The financial markets showed signs of recovery on Friday, with stock futures indicating a potential easing of losses that began at the start of 2025. Key indices had previously experienced a series of declines, leading to concerns about economic performance in the new year. The S&P 500 futures gained ground, while tech-focused and industrial sectors also saw positive movements. This shift comes after a volatile start to trading for the year, influenced by central bank policies and rising energy costs.

Positive Market Sentiment Begins to Emerge

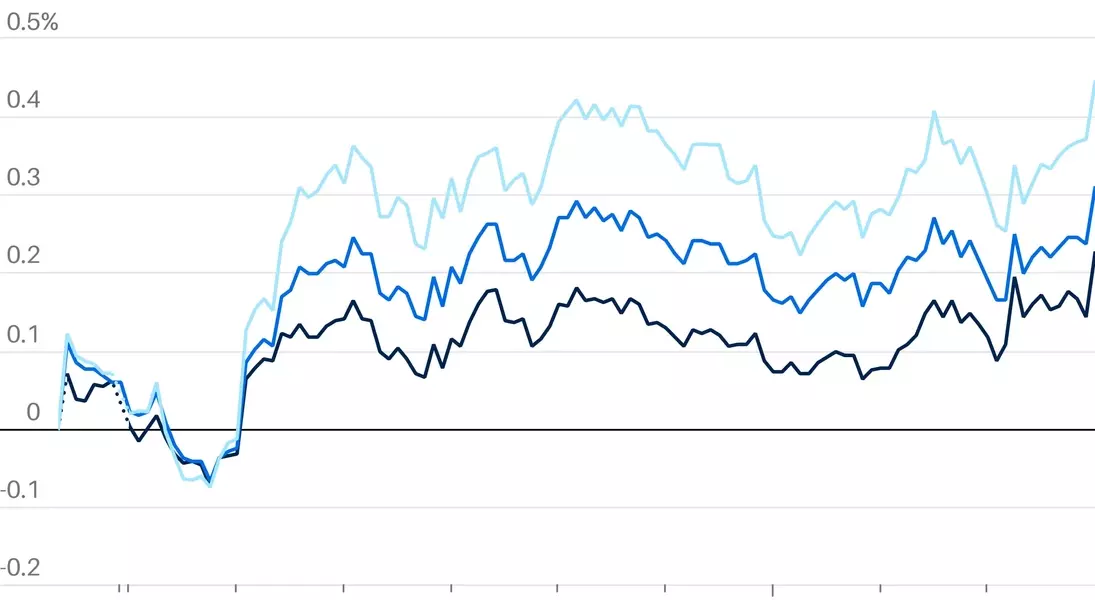

After several days of decline, there was a noticeable upturn in market sentiment. Futures linked to the S&P 500 index saw an increase, signaling a possible halt to the recent losing streak. Additionally, the Nasdaq 100 and Dow Jones Industrial Average futures also showed gains, reflecting a broader improvement in investor confidence. These developments suggest that traders are cautiously optimistic about stabilizing market conditions.

In detail, the S&P 500 futures rose by a modest margin, breaking the trend of consecutive daily losses. This upward movement is significant as it marks the first sign of recovery since early January. The Nasdaq 100, known for its focus on technology stocks, also saw an increase, indicating resilience in this sector. Meanwhile, the Dow Jones Industrial Average futures climbed, reinforcing the overall positive momentum. Traders and analysts view these changes as hopeful indicators that the market may be regaining its footing.

Factors Influencing Market Fluctuations

The initial volatility at the beginning of the year has been driven by various economic factors. Central bank statements and energy prices have played crucial roles in shaping investor expectations. Recent comments from the Federal Reserve have shifted market perceptions regarding future interest rate adjustments. Meanwhile, escalating natural gas prices in Europe have heightened concerns about inflationary pressures.

To elaborate, investors initially anticipated potential interest rate cuts from the Federal Reserve. However, following a firm stance expressed by Chair Jerome Powell, these expectations have been recalibrated. The central bank's hawkish approach has led to a reassessment of monetary policy impacts on the economy. Furthermore, the surge in natural gas prices across Europe has added another layer of complexity. This development has increased worries about persistent inflation, which could affect global economic stability. As a result, market participants are carefully monitoring these factors, seeking signs of stabilization and sustainable growth.