Global equity markets showed signs of recovery as major indexes advanced, driven primarily by a resurgence in technology stocks. This upward trend comes after a period of market volatility, highlighting shifting investor sentiment and ongoing economic developments. Companies in the AI sector, alongside pharmaceutical giant Moderna, recorded notable gains, while financial markets eagerly awaited critical insights from the Federal Reserve.

Detailed Market Insights and Corporate Actions

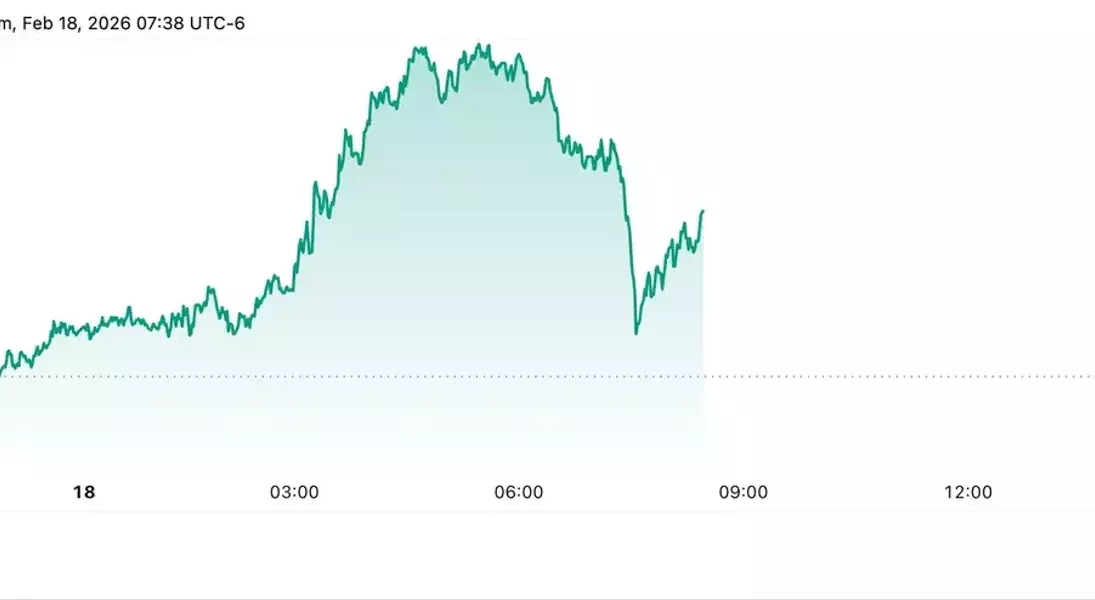

On a recent Wednesday, major stock indexes across the globe experienced an uplifting trading day. The tech-heavy Nasdaq Composite led the charge, climbing by an impressive 1.3%, signaling a renewed confidence in the artificial intelligence (AI) sector following previous volatile sessions. The broader S&P 500 index also advanced by 0.8%, and the industrially focused Dow Jones Industrial Average saw a modest increase of 0.5%. This broad market ascent occurred after all three indexes had registered marginal gains in the preceding day's tumultuous trading.

