The U.S. stock market experienced a day of minimal change, influenced by both the fluctuating performance of AI-related semiconductor companies and broader economic discussions. While AI stocks initially surged on projections of increased data center demand, this enthusiasm later softened. Simultaneously, the Federal Reserve's autonomy in monetary policy decisions faced scrutiny, raising questions about future interest rate adjustments. Meanwhile, regional banking sector earnings revealed a mixed picture, and a slight uptick in Treasury yields reflected ongoing market adjustments to inflation data and concerns about central bank independence. Commodities like oil, gold, and silver, along with cryptocurrencies, also saw varied movements, painting a complex financial landscape.

AI's Impact on Semiconductor Stocks and Data Storage

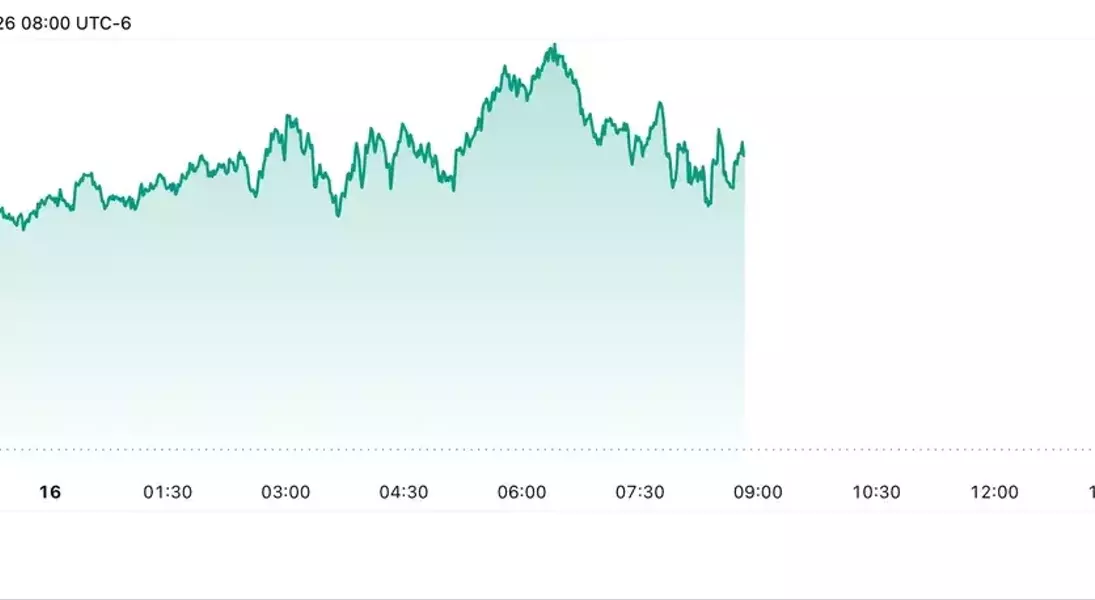

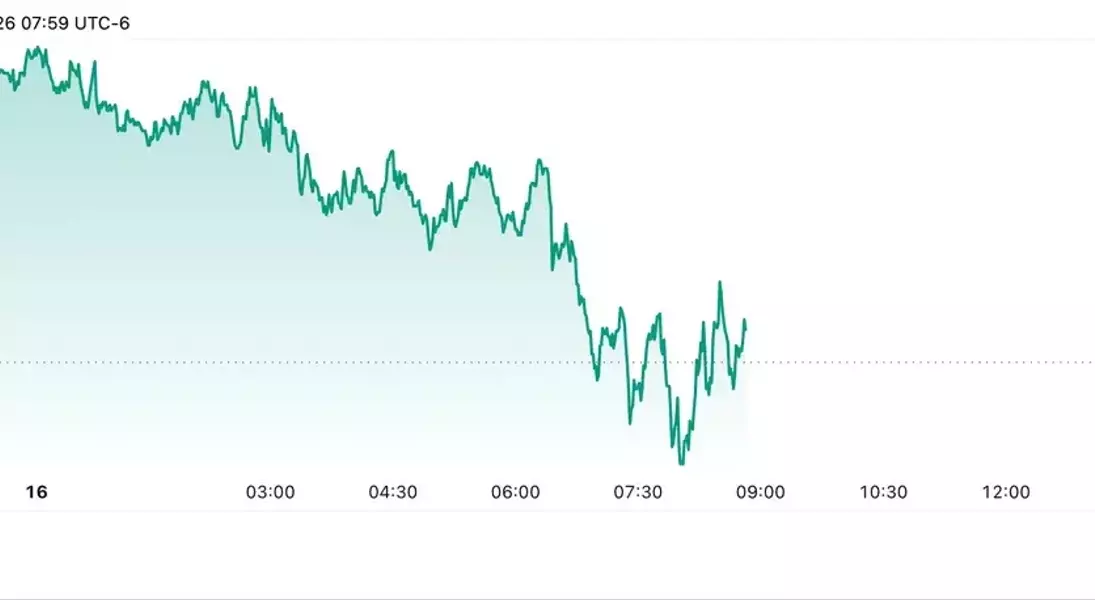

