Navigating the Currents: Earnings, Rates, and Executive Debates

Anticipating Market Open: Mixed Signals and Sectoral Divergences

As the market opened on Tuesday, analysts observed a divided outlook, primarily influenced by the latest quarterly reports from prominent corporations. While the technology sector, particularly chip manufacturers, showed promising growth, the health insurance industry faced headwinds from unexpected policy changes.

The Federal Reserve's Influence on Mortgage Rates: A Week of Anticipation

With the U.S. Federal Reserve's upcoming meeting, attention is keenly focused on its potential impact on mortgage rates. Homeowners and prospective buyers are closely monitoring developments, although current trends suggest a relatively stable borrowing environment heading into the week. Freddie Mac reported a recent dip in the average 30-year fixed mortgage rate, marking its lowest point in three years, though it has since seen a slight increase.

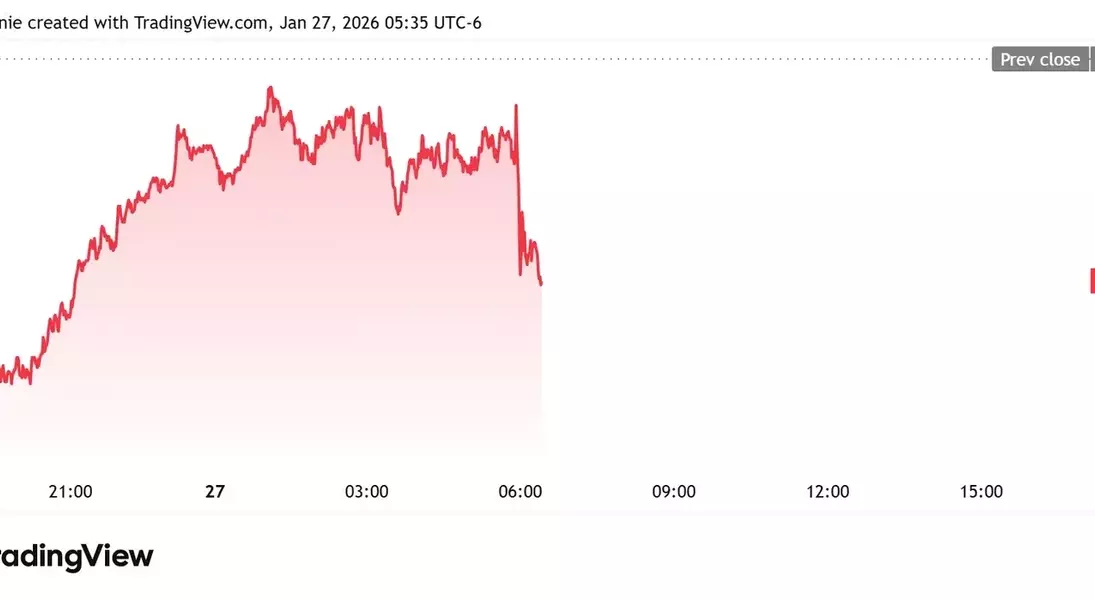

Meme Stock Rebound: Michael Burry's Endorsement of GameStop

In a notable market event, GameStop, a company emblematic of the meme stock phenomenon, received a significant boost from renowned investor Michael Burry. Famous for his foresight in predicting the 2008 financial crisis, Burry's announcement of his investment in GameStop through his Substack newsletter spurred considerable interest among investors.

