A New Year, A Fresh Start for Investors

In the opening days of 2025, the financial markets have shown signs of recovery, with major indices pointing toward gains. Futures tracking the Dow Jones Industrial Average have surged, indicating a strong start to the trading year. The S&P 500 and Nasdaq 100 futures have also climbed, particularly driven by the tech-heavy Nasdaq, which has seen notable momentum. This rally suggests that despite lingering uncertainties, investors are beginning to see light at the end of the tunnel.

Economic Challenges Loom Large

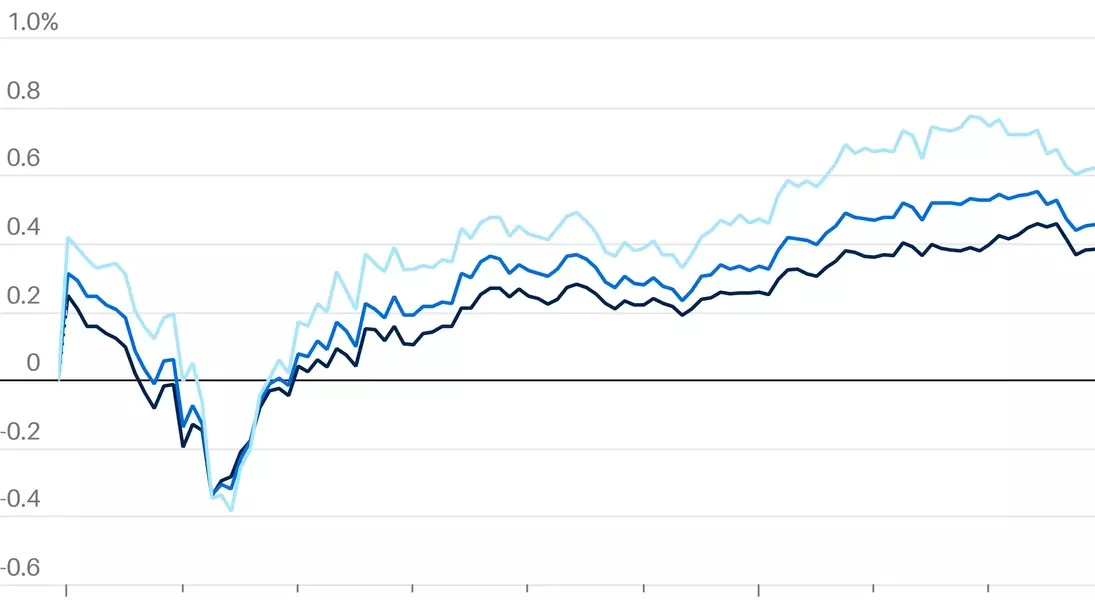

The past few weeks have been challenging for the markets, as concerns over persistently high interest rates and the federal deficit weighed heavily on investor sentiment. Despite these headwinds, the year 2024 saw triple-digit gains across all three major indexes. However, the final month of the year was marked by volatility, with many questioning whether the Federal Reserve would continue to lower interest rates given that inflation remains above its target of 2%. This uncertainty has kept markets on edge, with investors closely monitoring economic data and policy decisions.

Another significant factor contributing to market anxiety is the looming U.S. debt ceiling. Treasury Secretary Janet Yellen recently warned that the government could reach its borrowing limit by mid-January, adding another layer of complexity to an already uncertain economic landscape. This situation has raised concerns about potential disruptions to government operations and the broader economy, further influencing investor behavior.

Tech Sector Shows Resilience

The technology sector has emerged as a beacon of strength amidst the broader market turmoil. The Nasdaq 100, which includes many of the largest and most innovative tech companies, has seen substantial gains in futures trading. This performance underscores the sector's resilience and its ability to attract investment even in uncertain times. Tech stocks are often seen as growth-oriented, offering potential for long-term returns, which makes them an attractive option for investors seeking stability in volatile markets.

Moreover, the tech sector's robust performance can be attributed to its adaptability and innovation. Companies within this sector have consistently demonstrated their capacity to navigate challenges and capitalize on emerging trends. As digital transformation continues to reshape industries, the tech sector remains well-positioned to lead the way, driving both economic growth and investor confidence.

Looking Ahead: What Lies in Store for Investors?

As the year progresses, investors will be keeping a close eye on several key factors that could influence market performance. Central to these considerations is the trajectory of interest rates and inflation. The Federal Reserve's stance on monetary policy will play a crucial role in shaping market expectations. If inflation begins to moderate, it could pave the way for further rate cuts, potentially boosting investor sentiment and market performance.

Additionally, the resolution of the debt ceiling issue will be critical. Any agreement or delay in addressing this matter could have far-reaching implications for the economy and financial markets. Investors will be watching closely for any developments that could provide clarity on this front. In the meantime, the resilience of the tech sector offers a glimmer of hope, suggesting that there are still opportunities for growth and profitability in the coming months.