In a significant shift, the exodus of residents from London to acquire properties elsewhere has reached its lowest level since 2013. This change is largely attributed to the stagnant appreciation of home values within the city and a growing requirement for employees to resume working from their company's offices. Such factors have collectively influenced the decisions of many Londoners, leading to a reduced inclination to move out of the capital. This current trend stands in stark contrast to the outward migration seen during the pandemic, when a desire for more expansive living spaces fueled moves away from urban centers.

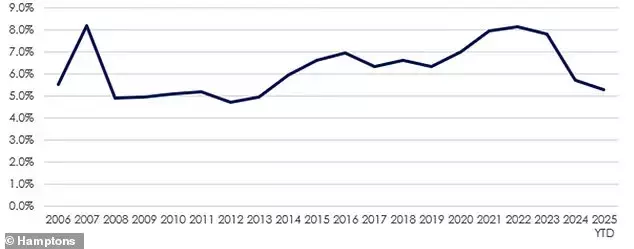

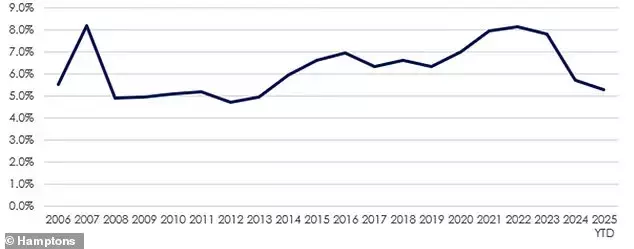

Data from Hamptons, a prominent estate agent, reveals that only 31,620 homes were purchased by Londoners outside the capital in England and Wales during the initial seven months of this year. This figure represents 5.3 percent of all sales outside London, marking the lowest proportion recorded in over a decade. This is a substantial decrease from the 2022 peak of 8.2 percent, which was largely a result of the widespread remote work policies implemented during the COVID-19 pandemic. The current outmigration rate also falls below the pre-pandemic average of 5.9 percent observed between 2010 and 2020, indicating a return to more traditional housing market dynamics.

A primary driver behind this phenomenon is the comparatively modest increase in London's property values when compared to other parts of the country. Over the past five years, home prices outside the capital have surged by an average of 26 percent, three times the 8 percent growth seen in London. This disparity has diminished the purchasing power of potential movers from London, making it more challenging for them to upgrade their homes or relocate to larger residences beyond the city limits. Consequently, many homeowners find themselves with insufficient equity to facilitate a significant move, particularly with the prevailing high borrowing costs.

Interestingly, this muted price growth in central London has led to an uptick in residents from inner London postcodes seeking homes elsewhere. These areas have sometimes seen their property values remain below 2014 levels. As a result, inner London residents now constitute a record 30 percent of all individuals moving out of the capital, an increase from 25 percent a decade prior. This illustrates a growing trend where central London homeowners are compelled to explore more distant regions to find better value, as local relocation options become less viable.

Despite the challenges posed by the housing market, Londoners who do move out still gain considerably more living space. An average household selling a property in inner London for £655,580 this year could nearly double their living area, acquiring an additional 1,178 square feet. However, this gain is almost a third less than what was achievable in 2016, when spatial purchasing power was at its peak. Back then, movers could nearly triple their space. For those leaving outer London, the reduction in potential extra space has been less pronounced, still allowing for a 55 percent increase in living area compared to a 72 percent increase in 2016.

The current migratory patterns also reflect evolving preferences regarding relocation destinations. In 2015, commuter towns like Broxbourne, Sevenoaks, and Welwyn Hatfield were highly sought after. By 2020, during the pandemic, Dartford, Epsom & Ewell, and Epping Forest became popular as buyers prioritized space. However, in 2025, a shift towards value over prestige is evident, with more affordable areas such as Thurrock, Hertsmere, and Basildon gaining popularity while remaining within commuting distance of the capital. This indicates a more pragmatic approach among those leaving London, driven by financial considerations rather than solely by a desire for expansive, leafy suburbs.

The slowdown in Londoners relocating outside the capital is a direct consequence of the city's subdued property price appreciation and the increasing emphasis on office-based work. Many homeowners simply haven't accumulated enough equity to afford a substantial move, especially given the rising costs of properties outside London. This has resulted in fewer moves, shorter relocation distances, and a heightened focus on practical affordability over aspirational living. The dream of significantly expanding one's living space upon leaving London, while still possible, is no longer as readily attainable as it once was, thereby reshaping the patterns of outmigration.