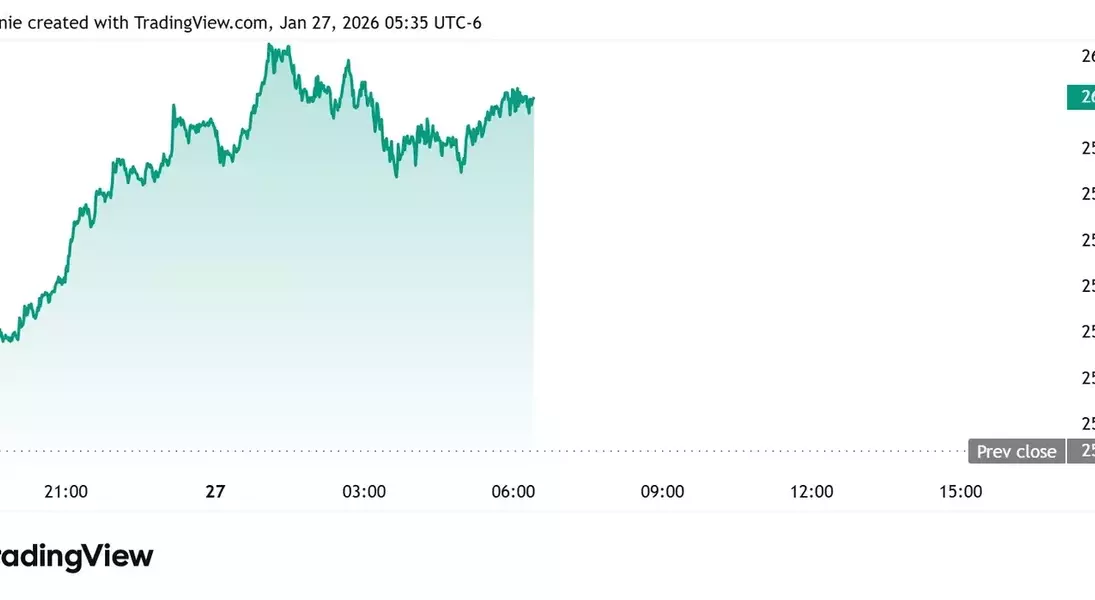

American Airlines Soars on Positive Profit Outlook

Despite fourth-quarter results that fell short of some analyst predictions, American Airlines Group experienced a surge in its stock value on Tuesday. This rise was largely attributed to an optimistic profit forecast for fiscal year 2026, which exceeded market expectations and reassured investors about the airline's future profitability.

High-Stakes Exchange: The Public Spat Between Elon Musk and Ryanair's CEO

A public feud between Elon Musk and Ryanair CEO Michael O'Leary has captured headlines, illustrating the dramatic flair often seen among high-profile business leaders. The dispute began with Ryanair's decision not to adopt SpaceX's Starlink internet service, escalating into a series of pointed remarks and social media exchanges that highlight a clash of personalities and corporate strategies.

