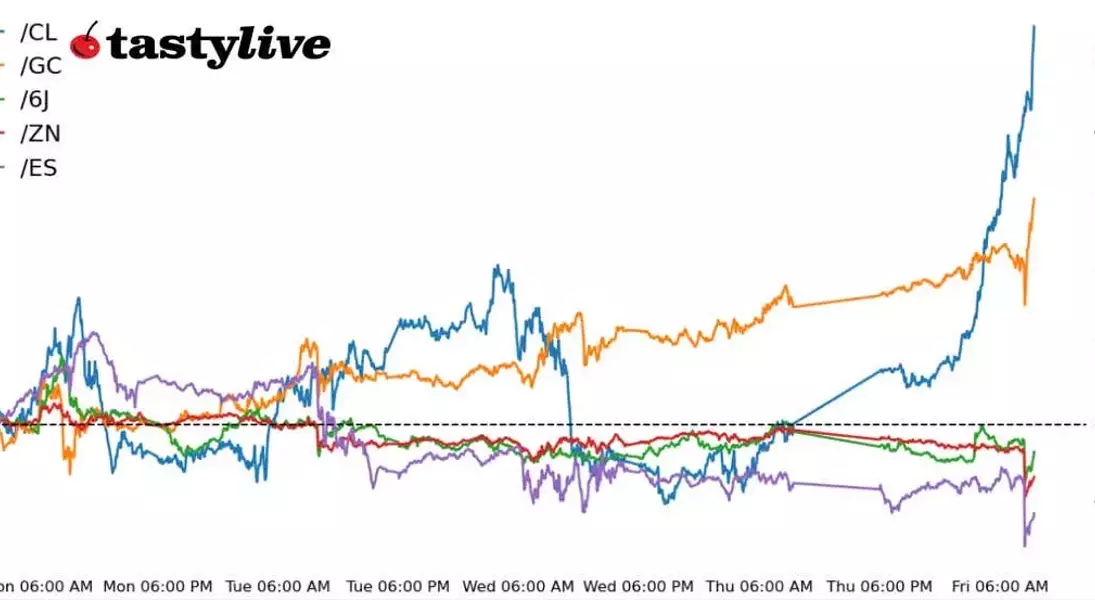

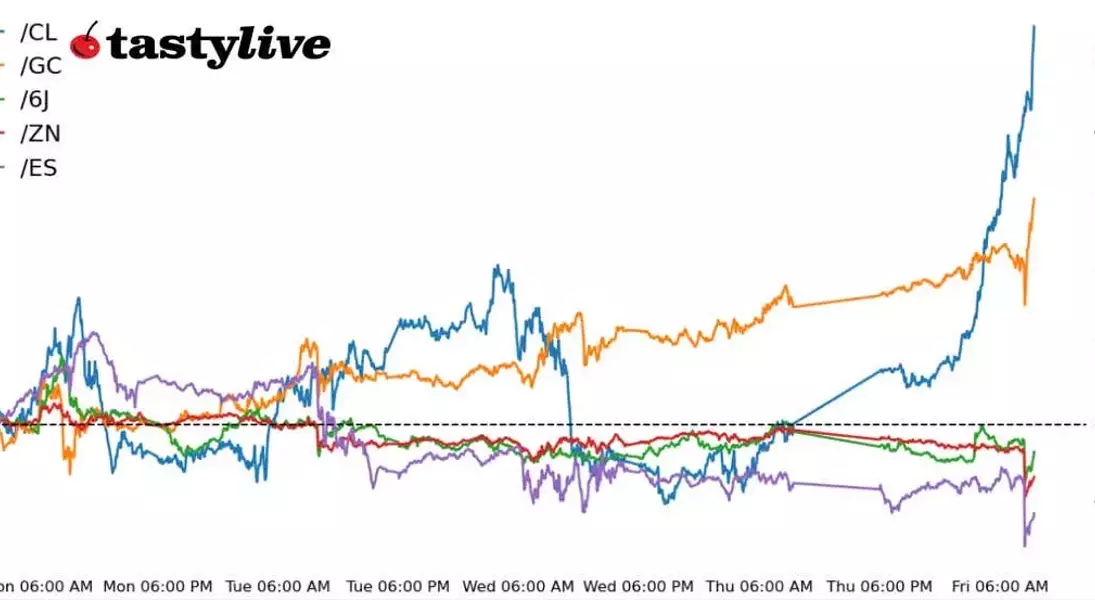

In the wake of robust December jobs data, financial markets experienced a mixed reaction. The latest employment figures revealed an addition of 256,000 jobs, significantly surpassing expectations. This positive surprise led to varied responses across different asset classes. S&P 500 E-mini futures saw a decline of 1.19%, while gold and crude oil futures gained 1.32% and 4.37%, respectively. Japanese yen futures also showed a slight increase of 0.05%. These movements underscored traders' concerns about the Federal Reserve's future monetary policy decisions in light of a resilient labor market.

The December U.S. nonfarm payrolls report highlighted a strong job market, with the unemployment rate dropping to 4.1% from 4.2%. This improvement marked three consecutive months of stable job growth, alleviating earlier worries about economic downturns. Analysts noted that the Sahm Rule indicator, which signals potential recessions, had decreased further, reinforcing confidence in the economy's stability. The household employment survey reported an additional 478,000 jobs, signaling broad-based strength in the labor sector.

Equity markets responded negatively to the jobs report, as investors anticipated that the Federal Reserve might be less inclined to continue its rate-cutting cycle. Futures contracts for major indices such as the S&P 500 and Nasdaq fell, reflecting this sentiment. However, some individual stocks performed well, with Delta Air Lines and Walgreens Boots Alliance posting gains due to strong earnings reports. Meanwhile, bond yields rose across the curve, particularly for the 10-year Treasury note, as traders adjusted their expectations for Fed policy.

Precious metals like gold benefited from the uncertainty surrounding fiscal policies and potential inflationary pressures. Gold prices surged past the $2,700 mark for the first time since mid-December, driven by safe-haven demand. Energy markets also saw significant gains, with crude oil prices rising over 5% amid increased winter demand. This surge was partly attributed to a winter storm affecting large parts of the United States, boosting short-term energy consumption.

Foreign exchange markets witnessed volatility as well, especially for the Japanese yen. Yen futures trimmed overnight losses, possibly due to profit-taking after the jobs report reduced market risks. Overall, the strong jobs data has set the stage for a cautious approach from the Federal Reserve, with only one rate cut expected in 2025. Traders are now closely monitoring economic indicators and geopolitical developments to gauge future market trends.