On Friday, global financial markets displayed a nuanced reaction to significant political and economic developments. Stock futures initially dipped but later moderated their decline following President Trump's announcement of former Federal Reserve Governor Kevin Warsh as his choice for the next Fed Chair. This nomination sparked considerable debate about the future direction of interest rate policies. Concurrently, a substantial sell-off in precious metals occurred as traders capitalized on recent record highs, leading to sharp drops in the values of gold and silver. Elsewhere, concerns emerged regarding potential delays in tax refunds due to a significant reduction in IRS workforce numbers, while major stock indexes and commodity prices exhibited varied movements.

The nomination of Kevin Warsh by President Trump for the pivotal role of Federal Reserve Chair has introduced a new layer of uncertainty and speculation into the market's outlook on monetary policy. Warsh, who previously served as a Fed governor from 2006 to 2011, is known for his advocacy of lower interest rates and has been vocal in his support for the President's economic strategies. Should he be confirmed by the Senate, succeeding current Chair Jerome Powell in May, his appointment is anticipated to usher in a less aggressive approach to rate hikes, potentially impacting borrowing costs across various consumer loans, including mortgages. This prospective shift has already begun to shape market sentiment, with investors closely watching for further indications of future policy adjustments.

Adding to the market's complexities, the Internal Revenue Service (IRS) faces significant operational challenges that could directly affect taxpayers. A recent report from the Taxpayer Advocate Service, an independent oversight body within the IRS, highlighted a 27% reduction in the agency's workforce during the past year. This substantial staffing cut, combined with frequent changes in leadership—including seven different commissioners in the previous year—raises concerns about the IRS's capacity to process tax returns efficiently. Despite efforts to recruit additional customer service representatives, the agency reportedly fell short of its hiring targets by 1,000 employees. This deficit in personnel, coupled with evolving tax legislation, suggests that some taxpayers may experience delays in receiving their refunds during the upcoming filing season, particularly those who require direct assistance or whose returns contain errors.