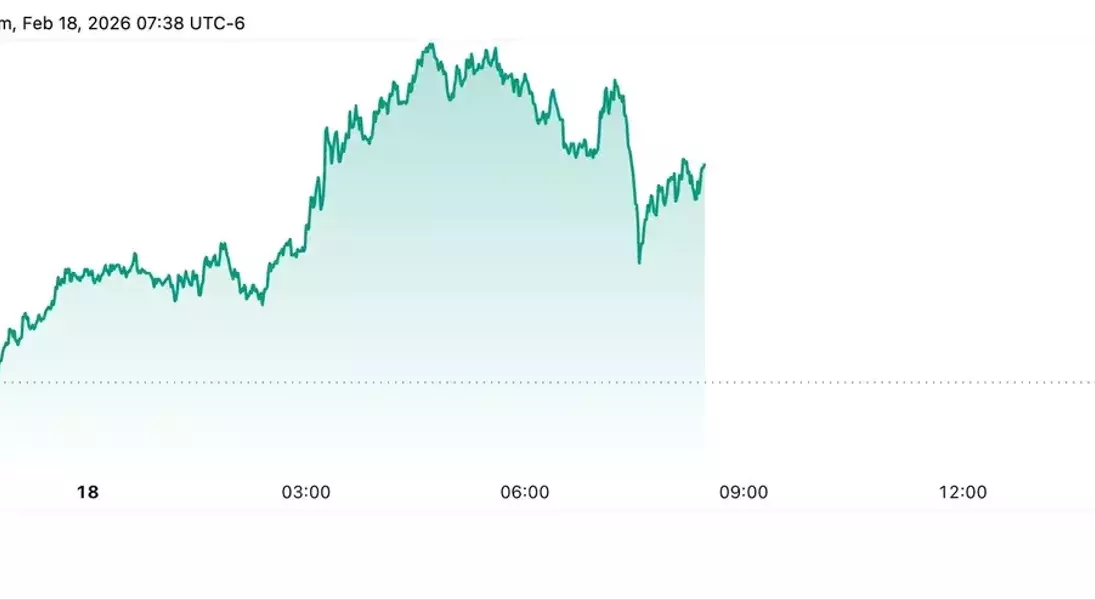

A significant driver of the tech sector's recovery was the news surrounding Nvidia, whose shares rose by 2%. This surge followed an announcement from Meta, the social media titan, detailing a substantial agreement to procure millions of Nvidia's advanced chips, crucial for AI development. While Meta's own shares experienced a slight dip, other key players in the AI supply chain, such as Micron and Western Digital, also observed price increases, reinforcing the positive outlook for AI-related enterprises.

Beyond the immediate tech sphere, the 'Magnificent Seven' cohort of leading technology companies largely traded higher. Amazon's stock gained over 2%, despite the recent disclosure from Berkshire Hathaway—the conglomerate previously steered by the venerable Warren Buffett—that it had divested nearly all its holdings in the e-commerce giant. Other tech stalwarts like Apple, Alphabet, Microsoft, and Tesla also posted slight gains, contributing to the overall market's bullish tone.

In the pharmaceutical arena, Moderna's stock saw a notable 6% increase. This boost came after the company revealed that the U.S. Food and Drug Administration (FDA) had reconsidered and agreed to review Moderna's application for a new mRNA influenza vaccine. This reversal followed an initial refusal by regulators, which had surprised investors. Moderna is seeking full approval for adults aged 50 to 64 and accelerated approval for those over 65, with a decision anticipated by August 5.

Conversely, Palo Alto Networks, a cybersecurity firm, saw its shares decline by 6% after its latest earnings guidance fell short of market expectations. However, other chip manufacturers, Cadence Design Systems and Analog Devices, reported stronger-than-expected revenues and profits, leading to stock increases of 10% and 3%, respectively.

Investors were also keenly awaiting the release of the Federal Reserve's January meeting minutes. These documents are expected to provide crucial insights into the central bank's future stance on interest rates, especially after officials voted to keep rates unchanged for the first time since July. Market sentiment regarding further rate cuts has diminished recently, influenced by stronger-than-expected inflation and jobs reports. The upcoming release of the Personal Consumption Expenditures (PCE) price index, the Fed's preferred inflation metric, is set for Friday morning.

