The financial markets are bracing for a shift in sentiment following the release of robust employment figures, which have dampened hopes for near-term interest rate cuts by the Federal Reserve. Investors now face a week filled with economic indicators that could further solidify the central bank's stance on maintaining current borrowing costs.

Prepare for Market Volatility as Key Economic Reports Shape Investor Expectations

Employment Surge Signals Economic Resilience

The recent surge in employment has sent ripples through the investment community, signaling an economy that remains robust despite global uncertainties. Analysts point out that the strong jobs report not only reflects underlying strength but also complicates the narrative around potential monetary easing. With unemployment at historic lows and wage growth steady, the case for lower interest rates becomes less compelling. Investors must now recalibrate their strategies to account for this new reality, where the Fed is more likely to prioritize inflation control over stimulus measures.The implications of this data extend beyond just interest rates. A resilient job market can lead to increased consumer spending, which in turn drives corporate earnings. However, it also means that companies may face higher labor costs, potentially squeezing profit margins. This dynamic creates a delicate balance for businesses navigating the current economic landscape. As investors assess these factors, they will be closely watching how corporations adapt to changing conditions.Economic Indicators Set the Tone for Central Bank Decisions

This week, the focus shifts to a series of critical economic reports that will shape the Fed’s decision-making process. Chief among them is the Consumer Price Index (CPI), scheduled for release mid-week. Economists predict that the CPI will reveal a slight uptick in inflation during December, reinforcing the Fed’s cautious approach. Inflationary pressures remain a key concern for policymakers, who aim to strike a balance between fostering growth and preventing overheating.Moreover, the upcoming retail sales data will offer insights into consumer behavior, a crucial component of the U.S. economy. If sales figures exceed expectations, it could signal continued robust demand, further supporting the case for stable interest rates. Conversely, any signs of weakening consumer confidence could prompt a reevaluation of the Fed’s stance. Investors will be parsing every detail of these reports, looking for clues about the future trajectory of monetary policy.Investor Sentiment Under Pressure from Policy Uncertainty

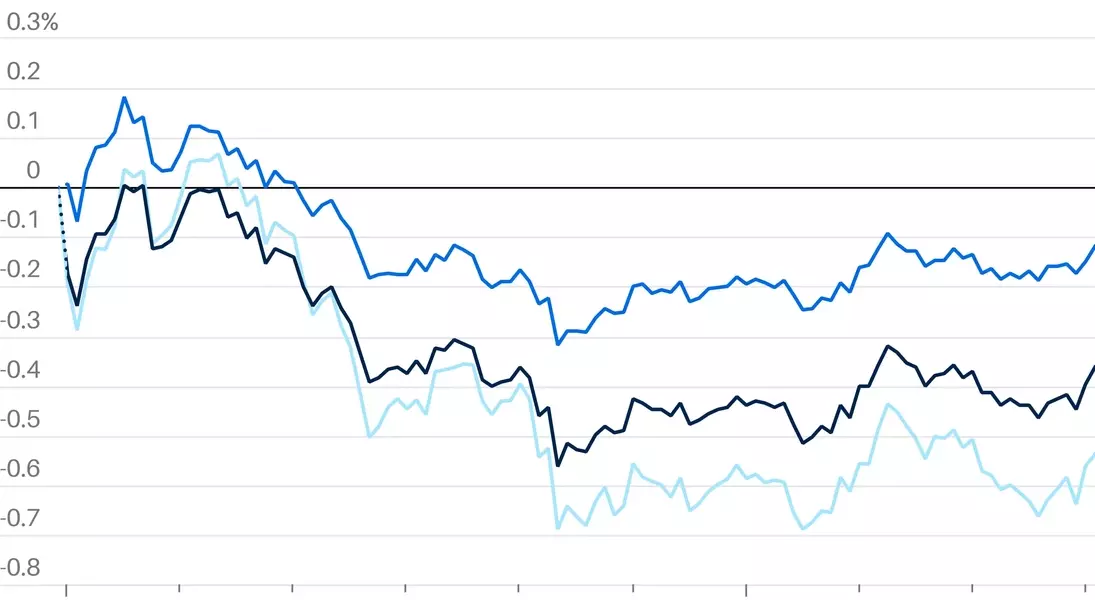

The uncertainty surrounding Fed policy has already begun to weigh on investor sentiment. Stock futures have taken a hit, reflecting growing concerns about the impact of sustained high interest rates on asset valuations. High-growth sectors, particularly those reliant on cheap capital, may find themselves under increased scrutiny. Tech stocks, for instance, have historically benefited from low-rate environments, but could face challenges if borrowing costs remain elevated.However, not all sectors are equally affected. Value-oriented investments, such as utilities and consumer staples, tend to perform well in periods of economic stability. These industries often provide consistent returns, making them attractive options for risk-averse investors. The shifting dynamics create opportunities for portfolio diversification, as investors seek to mitigate risks while positioning for long-term gains.Strategic Planning in a Changing Economic Environment

For investors, the coming weeks present both challenges and opportunities. Adapting to the evolving economic environment requires a nuanced understanding of macroeconomic trends and their implications for various asset classes. Diversification remains a cornerstone strategy, helping to spread risk across different sectors and geographies. Additionally, staying informed about key economic releases and central bank communications will be essential for making timely and informed investment decisions.Financial advisors recommend focusing on fundamentals, such as company earnings and balance sheet strength, rather than reacting impulsively to short-term market fluctuations. By adopting a disciplined approach, investors can navigate the complexities of the current market landscape and position themselves for success in the long run. The resilience demonstrated by the U.S. economy underscores the importance of maintaining a balanced and forward-looking investment strategy.