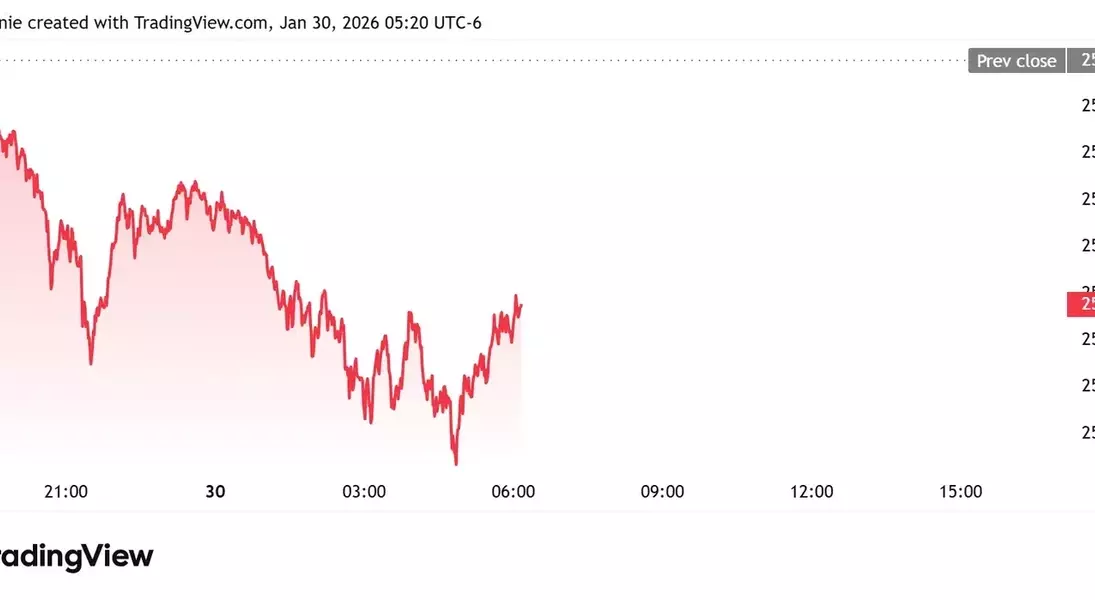

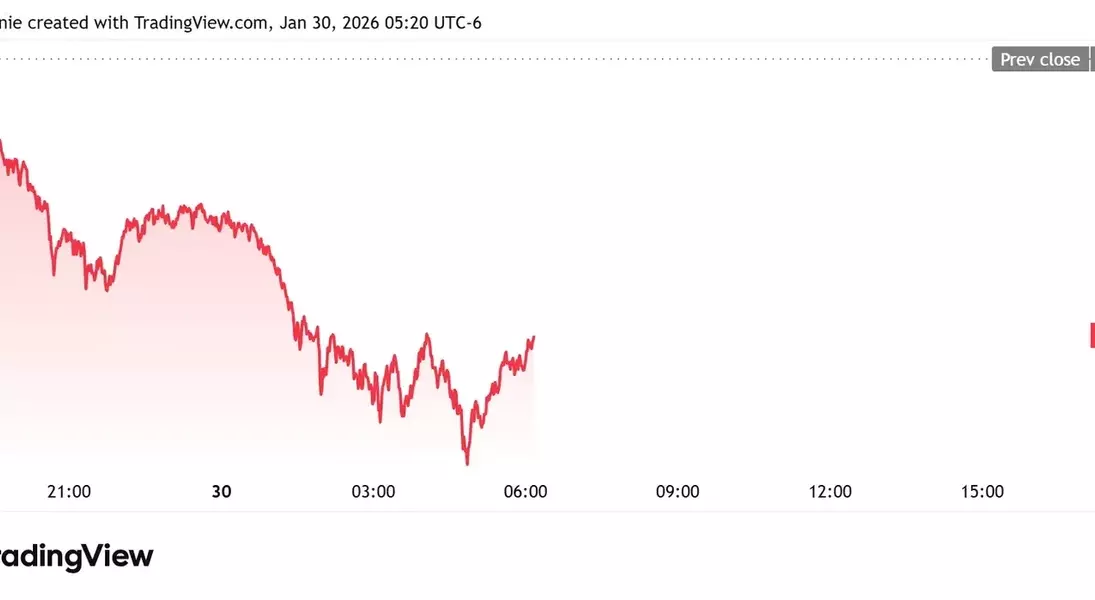

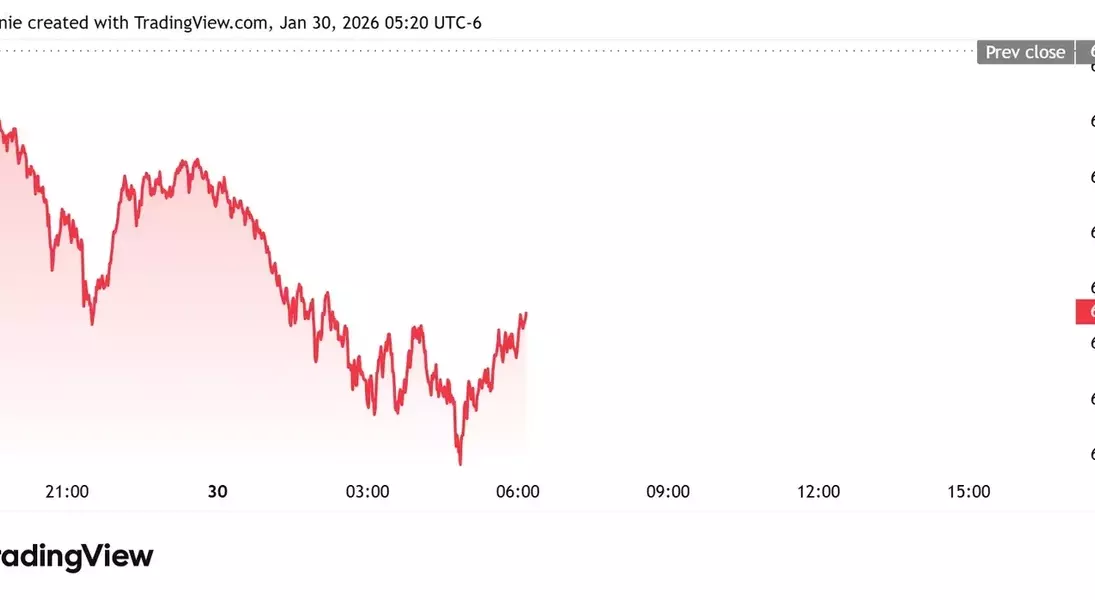

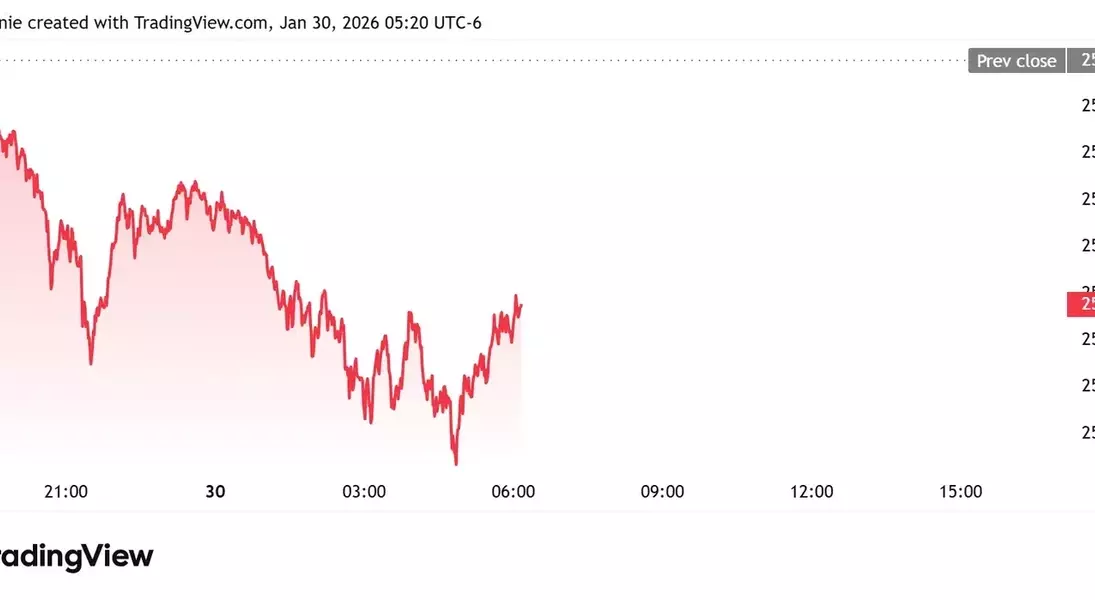

In the broader market, several key economic indicators and corporate performances contributed to the day's fluctuating landscape. Producer Price Index (PPI) data for December, expected to show a 0.3% month-over-month increase for both headline and core PPI, was eagerly awaited by traders. This report provides crucial insights into inflationary pressures at the wholesale level. Meanwhile, safe-haven assets like gold and silver experienced a dramatic decline. Gold prices tumbled 4% to approximately $5,150 an ounce, while silver futures plummeted about 10% to $103 an ounce, as investors locked in profits following Thursday's record-setting highs. The U.S. dollar index saw a slight uptick, trading at 96.38, while Bitcoin experienced a modest dip from its overnight peak. Crude oil futures for West Texas Intermediate also saw a slight decrease, settling around $64.90 a barrel. In corporate news, Apple shares edged down after an initial post-earnings rally, while other companies such as Sandisk and Deckers Outdoor saw significant gains, contrasting with declines for Exxon Mobil and Visa.

Market observers note the day's mixed performance underscores a period of recalibration, influenced by political appointments, operational challenges in key government agencies, and a natural correction in asset valuations. The Federal Reserve's future stance on interest rates under new leadership remains a primary focus, with implications extending across equity, bond, and commodity markets. Simultaneously, domestic administrative hurdles, such as those faced by the IRS, highlight broader economic interdependencies and potential impacts on household finances. The interplay of these factors shapes a dynamic and uncertain economic outlook for the immediate future.