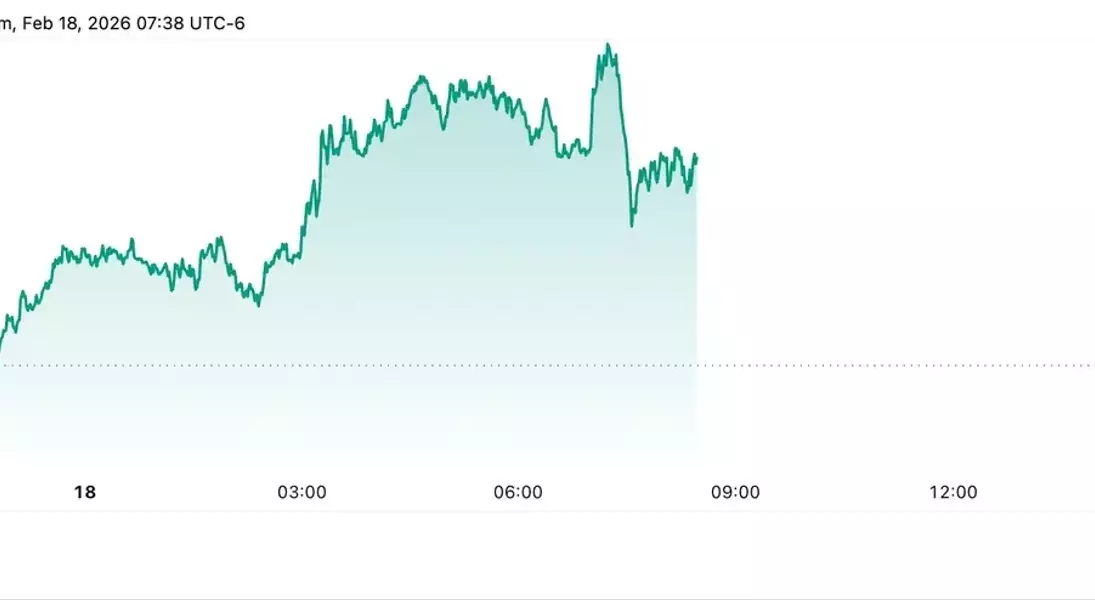

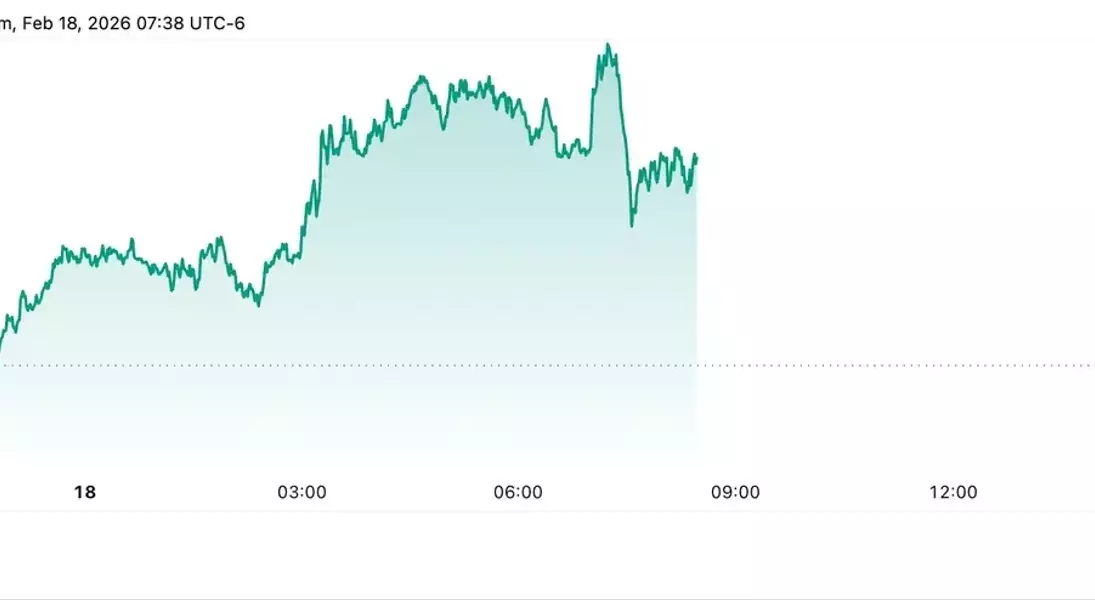

In the broader financial landscape, the 10-year Treasury yield edged up to 4.08%, marginally higher than its previous close, indicating potential shifts in borrowing costs. Commodity markets also showed dynamism: West Texas Intermediate crude oil futures surged by approximately 3% to $64.40 per barrel, influenced by Vice President JD Vance's expressions of doubt regarding U.S.-Iran diplomatic progress. Gold and silver futures rebounded from a recent downturn, with gold increasing by about 2.5% to $5,020 per ounce and silver by 6% to $78 per ounce. Bitcoin, meanwhile, experienced a slight dip, trading around $67,000, and the U.S. dollar index showed a marginal increase of 0.3% against a basket of major currencies.

This day's market movements highlight a complex interplay of technological innovation, corporate strategy, regulatory decisions, and macroeconomic indicators. The tech sector's bounce back, coupled with significant developments in the pharmaceutical industry and anticipation surrounding central bank policies, paints a dynamic picture for global investors. The varying performances across different sectors and commodities underscore the importance of diversified investment strategies and careful monitoring of both micro and macroeconomic factors. As the market continues to react to these influences, adaptability and informed decision-making remain paramount for navigating the evolving financial landscape.