This past week in the financial markets has been characterized by considerable fluctuation and several impactful events. Stock markets are closing the week with mixed signals, as major indices navigate a complex landscape of corporate earnings, geopolitical shifts, and economic data challenges. Gold prices have surged to unprecedented levels, underscoring investor demand for safe-haven assets amidst uncertainty. Concurrently, the aviation sector faces significant disruptions from severe weather, leading to numerous flight cancellations across the United States. These elements collectively paint a picture of a market reacting dynamically to both microeconomic and macroeconomic pressures, with investors closely monitoring global developments for future direction.

As the week draws to a close, a confluence of factors continues to shape market sentiment. Stock futures point to a cautious start, reflecting ongoing investor concerns. The Federal Reserve's decision-making process remains complicated by lingering data gaps from a past government shutdown, making it challenging to accurately assess economic conditions. This uncertainty is further compounded by recent geopolitical developments, particularly shifts in international trade policies, which have a direct bearing on market stability. The interplay of these forces—market volatility, a flight to safety in gold, and the Federal Reserve's data-driven challenges—underscores a period of heightened sensitivity and strategic re-evaluation for investors worldwide.

Market Trends and Economic Headwinds

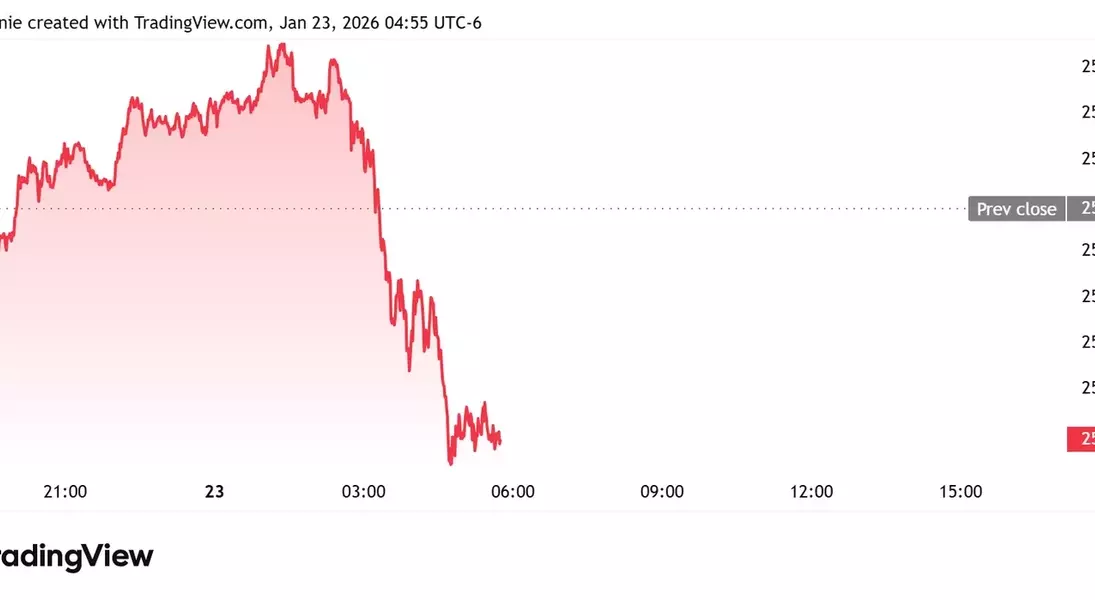

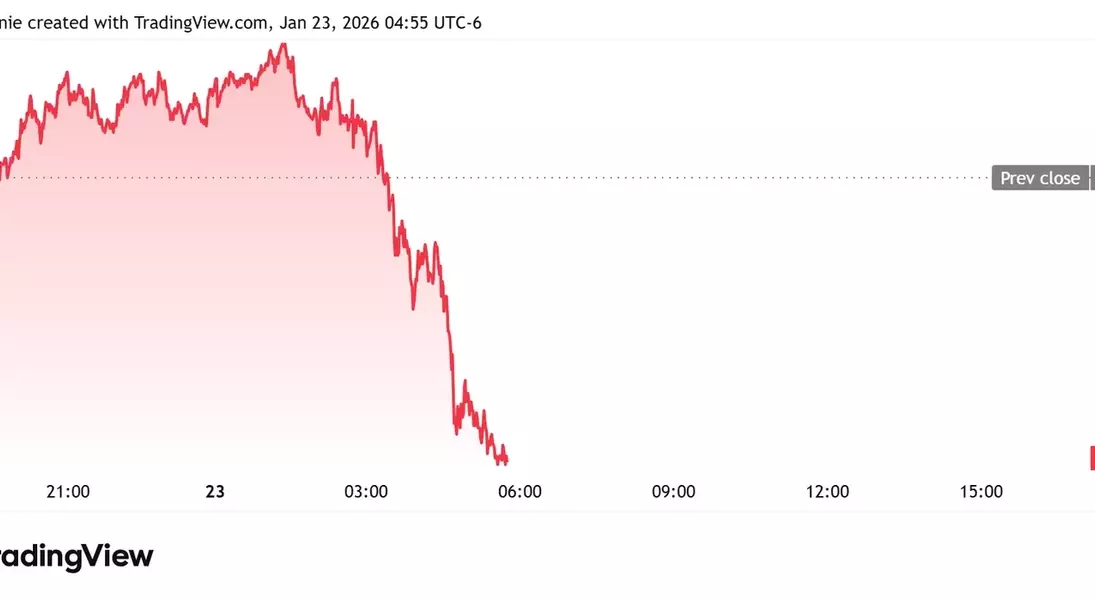

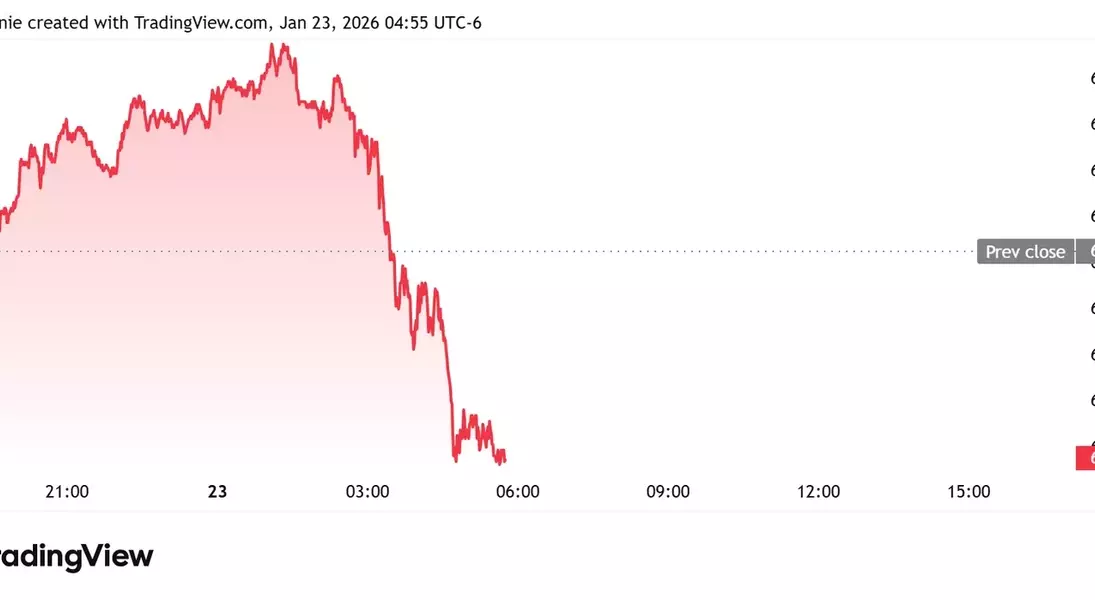

