Global markets are witnessing a dynamic shift today as stock futures suggest an upward trajectory for major indexes, a day after a minor setback. This comes amid a flurry of corporate earnings reports, noteworthy developments in the biotechnology sector, and an intriguing event in the collectibles market, signaling a diverse range of factors influencing investor sentiment.

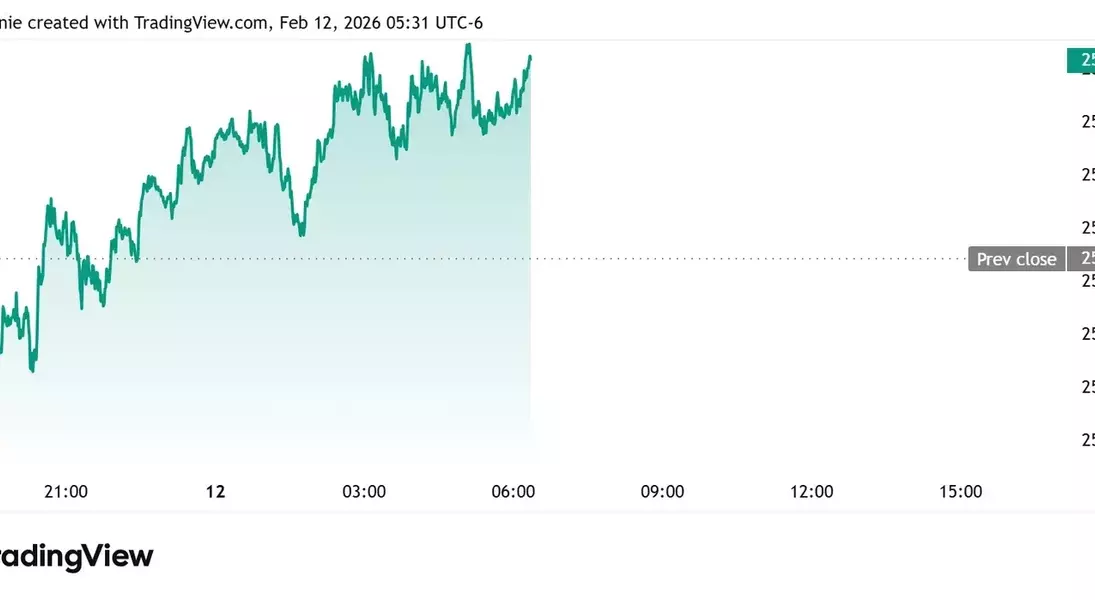

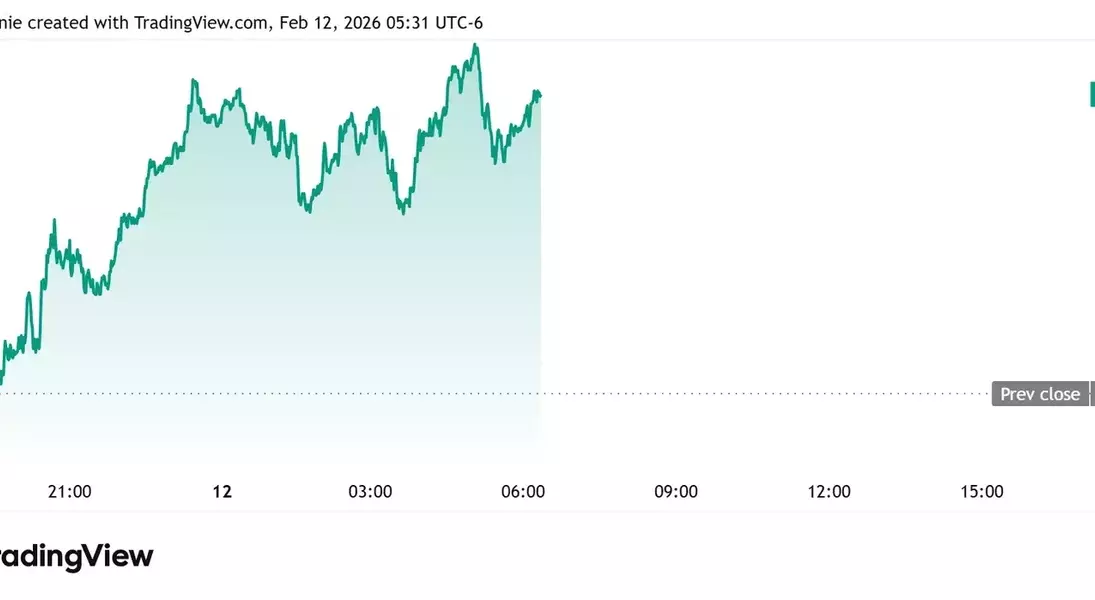

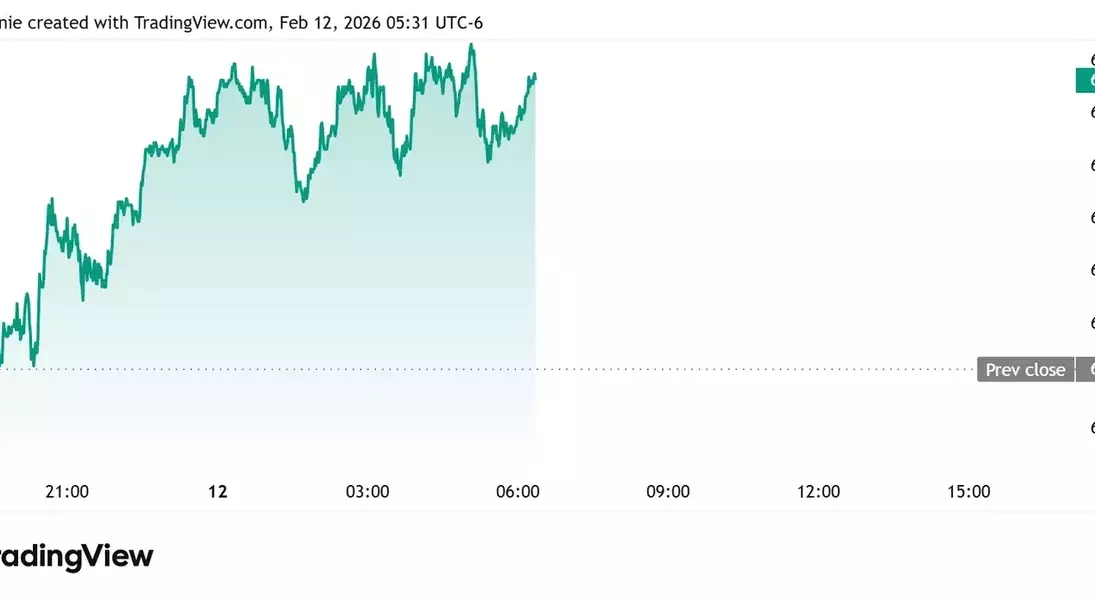

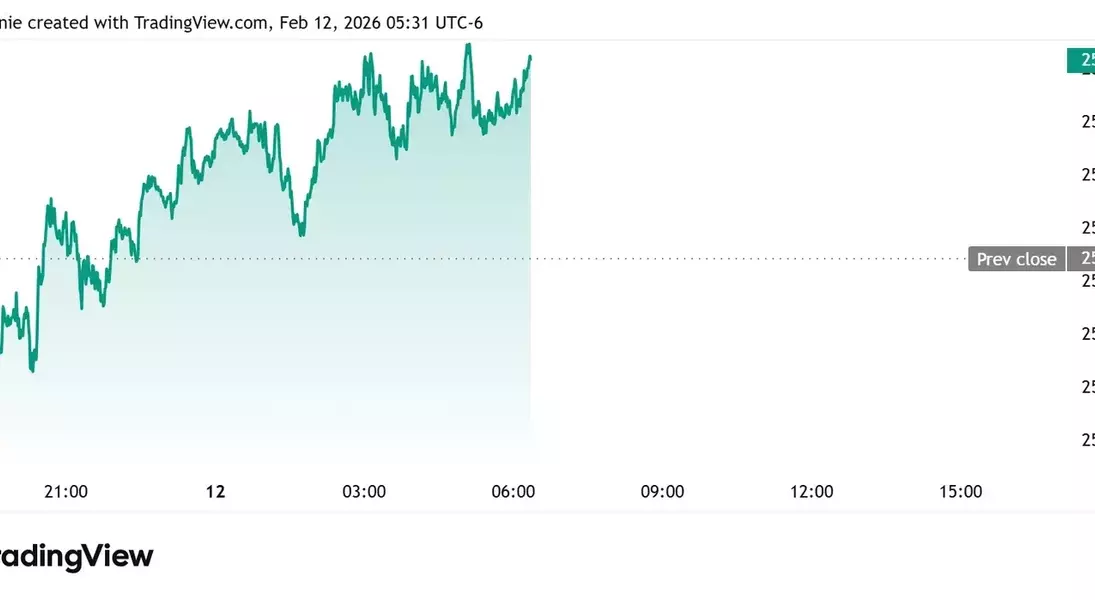

U.S. stock futures, encompassing the Dow, S&P 500, and Nasdaq 100, each registered a 0.2% increase approximately three hours ahead of the market's open. This optimistic outlook follows Wednesday's trading session where the Nasdaq and Dow Jones Industrial Average experienced marginal declines of 0.2% and 0.1% respectively. The S&P 500 also closed slightly lower, as market participants processed various corporate financial disclosures and a robust January U.S. employment report that surpassed economic forecasts. Despite these minor corrections, all three primary indexes maintained a positive performance for the week.

Adding to the economic data, weekly jobless claims, reported early Thursday, totaled 227,000. This figure was marginally above economists' projections of 225,000 but represented a decrease from the previous week's 231,000. Later