Recent market activities highlight a complex interplay of economic indicators and corporate performances. While retail sales data revealed unexpected stagnation, major stock indexes experienced varied movements, influenced by both broader market trends and individual company earnings. The growing adoption of 'Buy Now, Pay Later' schemes for rent payments signals a shift in consumer financial behavior, though associated costs warrant careful consideration. Additionally, forecasts for key economic sectors, such as the job market and fast-food industry, offer insights into future market dynamics. Commodity markets also saw fluctuations, reflecting ongoing global economic shifts.

This overview delves into these diverse but interconnected elements, providing a comprehensive look at the current financial landscape and what these trends might signify for investors and consumers alike. From the nuances of consumer spending habits to the anticipated trajectories of significant corporations and the broader employment picture, we aim to distill the essence of today's economic narrative.

Retail Sales Stagnate Amidst Market Fluctuations

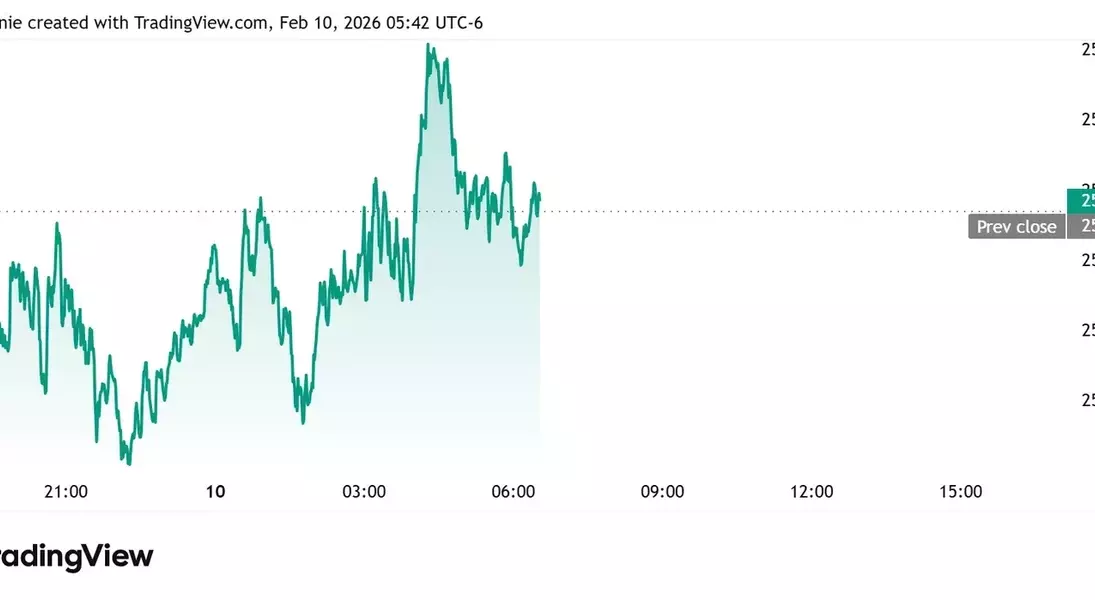

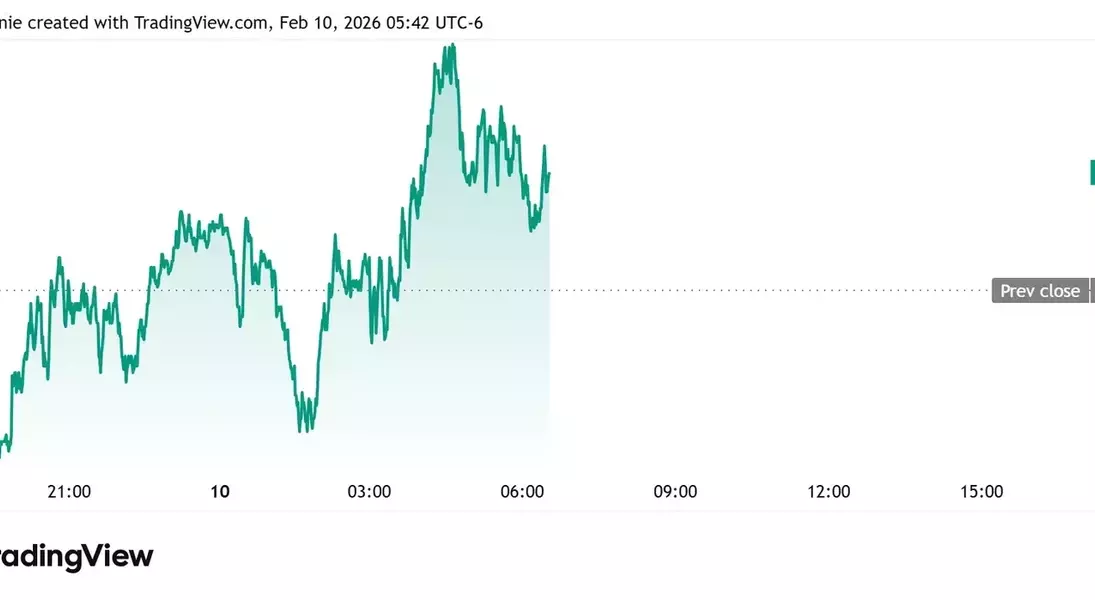

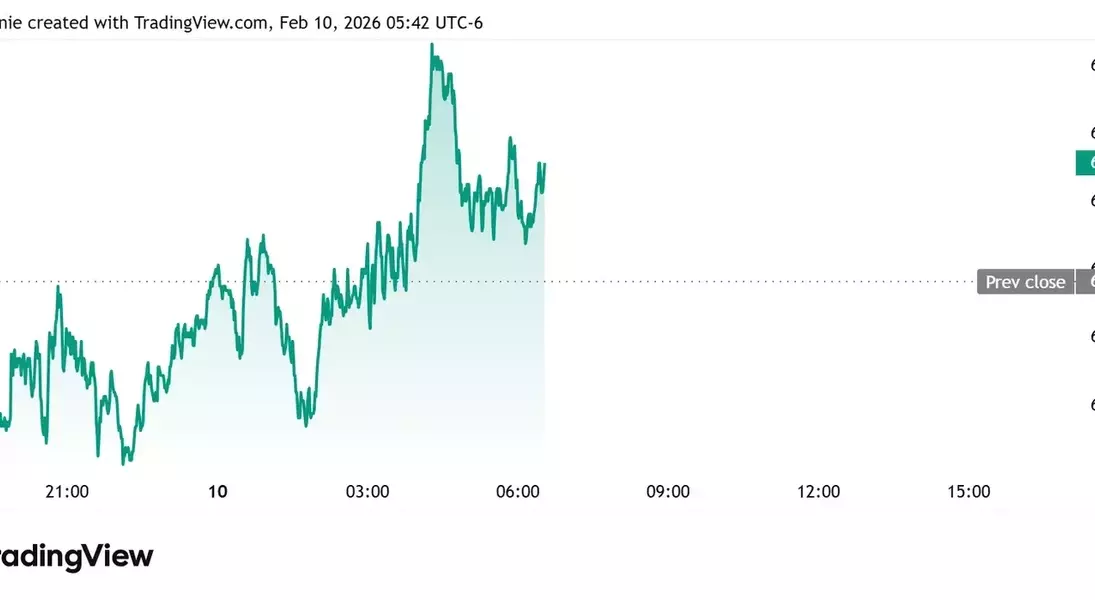

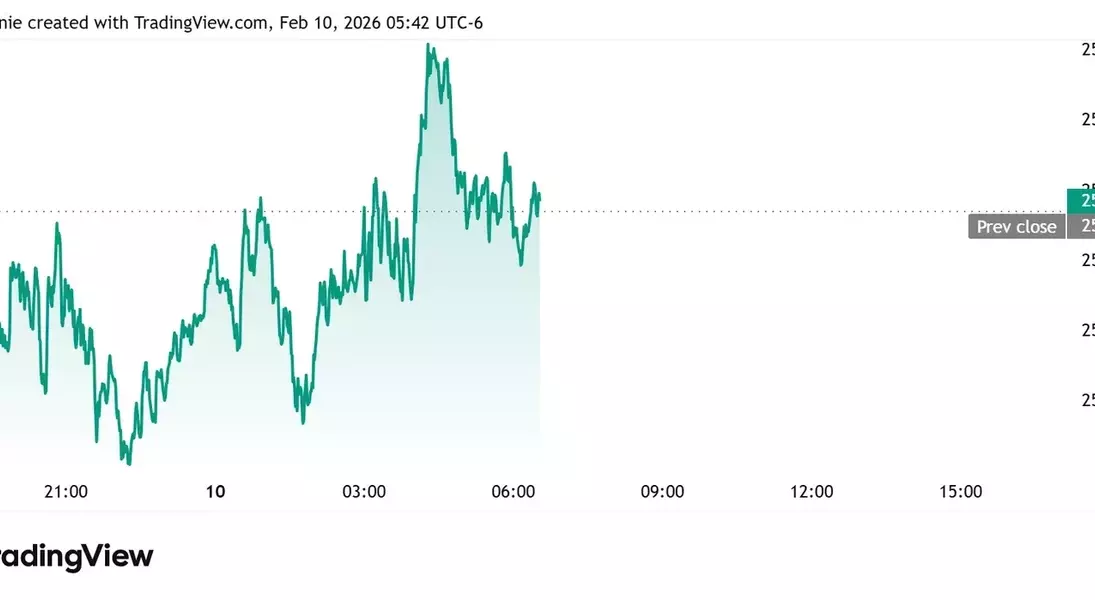

