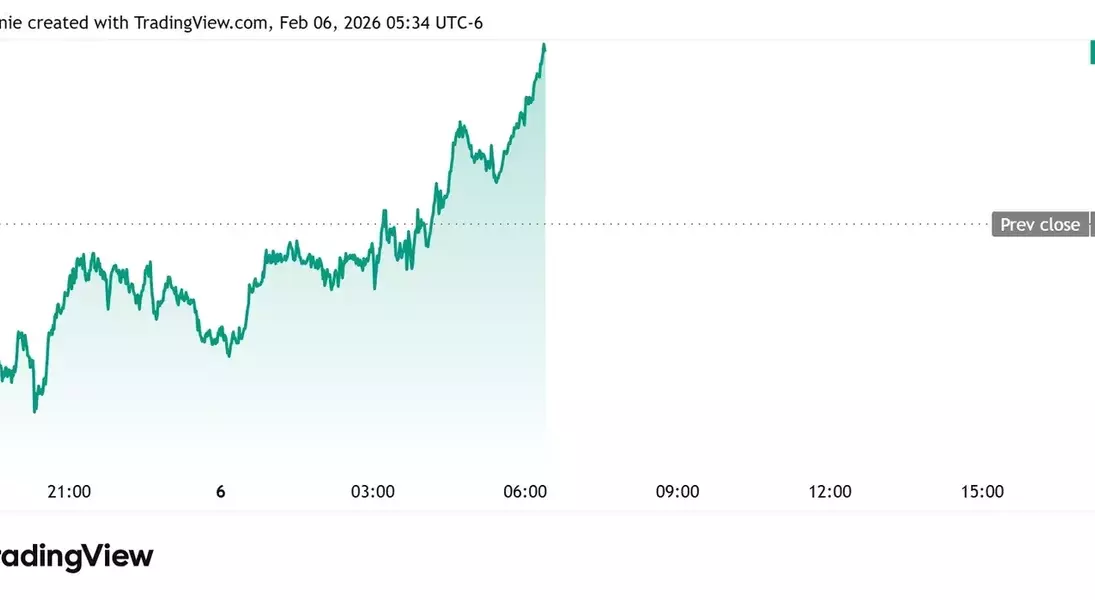

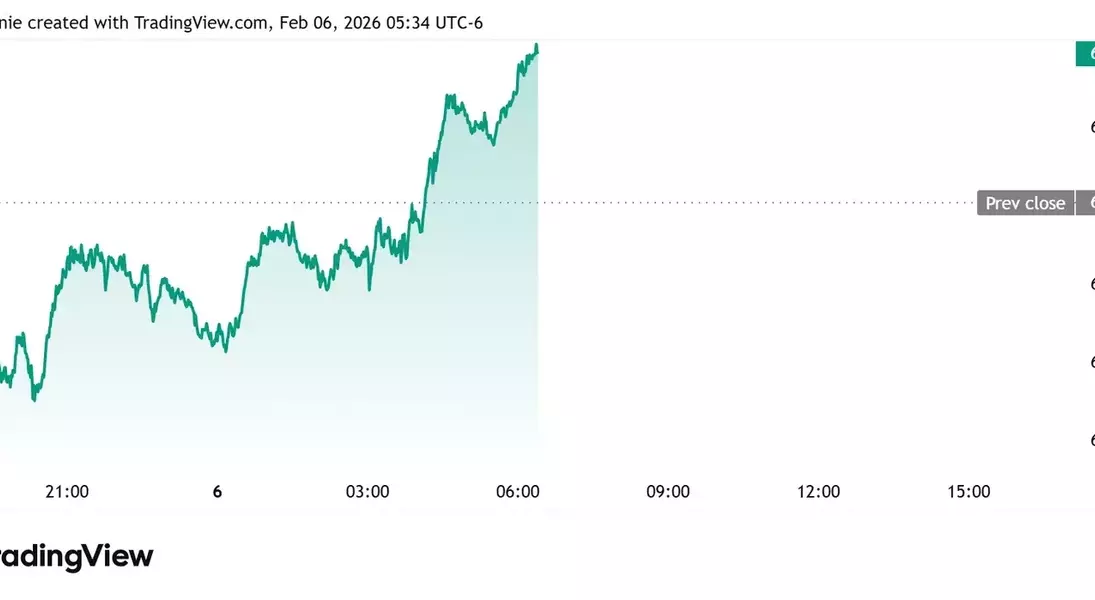

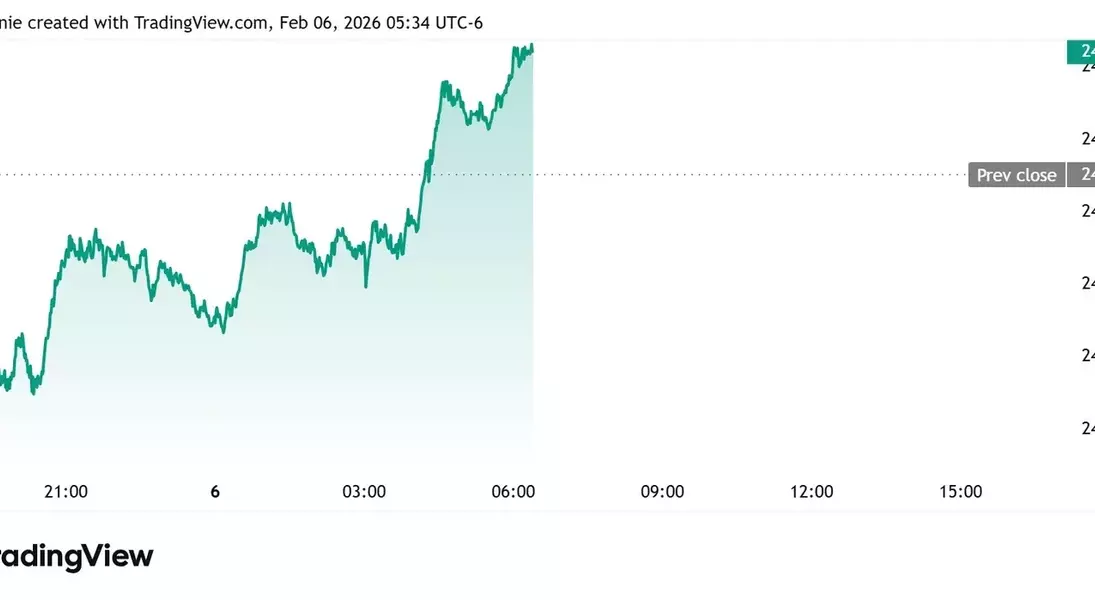

U.S. stock futures displayed an optimistic trajectory on Friday, signaling a potential recovery after a series of declines that impacted major indices. The Nasdaq 100, S&P 500, and Dow Jones Industrial Average futures each registered gains of 0.7%, 0.6%, and 0.6%, respectively. This positive sentiment emerged following a turbulent period where the Nasdaq and S&P 500 had incurred substantial weekly losses of 4% and 2%. The Dow, conversely, managed a slight increase for the week, highlighting a divergence in performance across different market segments. This rebound is particularly noteworthy as it follows three consecutive losing sessions for the tech-heavy Nasdaq and the benchmark S&P 500, with the Nasdaq on track for its most significant weekly drop since April of the previous year. The market's movement reflects a complex interplay of investor sentiment and corporate financial disclosures.