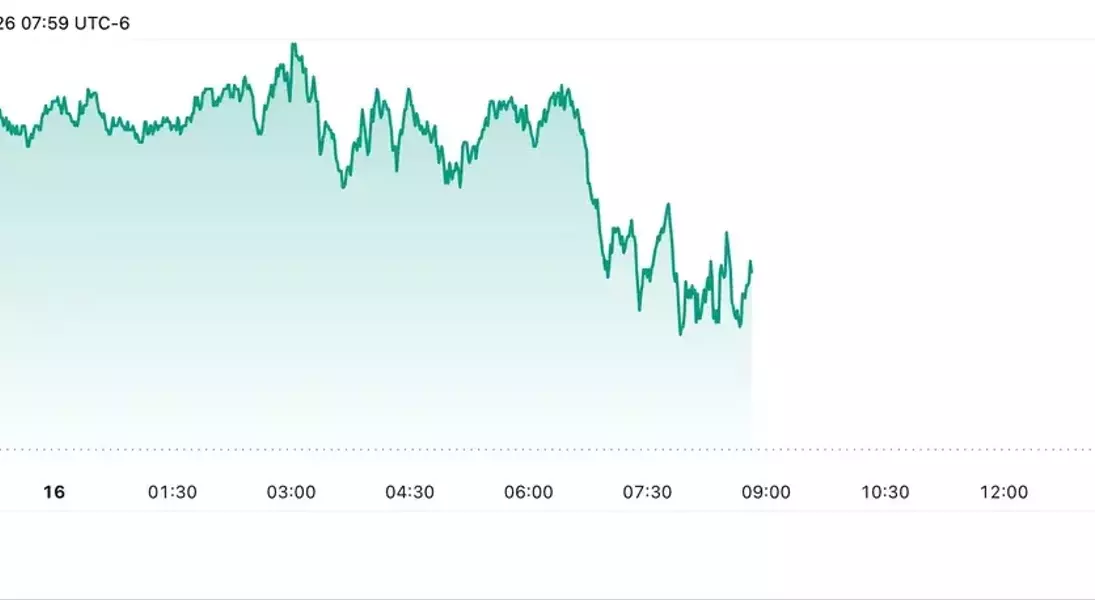

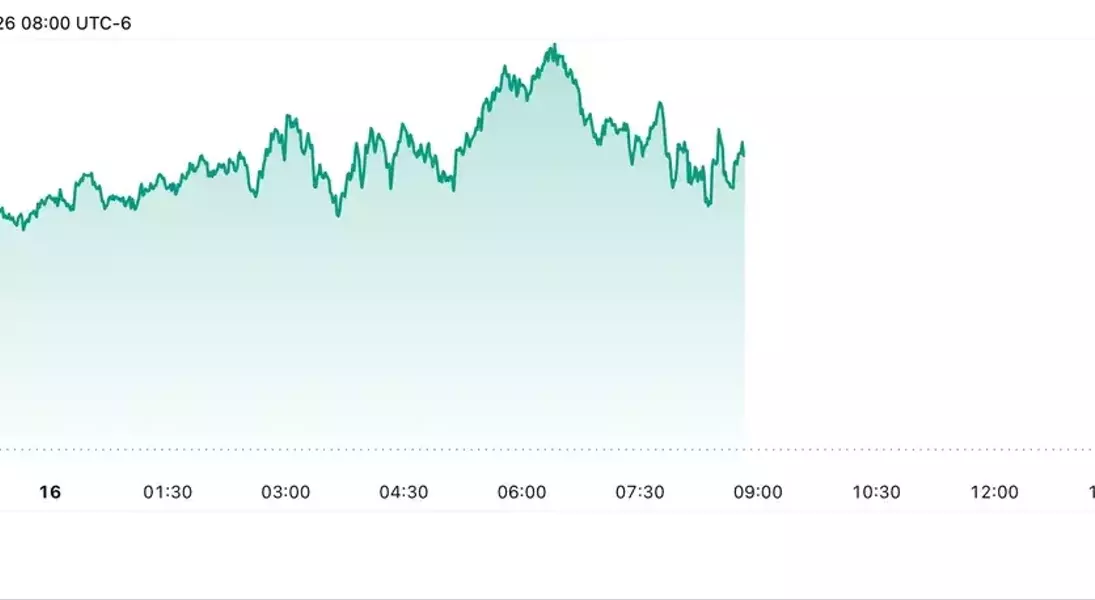

On Friday, the U.S. stock market experienced slight movements, with the Nasdaq Composite and S&P 500 showing gains of less than 0.1%, while the Dow Jones Industrial Average dipped by less than 0.1%. These shifts occurred as the initial excitement surrounding AI data center expansion, which had previously fueled a rally in semiconductor stocks, began to subside. Despite this moderation, some memory and data storage companies continued to perform well. Micron's stock notably surged by over 5% after a regulatory filing indicated that a board member had made a significant personal investment of nearly $8 million, signaling strong insider confidence. However, other memory device manufacturers like Sandisk and Western Digital, which had initially risen, later retracted some of their gains, ending the day slightly lower.