December's retail sales data from the U.S. remained flat, defying economists' expectations of a 0.4% increase. This unexpected stagnation, even when excluding auto sales, had an immediate impact on financial markets. Stock futures for the Dow Jones Industrial Average, S&P 500, and Nasdaq 100 all experienced a 0.1% downturn. Concurrently, the yield on the 10-year Treasury bond, a key indicator for various consumer interest rates, slightly decreased from 4.18% to 4.16%. This cooling in retail activity suggests a more cautious consumer landscape, potentially influencing future economic policy decisions and corporate strategies.

Despite the static retail figures, the stock market displayed resilience in other areas. The previous day saw the tech-heavy Nasdaq climb by 0.9% and the S&P 500 rise by 0.5%, with the Dow Jones Industrial Average also posting a marginal gain of less than 0.1%, achieving an intraday record for the second consecutive session. These contrasting movements underscore the market's current volatility and responsiveness to different data points. Individual company performances after earnings reports also showed significant fluctuations; Credo Technology Group Holding (CRDO) surged by 15%, Spotify (SPOT) by 10%, and Hasbro (HAS) by 2%. Conversely, Upwork (UPWK) plummeted by 22%, Coca-Cola (KO) fell by 3.5%, ON Semiconductor (ON) dropped by 3%, and CVS Health (CVS) declined by 1%. These varied outcomes highlight the importance of sector-specific and company-specific analysis in the current market environment.

Emerging Financial Trends and Economic Outlooks

