In the waning days of the year, U.S. financial markets appeared poised for a downturn amidst sparse trading activity. Concerns over persistently high interest rates and a burgeoning national debt cast a shadow over any potential year-end market rally. Early indicators showed a slight dip in major indices, with futures pointing to a modest decline across key stock benchmarks.

Detailed Market Observations

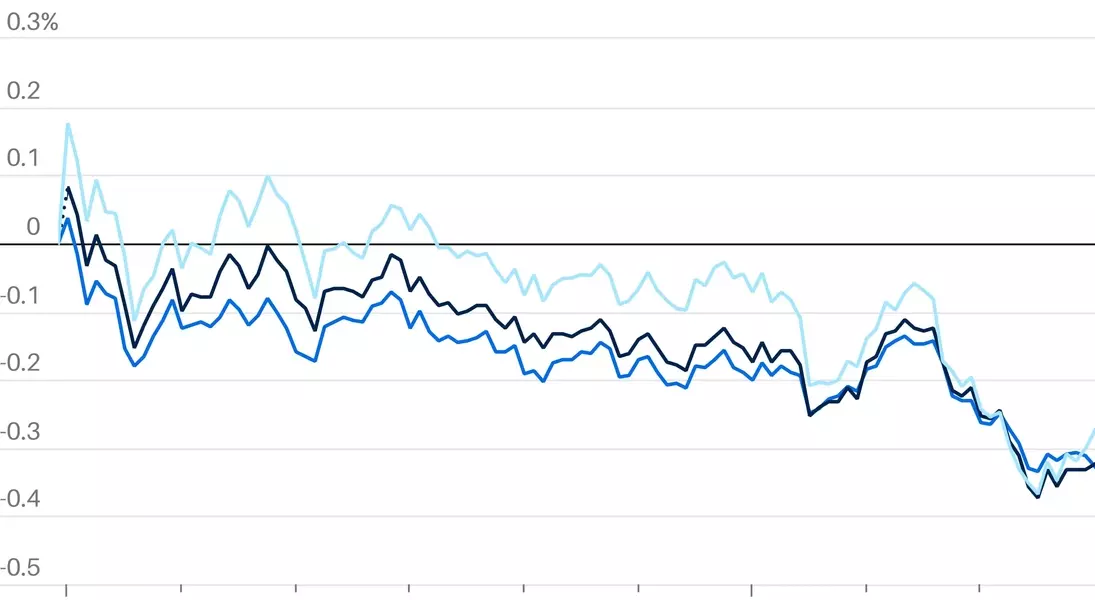

During this period of reduced trading volume, the economic climate has taken on a cautious tone. In the early hours of Monday, the Dow Jones Industrial Average futures experienced a minor setback, slipping by 0.2%. Similarly, the S&P 500 and the tech-focused Nasdaq 100 futures also indicated a decline of the same magnitude. These movements reflect ongoing investor concerns about the Federal Reserve's monetary policy. Despite hopes for more aggressive rate cuts in the coming years, inflation remains above the central bank’s desired threshold, leading to uncertainty about future economic conditions.

From an observer's perspective, this scenario underscores the delicate balance between monetary policy and market expectations. The current economic landscape serves as a reminder that while year-end optimism can influence short-term market sentiment, underlying macroeconomic factors ultimately shape long-term trends. Investors are encouraged to remain vigilant and adaptable in navigating these uncertain waters.