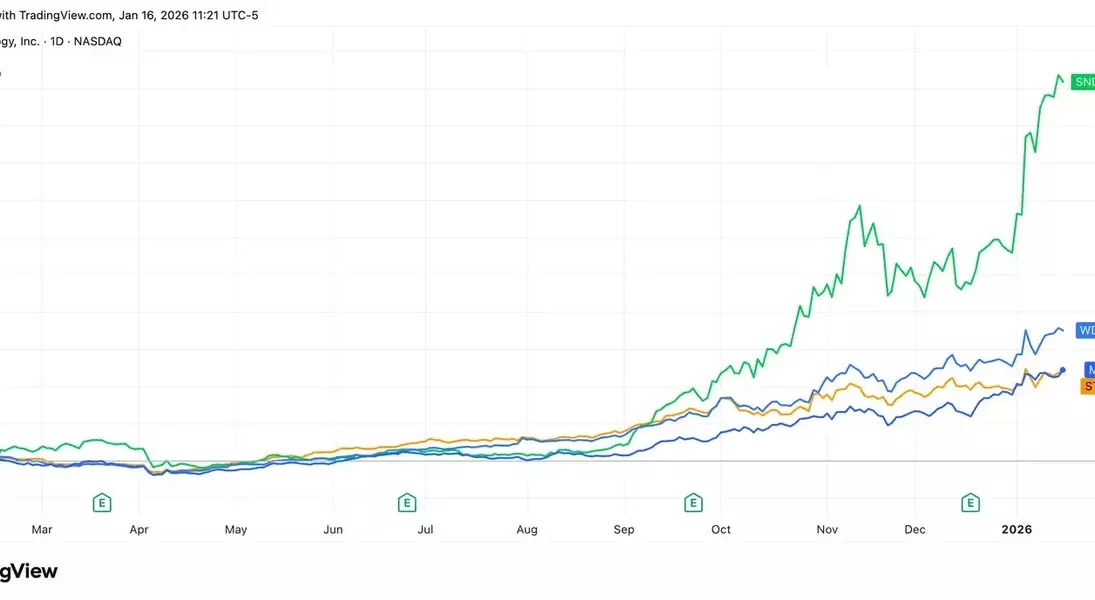

The semiconductor industry has been a focal point of market activity due to the increasing demand for memory and data storage solutions driven by the expanding AI sector. Micron's substantial stock increase over the past year, more than tripling in value, highlights the robust growth fueled by AI data center construction. Other companies such as Sandisk, Western Digital, and Seagate Technology have also benefited from this trend, experiencing significant stock appreciation. Sandisk shares, for instance, have soared over 1,000% since its spin-off, while Western Digital and Seagate saw increases of approximately 350% and 240% respectively. This strong performance underscores the critical role these companies play in supporting the infrastructure necessary for advanced AI development, even as market sentiment can fluctuate on a daily basis. The market's response to both positive insider news and broader industry trends reflects the dynamic and sometimes volatile nature of the technology sector, particularly in high-growth areas like AI.

Federal Reserve's Independence and Market Reaction to Rate Cut Speculation

The Federal Reserve's independence and the prospects of interest rate adjustments became a significant point of discussion in the market, particularly after recent political developments. Following an investigation by the Trump administration into Federal Reserve Chair Jerome Powell, aimed at influencing the central bank's rate decisions, several Fed officials publicly defended Powell and the institution's autonomy. These statements emphasized the importance of monetary policy decisions being made in the public interest, free from political interference. This stance led traders to reassess the likelihood of early rate cuts, pricing in reduced chances of such actions, indicating a market belief that the Fed would maintain its independent course despite external pressures.

The political pressure on the Federal Reserve, specifically regarding the subpoena issued by the Justice Department concerning Powell's 2020 Senate testimony, brought the issue of central bank independence to the forefront. Powell himself linked the criminal investigation to ongoing efforts by the Trump administration to push for lower interest rates, which impact a wide range of consumer loans. In response, a number of Federal Reserve governors and regional bank presidents voiced their support for Powell, underscoring the necessity of the Fed's ability to operate without political influence to effectively manage inflation. Such public comments from Fed officials are uncommon, highlighting the gravity of the situation and the institution's commitment to its mandate. This defense of independence suggests that the Federal Reserve is resolved to make policy decisions based on economic indicators rather than political expediency, influencing market expectations for future rate adjustments and overall economic stability.