The financial services sector is witnessing a notable trend with the increasing popularity of 'Buy Now, Pay Later' (BNPL) schemes for rent payments. Providers like Affirm, in partnership with Esusu, now offer options for renters to split their monthly payments into installments. While this offers flexibility, it comes with potential financial risks, as finance charges can accumulate, particularly if borrowers struggle with repayments. These services, despite advertising no interest, often involve other fees that can make them more expensive than anticipated. This trend reflects a broader consumer demand for flexible payment solutions but also raises concerns about financial literacy and potential debt accumulation among users.

Looking ahead, McDonald's is poised to release its fourth-quarter earnings, with market analysts anticipating a potential 3% stock movement in either direction, possibly pushing its shares to new record highs. This projection is underpinned by a shift from tech investments to consumer-focused stocks and McDonald's strategic emphasis on value offerings. In parallel, the job market report for January is expected to show a modest addition of 55,000 jobs, primarily concentrated in the healthcare sector, reflecting a cautious hiring environment across other industries. The unemployment rate is projected to remain stable at 4.4%. This outlook contrasts with growing concerns from Federal Reserve officials regarding a potential surge in unemployment, exacerbated by a significant drop in job openings in December—a leading indicator of future job growth. These developments paint a picture of an economy navigating a precarious balance between stability and potential downturns.