Today's market witnessed a dynamic interplay of surging stocks, evolving savings account landscapes, and crucial discussions surrounding wealth transfer and corporate leadership. Tech stocks, spearheaded by Palantir, drove market optimism, while the value of traditional savings accounts faced scrutiny due to inflation and shifting interest rates. Concurrently, the "Great Wealth Transfer" brought into focus the nuanced financial implications of inheriting assets, particularly real estate. Amidst these economic shifts, two major retail giants, Target and Walmart, welcomed new CEOs, each tasked with distinct strategic objectives, reflecting their unique market positions.

These developments underscore the need for astute financial awareness, from understanding investment opportunities in a bullish market to carefully evaluating personal savings strategies. The report emphasizes how macroeconomic factors, such as central bank policies and inflation, directly impact individual wealth management. Additionally, it sheds light on the generational transfer of assets and the distinct challenges confronting leaders in the competitive retail sector, providing a comprehensive overview of current financial and business trends.

Market Momentum and Key Company Performances

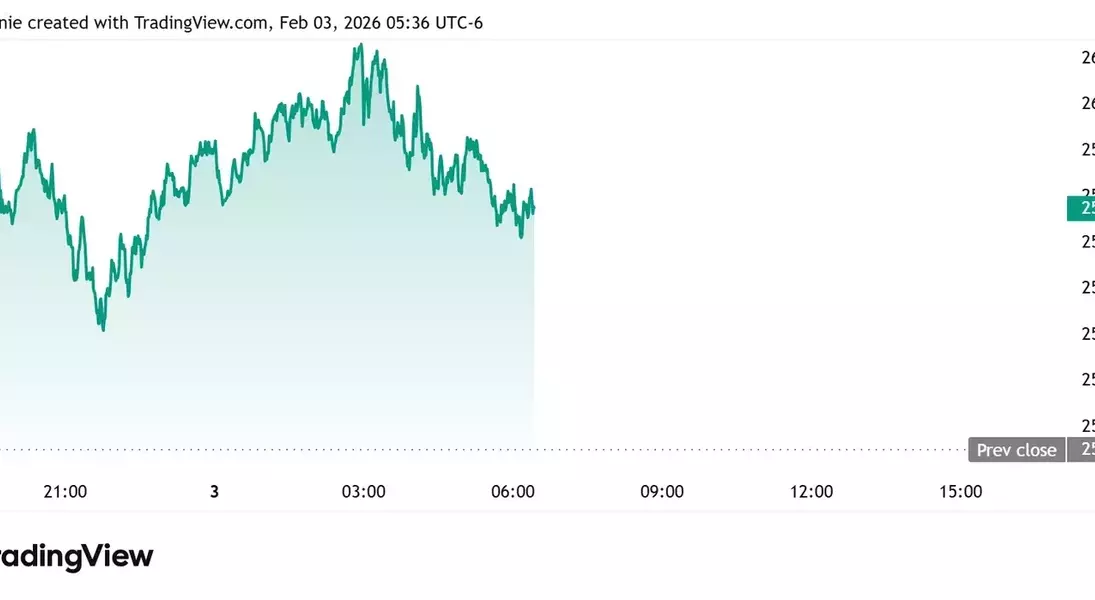

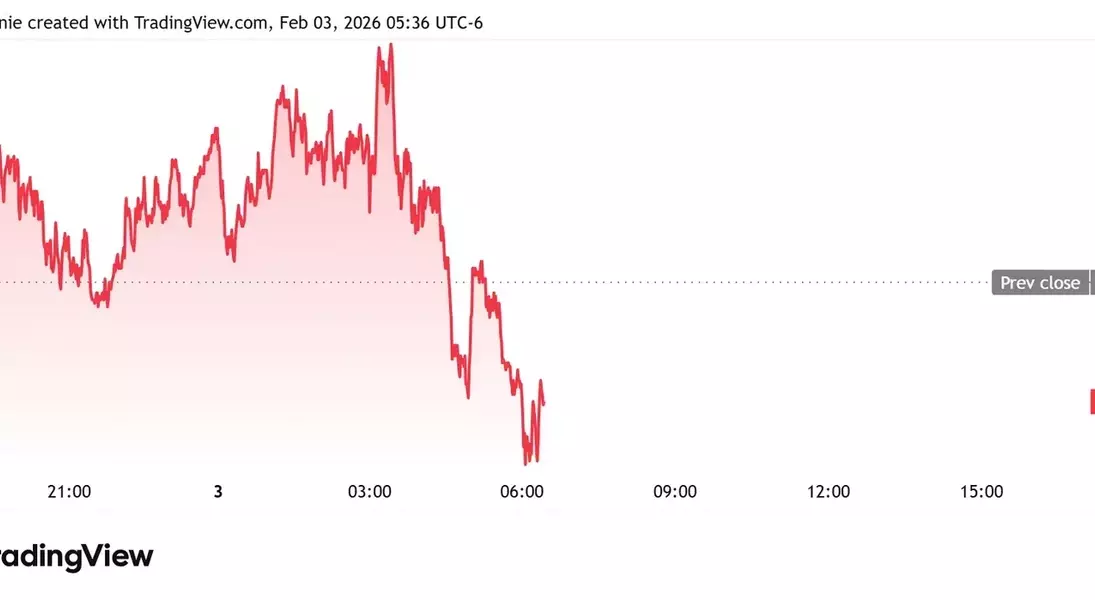

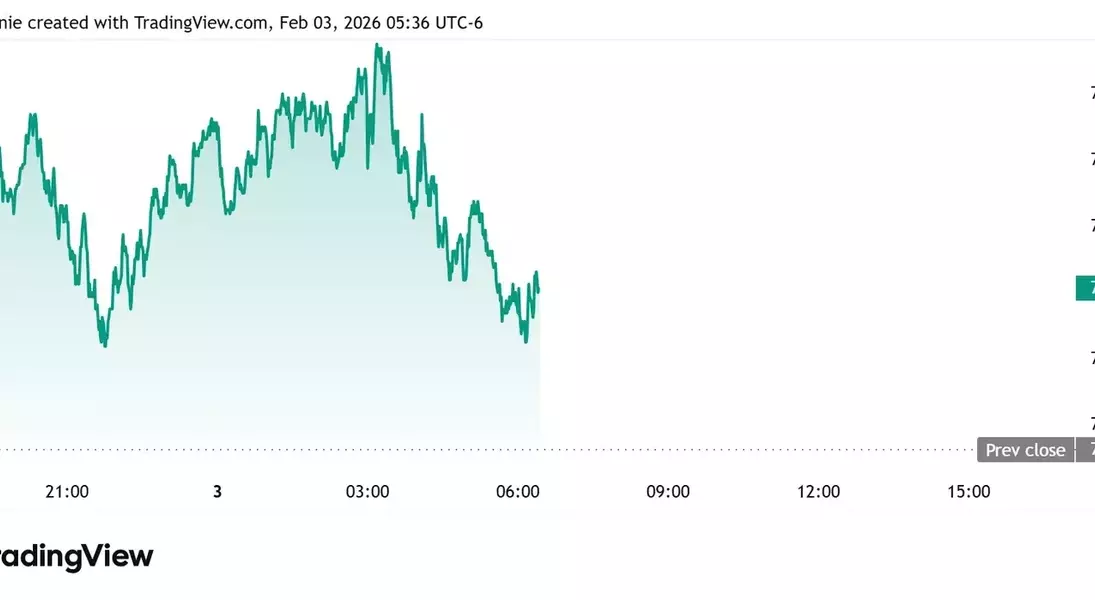

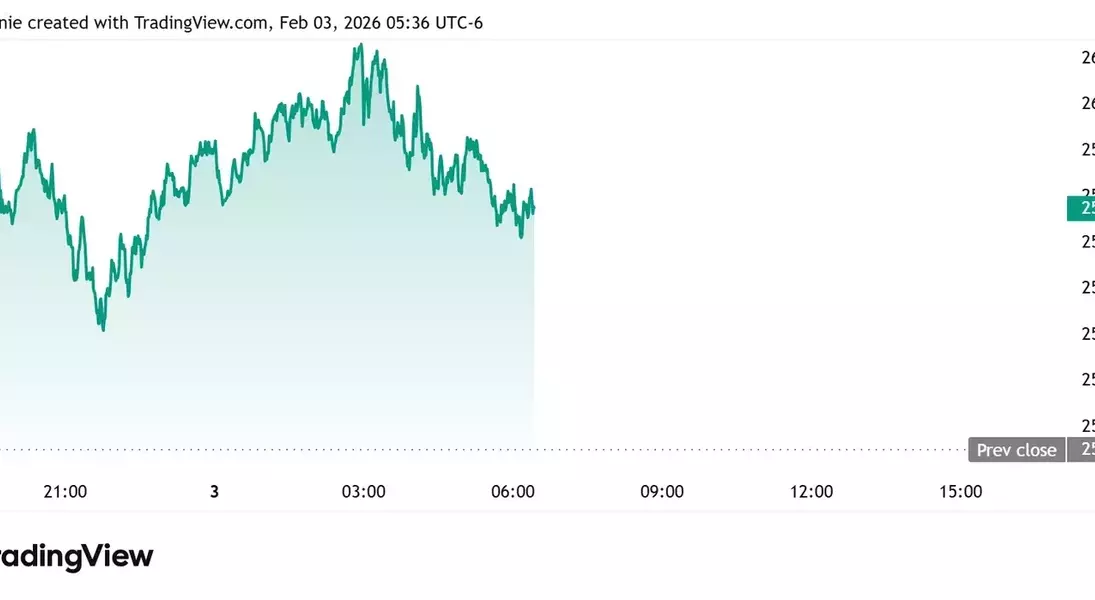