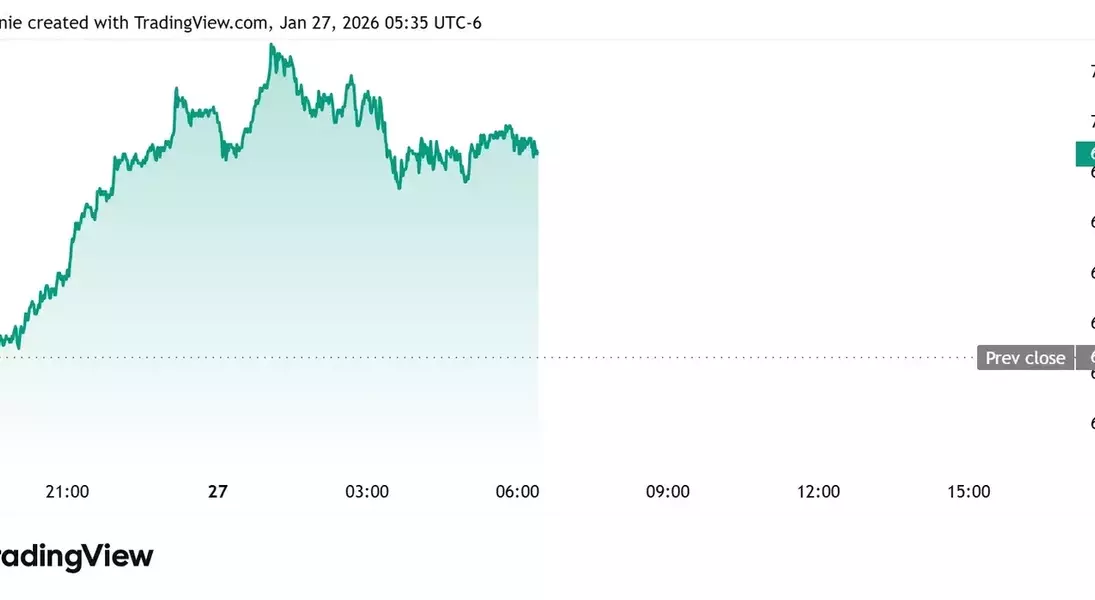

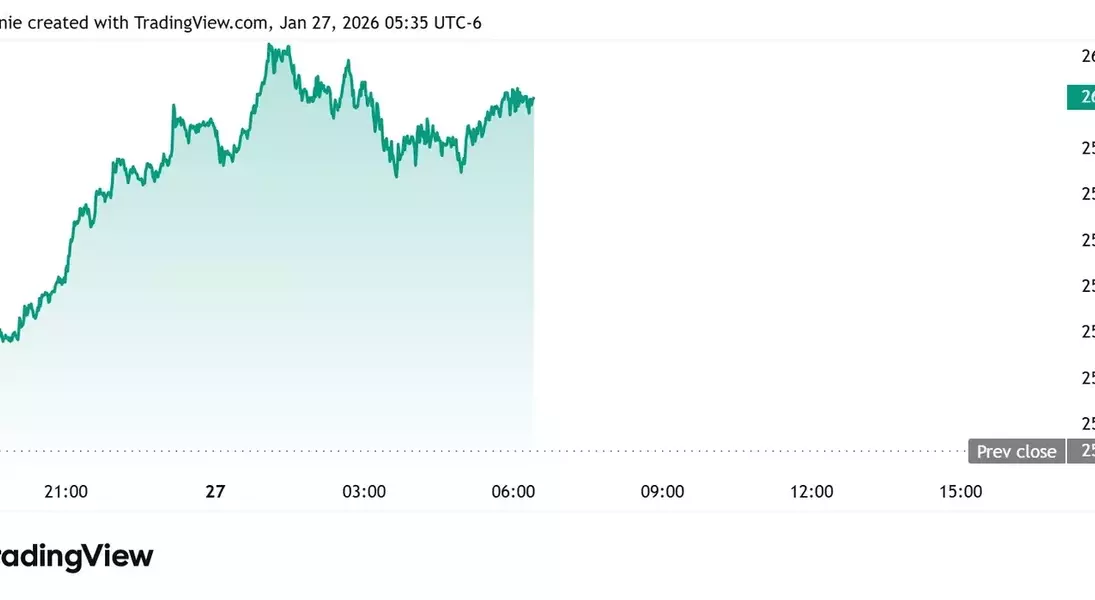

Examining Pre-Market Indicators for Major Indices

Ahead of Tuesday's trading, key market indicators presented a mixed picture. Dow Jones Industrial Average futures showed a slight decline, while S&P 500 and Nasdaq 100 futures indicated upward momentum, reflecting a nuanced investor sentiment driven by diverse corporate performances and macroeconomic factors.

Navigating Fluctuations: Gold, Silver, and Crude Oil Markets

Commodity markets also demonstrated volatility, with gold prices holding steady after recently surpassing a significant threshold. Silver futures, however, experienced a pullback from their recent record highs. In the energy sector, West Texas Intermediate crude futures saw a marginal decrease, underscoring the dynamic nature of global commodity prices in response to various economic and geopolitical influences.

Digital Currencies and Global Exchange Rates: A Snapshot

The cryptocurrency market remained relatively stable, with Bitcoin trading near previous levels. Concurrently, the U.S. dollar index, a gauge of the dollar's strength against major global currencies, registered a slight decline, indicating subtle shifts in international foreign exchange dynamics.