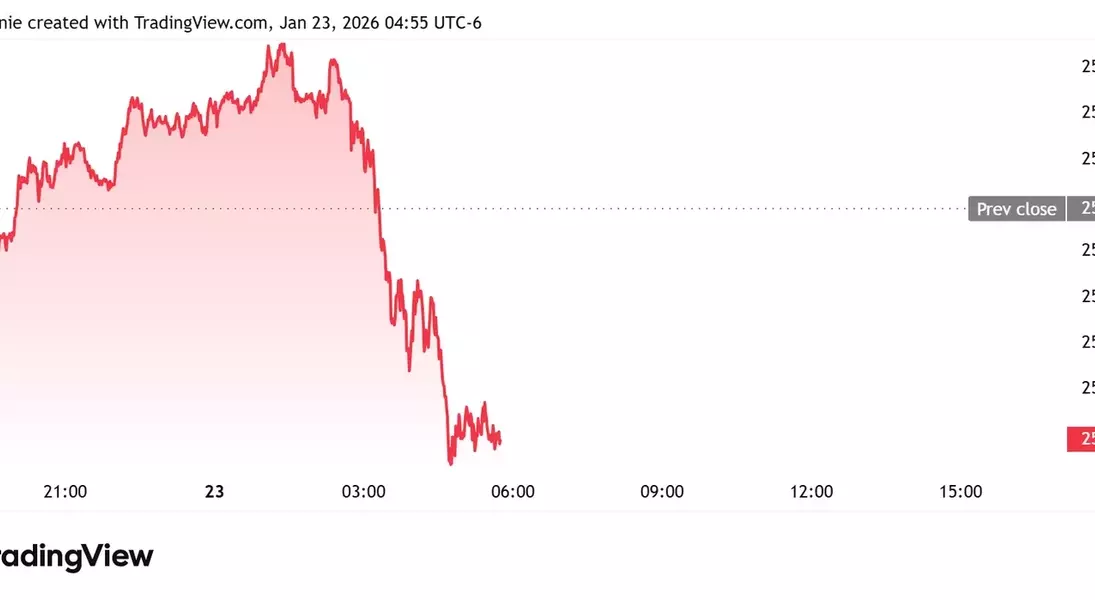

The financial markets experienced a week of notable volatility, with stock futures signaling a potentially subdued opening as the trading period concluded. Major indices such as the Dow Jones Industrial Average, Nasdaq 100, and S&P 500 saw their futures contracts decline, reflecting investor caution. This comes after a period of gains, partly fueled by President Trump's decision to ease tariff tensions with European allies, which had initially provided a boost. However, the overall weekly performance remained mixed, with the S&P 500 and Nasdaq in negative territory, highlighting the persistent challenges and uncertainties faced by the market. In contrast, the appeal of safe-haven assets intensified, driving gold futures to achieve new all-time highs, indicating a broader move by investors to mitigate risk amidst the turbulent environment.

Amidst this backdrop, several corporate developments added to the market's dynamism. Intel's shares experienced a significant drop in premarket trading following a disappointing outlook and concerns over chip supply constraints, impacting the technology sector. Conversely, Oracle saw a slight uptick after announcing a deal to host TikTok's American user data, a move prompted by a presidential executive order aimed at ensuring the social media platform's continued operation in the U.S. Capital One Financial's stock declined after its acquisition of credit card startup Brex, while Ericsson's shares surged on the back of better-than-expected quarterly earnings, an increased dividend, and a substantial buyback program. These varied corporate performances underscore the sector-specific impacts of broader economic trends and strategic business decisions.

Operational Disruptions and Policy Challenges

Beyond market numbers, significant operational disruptions and policy challenges also defined the week. U.S. airlines, including American Airlines and Southwest Airlines, preemptively canceled nearly 2,000 flights through Sunday in anticipation of a massive storm. This widespread disruption primarily affected hubs like Dallas-Fort Worth International and Dallas Love Field, demonstrating the significant impact of severe weather on commercial aviation and leading to minor fluctuations in airline stock prices. Such events highlight the vulnerability of economic activity to external factors and the proactive measures taken by industries to manage potential risks, influencing both company performance and broader market sentiment.

Furthermore, the Federal Reserve continues to confront the lasting effects of a prior government shutdown, which has created a 'data fog' impeding its ability to accurately assess economic conditions. Official reports on inflation, particularly the Personal Consumption Expenditures (PCE) and Consumer Price Index (CPI), have been delayed and distorted, complicating the formulation of monetary policy. This ongoing challenge means that crucial economic indicators are not consistently available, forcing policymakers to make decisions with incomplete information. The delay in returning to a regular reporting schedule for these vital statistics underscores the far-reaching consequences of government disruptions on economic analysis and the subsequent impact on financial planning and investment strategies.