As the second to last trading day of 2024 nears its end, market futures are showing a downturn. Major benchmarks like the Dow Jones Industrial Average (DJIA), Nasdaq-100 Index (NDX), and S&P 500 Index (SPX) are all trading below their fair market values. Treasury yields and small-cap stocks are also retreating, with the 10-year note losing more than 4 basis points and the Russell 2000 index facing its worst month since September 2022. The low-volume trading week following Christmas has ended on a subdued note, while various sectors, including defense and technology, are making headlines.

In addition to market performance, several key events are shaping today's financial landscape. Boeing Co. is under scrutiny following South Korea’s deadliest air accident, involving a B737-800 aircraft. Meanwhile, V2X Inc. has secured a significant contract with the Drug Enforcement Agency (DEA), boosting its stock. Warren Buffett’s Berkshire Hathaway has also made notable investments in VeriSign Inc., adding to market buzz. Economic data remains light as New Year’s Day approaches, and Asian markets have been affected by the Korean tragedy and economic updates.

Global Markets React to Tragic News and Economic Data

Asian and European markets are experiencing volatility due to recent tragic events and economic reports. The impact of South Korea’s deadliest airline crash has reverberated through regional markets, causing fluctuations in trading volumes. Economic indicators from South Korea and Japan have added to the uncertainty, with industrial output and manufacturing data showing weaker-than-expected performance. Despite these challenges, China’s Shanghai Composite managed to post a slight gain, offering a glimmer of hope.

The Korean tragedy has sent shockwaves through global markets. South Korea’s Kospi fell 0.2% after November industrial output contracted by 0.7%, exceeding expectations. In Japan, the Nikkei declined by 1%, reflecting slower factory data and a softer contraction in the manufacturing PMI. Hong Kong’s Hang Seng also saw a minor dip, while China’s Shanghai Composite was the sole bright spot, rising 0.2%. European markets followed suit, with healthcare and tech sectors leading the decline. France’s CAC 40, London’s FTSE 100, and Germany’s DAX all fell by 0.4%, mirroring the cautious sentiment.

Key Corporate Developments Drive Market Movements

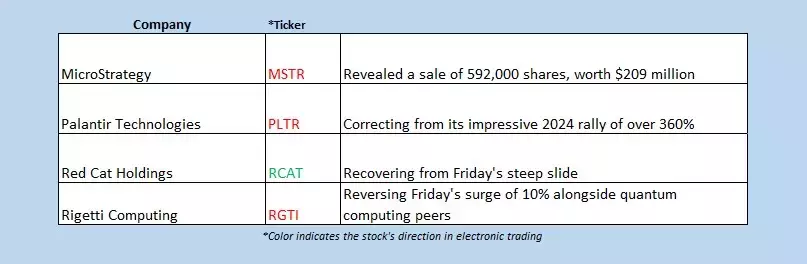

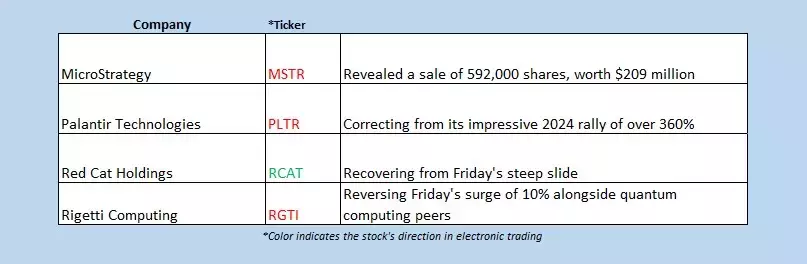

Several corporate developments are influencing market dynamics as the year comes to a close. Pre-market trading has seen notable changes, particularly for companies like Boeing Co. and V2X Inc. Following South Korea’s aviation disaster, Boeing shares dipped 3.4%, raising concerns about safety inspections and future operations. On a positive note, V2X Inc. received a substantial contract from the DEA, pushing its stock up by 8.6%. These contrasting movements highlight the diverse factors affecting investor confidence.

Boeing Co. faces renewed scrutiny after South Korean officials ordered inspections of all B737-800 aircraft following the Jeju Air crash, which claimed 179 lives out of 181 passengers. This incident has overshadowed the company’s year-to-date performance, with shares down 30.7%. Conversely, V2X Inc. secured a $170 million contract with the DEA, allowing it to continue supporting the agency’s fleet of aircraft. The company’s stock has risen 8.6% pre-market, extending its modest year-to-date gain. Additionally, VeriSign Inc. saw its stock climb 2.5% after Warren Buffett’s Berkshire Hathaway disclosed the purchase of over 140,000 shares, signaling renewed interest in the registry service company. As New Year’s Day approaches, these developments underscore the mixed sentiments driving market activity.