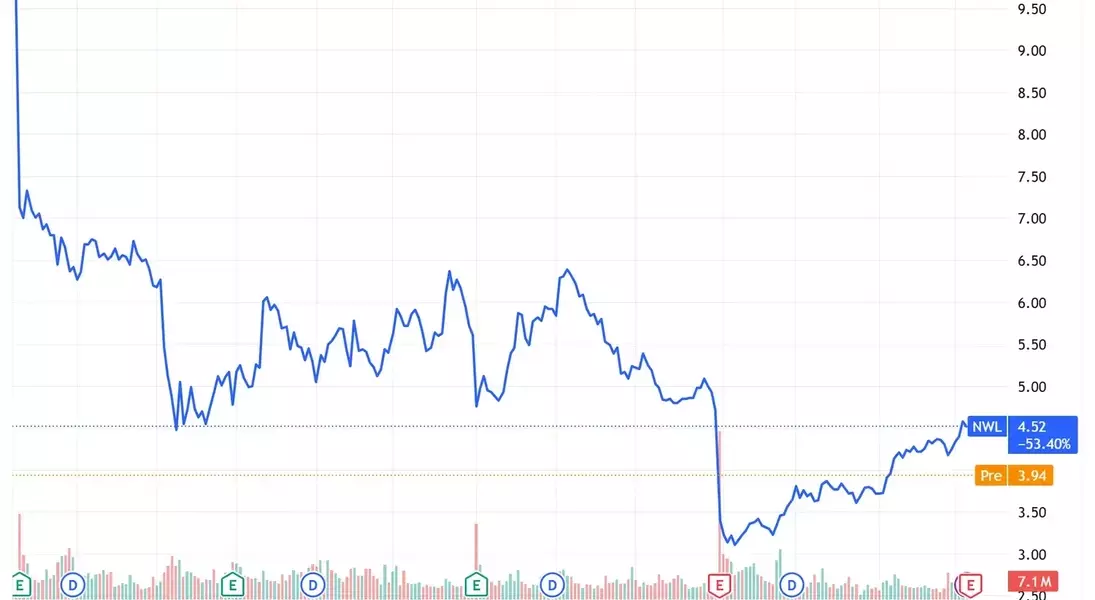

The technology sector experienced considerable volatility, with several high-profile companies reacting sharply to their latest earnings reports. Amazon's stock, for instance, saw a decline of over 8% in premarket trading after its earnings failed to meet expectations. In contrast, Nvidia, another prominent tech giant, led gainers with a nearly 3% advance, showcasing the varied investor responses within the sector. Microsoft, which had faced a 5% drop the previous day, also recovered with a 1.5% increase before the market opened. Beyond these giants, Qualcomm experienced a modest recovery of less than 1% after a significant 8.5% drop, attributed to concerns over a global memory chip shortage impacting its future forecasts. Other notable shifts included Stellantis's sharp 24% decline following a business restructuring announcement, while companies like Roblox and Reddit saw their shares surge by 9% and 8%, respectively, post-earnings. Conversely, Doximity and Molina Healthcare faced substantial drops of 32% and 28%.

Shifting Investment Strategies: The Resurgence of Bonds

In a significant shift within the investment landscape, market experts, including Vanguard's Chief Investment Officer Gregory Davis, are advocating for a re-evaluation of portfolio allocations, particularly a greater emphasis on bonds. This recommendation marks a departure from conventional wisdom, suggesting that the long-standing "60/40 portfolio" might evolve, or even reverse, to a "40/60" split favoring fixed income. Davis highlighted the current appeal of bonds, noting that the 10-year Treasury yield, at 4.2%, offers a substantial premium over inflation rates. This situation represents a rare opportunity, being the first time in approximately a decade that investors can achieve a real yield from bond investments. The attractive yields are a direct consequence of aggressive interest rate hikes by the Federal Reserve in response to soaring inflation, a stark contrast to the historically low yields observed after the 2008 Global Financial Crisis and during the COVID-19 pandemic.

The renewed interest in bonds comes at a time when the stock market has experienced a robust bull run, with the S&P 500 achieving a nearly 90% increase since October 2022, largely propelled by investments in artificial intelligence. However, this impressive equity performance also raises concerns about potential overvaluation. Davis articulated this sentiment, suggesting that U.S. stocks have been overvalued for some time, leading him to predict that future returns from stocks and bonds will be "pretty comparable" over the next decade. This outlook aligns with Vanguard's 2026 market forecast, which projects mid-single-digit stock returns, a view echoed by Goldman Sachs analysts. This perspective underscores a strategic shift towards diversifying portfolios with a stronger bond component, aiming for more balanced and potentially more stable returns in an environment where equity markets might face headwinds after years of significant growth. The evolving dynamics between inflation, interest rates, and market valuations are compelling investors to reconsider traditional asset allocation models.