Following a robust kickoff to February trading, equity markets are displaying upward momentum, with leading tech companies driving a significant portion of this surge. Futures for major indices like the Nasdaq 100 and S&P 500 indicate positive openings, reinforcing investor confidence. This market activity is further complemented by renewed interest in precious metals, as gold and silver futures have resumed their upward trajectory after a brief period of profit-taking. This diverse movement across sectors signals a complex yet generally favorable environment for various asset classes, reflecting a broad-based optimism as the new month progresses.

Specific companies have captured investor attention with their recent performances. Palantir Technologies, a prominent player in the tech sector, saw its shares climb substantially in premarket trading, fueled by an impressive earnings report and an optimistic revenue forecast. However, the post-earnings landscape has been mixed for other corporations; while Teradyne experienced a significant jump and PepsiCo showed modest gains, PayPal faced a considerable downturn, and both Archer-Daniels-Midland and Pfizer reported declines. This selective market response highlights the importance of individual company fundamentals and earnings strength in shaping investor sentiment, even within a generally positive market trend.

Personal Finance Insights: Savings and Inheritances

In the realm of personal finance, the traditional role of savings accounts is being re-evaluated. While these accounts offer the undeniable benefits of immediate liquidity and FDIC insurance, protecting up to $250,000, their capacity to preserve wealth is increasingly challenged by inflation. With national average savings rates often lagging significantly behind inflation, the purchasing power of money held in these accounts can diminish over time. This underscores a critical trade-off between the security and accessibility of conventional savings and the potential erosion of real value, prompting individuals to consider more strategic approaches to their financial reserves.

The concept of wealth transfer, particularly through inherited assets like homes, is gaining prominence, especially with the ongoing "Great Wealth Transfer." While receiving a home can initially appear to be a significant financial boon, it often comes with a host of unforeseen responsibilities and costs. Property taxes, maintenance, and potential capital gains taxes can quickly complicate the perceived value of such an inheritance. This situation highlights that while substantial wealth is poised to transfer between generations, the practical implications for beneficiaries are multifaceted, necessitating careful financial planning and an understanding of both the benefits and potential burdens involved.