in the day, investors are keenly awaiting existing home sales data for January, with expectations of a decline to 4.15 million from December's 4.35 million. The Consumer Price Index data, scheduled for release tomorrow, is anticipated to heavily influence the Federal Reserve's decisions regarding interest rates.

Corporate news also drove significant market movements. Cisco Systems (CSCO) shares plummeted by 7% in pre-market trading, primarily due to narrower gross margins. Conversely, Novocure (NVCR) experienced a remarkable 25% surge following the U.S. Food and Drug Administration's approval of its innovative Optune Pax treatment for locally advanced pancreatic cancer. Other notable shifts included AppLovin (APP) shares falling by 9%, Restaurant Brands International (QSR) slipping by 2%, while Anheuser-Busch InBev (BUD) and McDonald's (MCD) saw gains of 3% and 1% respectively. Among the 'Magnificent Seven' stocks, Nvidia (NVDA) led the gains with a 1% rise, with only Apple (AAPL) not participating in the upward movement before the bell.

In the broader financial landscape, the yield on the 10-year Treasury bond, a key indicator affecting consumer loan rates including mortgages, dipped below 4.16% from Wednesday's closing figure of just under 4.18%. Cryptocurrency markets saw Bitcoin trading around $67,900, recovering from overnight lows of approximately $66,600. The U.S. dollar index climbed slightly to 96.89, reflecting its strength against a basket of international currencies. Commodity markets experienced a slight dip, with gold futures decreasing by 0.2% to $5,090 an ounce, and silver futures falling by 2% to $82.20 an ounce. West Texas Intermediate crude futures, the American benchmark, were down 0.3% at $64.45 a barrel.

Meanwhile, in an unusual blend of sports memorabilia and market excitement, Topps, the renowned trading card company now owned by Fanatics Inc., announced a unique promotion. A single pack from its new "Topps Series 1" baseball set will contain a redeemable card for a 1952 Mickey Mantle card, often hailed as the "Holy Grail" of card collecting. This specific card achieved over $12 million in a 2022 sale, underscoring the immense value of rare collectibles. This initiative celebrates the 75th anniversary of Topps baseball cards and highlights a growing trend in the collectibles market where the "chase" for rare items fuels demand and subsequent bidding wars. To ensure the preservation of the original card's condition, Topps confirmed that collectors would find a redemption card rather than the physical Mantle card itself.

This day's market activities reflect a complex interplay of corporate performance, economic indicators, and unique market phenomena, all contributing to a dynamic and engaging financial environment.